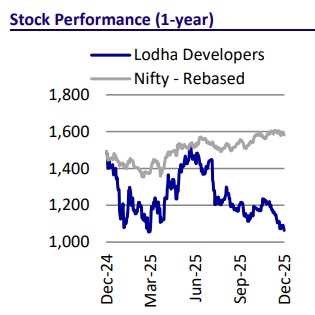

Buy Lodha Developers Ltd for the Target Rs. 1,888 by Motilal Oswal Financial Services Ltd

A journey of strength, acceleration, and market arrival

MMR leader tapping into NCR with a growth phase in Bengaluru and scale-up in Pune

* Lodha Developers’ (LODHA) presales are expected to clock a 22% CAGR, supported by healthy collections and debt at comfortable levels of 0.25x by the end of 1HFY26, despite aggressive BD additions of INR250b. Pune is scaling up at a healthy pace and is expected to deliver 40% YoY growth in sales. The company has also completed its pilot phase in Bengaluru and entered the growth phase, expecting a 12% market share by the end of the decade. In addition, it is in the process of initiating a pilot in the NCR. LODHA is further expanding its commercial and industrial portfolio to drive strong rentals. Palava is also set to scale up its sales by 20% YoY, supported by the Airoli-Katai tunnel nearing completion by the end of FY26 and other ongoing infrastructural developments. The company’s steady pace of project acquisitions enhances long-term visibility, while its disciplined and timely execution ensures that this momentum is effectively translated into sustained performance. We reiterate our BUY rating with a TP of INR1,888, which implies a 77% potential upside.

* Key risks to our TP include: a) a slowdown in residential absorption, b) a delay in the monetization of forthcoming projects, and c) slower BD convergence.

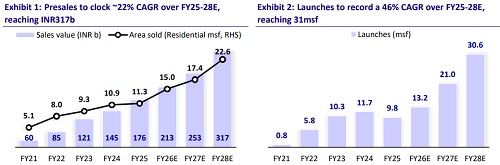

Expects to clock 22% CAGR in presales over FY25-28

* LODHA has maintained a strong presales momentum, delivering a 31% CAGR since FY21 and achieving INR90.2b in 1HFY26, or 43% of its annual target.

* Launch activity is expected to accelerate in 2HFY26 with 11 new projects and five-phase launches together carrying ~INR170b in GDV.

* With this pipeline and steady demand, LODHA is poised to deliver record quarterly presales of INR60b in both 3Q and 4Q, establishing the base for a sustained INR50b+ quarterly run rate from FY26 onward.

* The company is positioned for a 22% presales CAGR through FY28, supported by deepening presence across key markets, strong execution, and active project additions.

* Strategic BD additions of INR250b GDV and upcoming infrastructure upgrades, especially improved Palava connectivity, are expected to boost demand and drive ~20% higher sales.

Strengthening multicity momentum with rising headroom across key markets

* LODHA holds a leading 10% market share in MMR, ranks second in Pune with 5%, and has entered a defined growth phase in Bengaluru with a 2% share.

* In FY25, MMR, Pune, and Bengaluru contributed 66%, 27%, and 8% of launches (INR137b) and 82%, 14%, and 4% of presales (INR176b), highlighting concentration in key markets.

* Pune is expected to grow sales by 40% YoY to INR35b in FY26, while Bengaluru’s contribution rose sharply in 1HFY26, with launches of INR33b and sales increasing from 4% to 22%.

* With ~INR160b GDV secured and a robust launch pipeline, LODHA aims to expand the Bengaluru market’s share to 12% by FY31, supported by premium/luxury focus and strategic acquisitions.

* The company is also entering Delhi NCR with a strategic pilot phase, setting up a dedicated local team, acquiring key land parcels, and targeting its first project in FY27, supported by the appointment of an experienced CEO to drive on-ground execution and regional growth.

Strong cash flow allows future investments in land and reduction of debt

* Collections are set to accelerate sharply as major projects like Kharadi, Matunga, key JDAs, and Bengaluru developments reach ~70% completion by FY28, with Palava Phase 2 approaching ~40%, driving a significant rise in inflows to INR294b.

* Operating cash flow, which stood at INR67b in FY25, is projected to grow at a strong 26% CAGR to INR133b by FY28, supported by steady construction spending of ~INR70b annually.

* With a higher proportion of projects moving into mid- and late-stage construction by FY28, visibility on revenue recognition and cash inflows will strengthen further, enabling growth without incremental leverage.

Leasing set to double as Palava and data centers power up

* The annuity portfolio is expected to be ~85% leased by FY28, driving net lease income of INR6.9b (23% CAGR), supported by strong performance across malls, retail, and offices in key MMR micro-markets.

* Warehousing expansion in NCR and Chennai is set to scale the industrial portfolio to INR12.2b in revenue and INR5.6b in EBITDA by FY28, with industryleading margins of ~76%.

* Palava is emerging as a major data center hub, supported by marquee hyperscaler deals, sharp pricing growth, and a strong tenant mix, with another large deal expected soon.

Robust revenue and earnings trajectory ahead

* On the back of a strong execution track record and a rise in revenue recognition, total revenue is estimated at INR193b in FY28, with ~12% CAGR over FY25-FY28.

* EBITDA is expected at INR55b for FY28, implying ~11% CAGR over FY25-FY28. EBITDA margin is also projected to be 29%.

* PAT is likely to clock a 16% CAGR over FY25-28E to reach INR43b in FY28E, with a profit margin of 22%.

Valuation and view

* The company has delivered steady performance across its key parameters, and as it prepares to capitalize on strong growth and consolidation opportunities, we expect this consistent operational performance to continue.

* At Palava, LODHA has a development potential of 600msf. However, we assume that a portion of this would be monetized through industrial land sales. We value 250msf of residential land to be monetized at INR637b over the next three decades.

* We use a DCF-based method for the ex-Palava residential segment and arrive at a value of ~INR549b, assuming a WACC of 11.1%. Reiterate BUY with a TP of INR1,888.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412