Add Astra Microwave Products Ltd For Target Rs. 1,175 By Choice Broking Ltd

Calm Quarter; Strategic Momentum Builds

We maintain a constructive stance on ASTM, despite a relatively soft quarter, as we view the moderation in performance as temporary rather than structural. The company’s deep involvement across multiple hightechnology defence and space programs reinforces our long-term confidence in its strategic trajectory. While management commentary remains measured, the underlying business momentum continues to strengthen – supported by healthy margin, diversified verticals and an improving execution rhythm.

We believe the radar and electronic warfare (EW) divisions remain the primary growth drivers, anchored by flagship programs, such as Rohini, Uttam, Hisar and Virupaksha. ASTM’s role as lead system integrator for the Su-30 EW suite marks a key milestone in technological capability and value capture. The space segment is emerging as a strong growth pillar, with the Bengaluru satellite facility now operational and the in-house Astra-1 satellite advancing towards commercial launch. Meanwhile, the ARC joint venture continues to scale up in defence communications, further strengthening revenue visibility over FY26–27.

With a consolidated order book of ~INR 1,961 Cr and incremental inflows expected in the second half of FY26, we find ASTM’s 18–20% revenue growth guidance both, realistic and achievable. Margin is expected to remain steady, supported by a richer system-level mix and stronger operating leverage. We maintain our ADD rating with a TP of INR 1,175, valuing the company at 40x the average of FY27/28E EPS. The mediumterm outlook remains robust, supported by deep R&D capabilities, expanding platform exposure and a clear pathway to scaling up systemlevel revenue over the next 2–3 years.

Misses Expectations; Margin Resilience

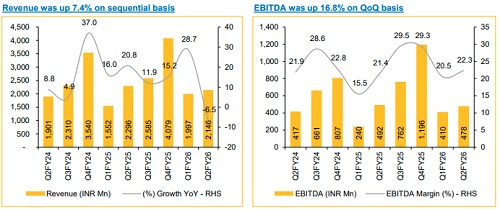

* Revenue for Q2FY26 down 6.5% YoY and up 7.4% QoQ at INR 2,146 Mn (vs CIE Est. INR 2,694 Mn)

* EBIDTA for Q2FY26 down 2.8% YoY and up 16.8% QoQ at INR 478 Mn (vs CIE Est. INR 579 Mn). EBITDA margin stood at 22.3%, improved 85bps YoY (vs CIE Est. of 21.5%)

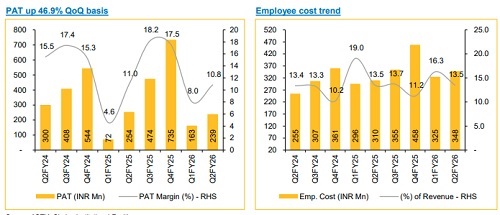

* PAT for Q2FY26 down 5.9% YoY and up 46.9% QoQ at INR 239 Mn (vs CIE Est. INR 300 Mn). PAT margin improved 8bps YoY, reaching 11.1% (vs CIE Est. 11.1%).

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131