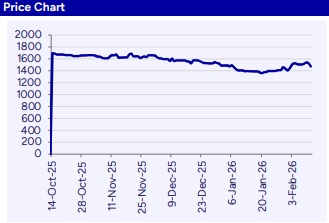

Buy LG Electronics India Ltd for the Target Rs.1,808 by PL Capital

Quick Pointers:

* Home Appliances & Air Sol reported 9.8% YoY rev. decline, margin contracted by 310bps

* Home Ent. reported 1.7% YoY rev. growth, margin contracted by 390bps YoY

Home Appliances & Air Solutions reported 9.8% YoY decline in revenue, with refrigerators and washing machines witnessing high single-digit YoY decline, while AC revenue remained largely flat. Segment margins contracted by 310bps YoY, impacted by rising commodity costs, operating deleverage, higher recycling compliance costs, and upfront AMC-related expenses. Despite the revenue softness, the company continued to gain market share across major categories on YTD basis. Home Entertainment reported 1.7% YoY revenue growth, driven by the Information Display business, while the TV segment remained flat YoY despite the GST reduction not translating into meaningful demand pickup. Segment margins declined by 390bps YoY, primarily due to execution of relatively low-margin Information Display orders during the quarter, which management expects to normalize going forward.

The management indicated that company enters Q4FY26 with strong momentum, supported by a positive response to its new BEE-rated portfolio and a two-track compressor products strategy focused on expanding both premium and ‘LG Essential’ offerings ahead of the summer season. The company remains focused on scaling its high-margin AMC business and tapping B2B infrastructure opportunities, while US tariff rationalization and the upcoming third manufacturing plant (Sri City plant) will strengthen its ‘Make India Global’ export ambitions and long-term growth outlook.

We downward revise our FY27/FY28 earnings estimates by 5.3%/5.0% factoring in correction in margins due to recycling costs linked to compliance, upfront AMC costs & elevated fixed costs arising with operation of new plant. We estimate FY26-28E revenue/EBITDA/PAT CAGR of 11.5%/23.0%/21.0%. Maintain ‘BUY’ rating with revised TP of Rs1,808 (earlier Rs1,920) based on 45x FY28 EPS.

Above views are of the author and not of the website kindly read disclaimer