Buy Crompton Greaves Consumer Ele. Ltd For Target Rs. 475 By Elara Capital Ltd

Growing its premium portfolio

We attended Crompton Greaves Consumer Electricals’ (CROMPTON IN) analyst meet. CROMPTON showcased its new platforms for premium fans – Nucleus and X-Tech, based on which it has launched India’s first five-star induction fan, offering double warranty compared with the industry average. CROMPTON seeks to grow its premium contribution to sales to 40% in the near term from the current 23-24%, and scale it up to 60% thereon. We reiterate Buy, led by robust growth potential in emerging categories, turnaround in Butterfly Gandhimathi Appliances (BGAM), attractive valuations and 11% underperformance versus the Nifty in the past three months.

Premium fans – Ramping up offerings:

CROMPTON has introduced a new range of premium fans – the indigenous Nucleus BLDC fan with next generation BLDC motor, robust electronics, high reliability hardware, surge protection and smart connectivity. CROMPTON also showcased the X-Tech platform-based next generation induction motor fan, which is fully indigenous. A one-star X Tech fan is economically priced compared with a BLDC fan, while a five-star fan is as energy efficient without BLDC.

CROMPTON has introduced HS Duro, India’s first five-star induction fan, Advancer Swirl, a three-star induction fan with a five-year warranty, and Superflo, India’s first fan offering 25% more air than other such models. CROMPTON has doubled its warranty on new products to within 3-5 years versus the industry average of two years. The new fans are priced at par with the industry average. Historically, CROMPTON has seen double-digit growth in BLDC and premium fans, growing 2-2.5x the growth rate of standard fans. CROMPTON is stocked up for the summer, to meet strong demand anticipated this year.

Solar pumps – Revenue at INR 2bn so far:

CROMPTON continues to grow its presence in solar pumps, having installed 5,000-6,000 pumps in the first year of the launch, and achieving related sales of INR 2bn so far. CROMPTON is increasing its product range in agri pumps, with wider voltage and better performance. Specialty pumps are witnessing a growth of 18-20% on a low base. Within the appliances segment, CROMPTON wants to cater to the entire house and not just fans. Hence, it may enter 2- 3 new categories soon. BGAM expects to grow in mid-teens and expand its margin

Reiterate Buy; TP retained at INR 475:

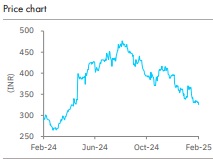

We have incorporated BGAM’s financials into CROMPTON. We maintain our TP at INR 475 on 36x FY26E P/E (December), led by longterm margin at 13% for CROMPTON, a recovery at BGAM and the Union Budget focusing on revamping consumption demand. We reiterate Buy led by strong growth potential in pumps and appliances, margin benefit from scaling up the premium portfolio, synergy benefits from turnaround at BGAM (in appliances), and attractive valuation of 30x FY26E P/E versus the industry’s 35x. The stock has underperformed the Nifty by 11% in the past three months. Expect an earnings CAGR of 26% in FY24-27E with average ROE of 33% in FY25E-27E.

Please refer disclaimer at Report

SEBI Registration number is INH000000933