Neutral Petronet LNG Ltd For Target Rs.330 by Motilal Oswal Financial Services Ltd

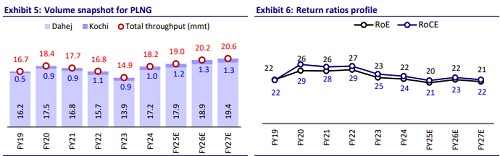

Dahej expansion and Kochi connectivity serve as mediumterm catalysts

* Petronet LNG’s 3QFY25 revenue came in below our estimates, as total volumes stood below our estimates, primarily due to lower third-party cargos. While EBITDA was also marginally below estimates, higher-thanexpected other income led to PAT coming in-line with our estimates. We believe that higher Spot LNG prices, averaging USD13.9/mmbtu in 3Q (up 7% QoQ), led to a decline in total volumes. Spot LNG prices continue to remain elevated in 4QFY25’td, averaging USD14.2/mmbtu.

* The Dahej terminal expansion from 17.5mmt to 22.5mmt is expected to be completed by Jun’25 (three months delay), after which it will be available for use. In 4Q, the management expects capacity utilization at Dahej to remain ~95%-100%. It believes that post connection to the National Gas Grid, Kochi terminal utilization could reach 50%. Management also stated that while Spot LNG is likely to remain in the range of USD12-USD14 per mmbtu, post FY27, these prices should be around USD7-USD8 per mmbtu due to the global supply glut.

* Going forward, the key catalysts will be: 1) the commissioning of the expanded Dahej capacity, and 2) pipeline connectivity for the Kochi terminal. While the PDH-PP project and Gopalpur FSRU can support the future volume trajectory, we believe that the economics of these projects are yet to be established and that they are longer-dated projects. As such, we maintain our Neutral rating with a TP of INR330.

Other key takeaways from the conference call

* The expected total capex for FY25 shall be INR14b-15b (INR9.8b has already been spent); total capex of INR40b-INR45b will be incurred in FY26.

* Petchem capex during 9MFY25 stood at INR3.4b (expected: INR4b by Mar’25). FY26 planned capex related to petchem amounts to INR30bINR35b.

* A 5% tariff hike has been taken at Dahej from 1st Jan’25.

* During 3Q, inventory gains amounted to INR830m, while trading gains stood at INR260m. In 3Q, Regas revenues stood at INR8.4b (INR7.3b in 2QFY25).

PAT in line; Dahej utilization drops

* In 3QFY25, revenue came in below our estimate, as total volumes were below estimate.

* We note that Spot LNG prices were high in 3Q, averaging USD13.9/mmbtu (up 7% QoQ).

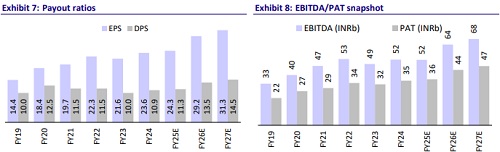

* EBITDA was 5% below our estimates at INR12.5b (-27% YoY), with employee expenses coming in above our estimate.

* Reported PAT stood in line with our est. at INR8.7b (-27% YoY), with other income coming in above our estimate.

Operational performance

* Volumes came in below our estimates, primarily due to lower third-party cargos.

* Dahej utilization was below estimates, while Kochi utilization stood in line.

* In 3Q, PLNG provisioned INR1b for UoP dues. Additionally, PLNG has waived off UoP charges of INR489m (INR1.8b in 9mFY25).

* In 9MFY25, net sales/EBITDA/PAT were similar YoY at INR387b/ INR40b/ INR29b. In 4QFY25, we estimate EBITDA/PAT to grow 14%/19% YoY.

* As of Dec'24, provisions on UoP dues stood at INR7b.

* UoP dues of INR16.7b (net provision INR9.6b) were included in trade receivables as of Dec'24. The company has obtained bank guarantees from customers to recover UoP charges for FY22 and FY23. The customers have not given balance confirmations toward these dues. However, the management is confident about recovering these charges.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412