Buy LG Electronics India Ltd for the Target Rs.1,700 by JM Financial Services Ltd.

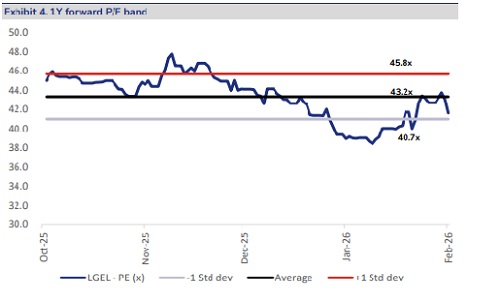

LG Electronics India Limited’s (LGEIL) 3Q performance missed our/Street estimates driven by a weak operating performance, the resulting negative operating leverage and high finance costs. Management guided for a strong 4Q (double-digit revenue growth/lower double-digit margin), and a stronger FY27E (double-digit revenue growth/EBITDA margin at FY25 levels), supported by (1) growth in exports (6-7% of revenue; target to 2x exports in FY27E, given lower US tariffs and EU-India FTA), (2) new launches in premium/Essential series, (3) growth in B2B products, and (4) incremental localization and price hikes. We factor in a weak 3Q through a 5% cut in FY26E EPS estimates, while we raise our FY27/28E EPS estimates by 1-3%. That said, we bake in a slightly conservative estimate vs. guidance; prefer not to rule out potential risks emanating from competitive intensity and rising input costs. We value LGEIL at 45x Dec’27E EPS, and arrive at a target price of INR 1,700. Maintain BUY

? Weak 3Q operational performance: 3Q revenue at INR 41.1bn, -6% YoY, was 2%/5% behind our/ consensus estimate; result of a 10% YoY decline in the home appliances & air solutions vertical and a modest 2% growth in the home entertainment segment. EBITDA at INR 2bn, declined 48% YoY, 15%/39% lower than our/consensus estimate on account of higher operational expenses. EBITDA margin at 4.8% contracted 300bps YoY on account of operating deleverage, elevated input costs, forex headwinds, higher e-waste compliance costs and the new labour code impact; margin was 70bps/270bps lower than our/consensus estimate. Both the home appliances & air solutions and home entertainment divisions reported a weaker YoY EBIT margin at 4% (vs. 7.1% YoY) and 9.6% (vs. 13.5% YoY) respectively. Adj. PAT at INR 1.1bn, -54% YoY, was 17%/47% below our/consensus estimate, driven by weak operating performance and higher finance costs

? Market share gains continue: Despite declines/modest growth in key categories, the Company maintained/expanded its market share across verticals. Within washing machines and refrigerators, LG retained pole position at a market share of ~33% and ~30% respectively. RAC market share stood at ~17%. In the premium segment, LG’s share in the OLED TV and side-byside refrigerator category stood at ~62% and ~43% respectively.

? Several factors drive healthy FY27E guidance: Management remains confident of a strong 4Q, historically a crucial quarter. For 4Q, management guided for double-digit revenue growth with lower double-digit EBITDA margin. For FY27E, management indicated double-digit revenue growth with margin at par with FY25 (12.8%), expected to be driven by (1) doubling of exports (6-7% of revenue currently, to 54 countries) aided by US tariff rationalization from 50% to 18% (LG has developed capabilities for premium products including side-by-side refrigerators and large-capacity top freezer refrigerators (650 ltr+) in its Pune facility and has passed US quality standards). and the India-EU FTA, (2) new product launches under the premium and Essential category, (3) higher localization, (4) expansion of B2B verticals (HVAC and information displays), and (5) scaling of the AMC business.

? Sri City facility progressing well; commencement likely by 4QCY26: In the upcoming Sri City facility, construction is progressing smoothly, with the first line of RAC production expected to commence in 4QCY26, followed by compressor production in the next phase. This facility will enhance production capacity, improve logistics efficiency, and support the localization roadmap, serving both domestic and export markets.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361