Accumulate Tata Steel Ltd for the Target Rs. 181 By Prabhudas Liladhar Capital Ltd

Need to fast track capacity addition pace

We met the management of Tata Steel to gain insights on company's expansion plans and current demand scenario. Tata aims to achieve its stated capacity target of 40mtpa over the next 5 years. KPO-II ramp up is on track with CRM and other finishing lines that would get commissioned in Q2FY26 and drive additional volumes for the next two years. EC for NINL’s 9.5mtpa expansion is in advanced stages, and the management is expected to seek board approval once the EC is obtained. The 0.75mtpa EAF at Ludhiana is on track to get commissioned by Q4FY26. Similar two EAF projects will be undertaken on a fast-track basis once Ludhiana becomes operational and proves viable. The KPO site has sufficient land to commission an additional 8mtpa capacity which will be developed in phases.

We expect Tata to face capacity constraints post-FY28 if the pace of execution does not improve, particularly when robust domestic consumption rate continues. There remains an upside risk to our EBITDA/t assumptions, as the safeguard duty has effectively set a floor for domestic pricing, and improving demand would lead to higher prices in domestic parlance which is at ~6% discount to import parity prices. On the downside, demand uncertainty in developed markets and continued China supplies remains a risk for TSE performance. The stock currently trades at 6.2x/5.6x FY27/28E EBITDA. We maintain Accumulate rating with a revised target price of 181 (earlier 177), valuing the company at 6.5x EV/Sep’27E EBITDA (rolling forward from Mar’27).

* NINL expansion is the key amid demand upswing: Domestic demand is expected to see a significant improvement, supported by GST rationalisation, which is likely to drive growth in the Auto and Engineering segments in the near term. In addition, GoI’s continued focus on infrastructure spending is anticipated to boost demand for long products. To capture this opportunity, Tata is fast-tracking the expansion of NINL over the next few years, aimed at strengthening its market share in the longs segment. On the global front, however, demand remains subdued amid an uncertain environment, largely due to the impact of US tariffs.

* China policy and safeguard duty to cushion domestic steel prices: Chinese exports to overseas markets remain elevated; however, the recently announced anti-involution policy could support global steel prices if implemented effectively by Chinese mills. For India, the safeguard dutythough recommended at a lower than expected ~12%- should still provide protection over the next three years for domestic producers. Domestic prices are likely to improve as demand strengthens with the receding monsoon.

* TSUK breakeven on track, TSN cost transformation may see delays: With substrates sourced from TSI, TSN, and local markets, TSUK is on track to achieve breakeven by Q4FY26. The Rs115 bn cost transformation initiatives across three locations remain on schedule, and TSI’s EBITDA is expected to surpass Rs15k/t over the next two years, assuming stable pricing. TSN redundancies, however, are still in the informal discussion phase, representing a potential risk of delays.

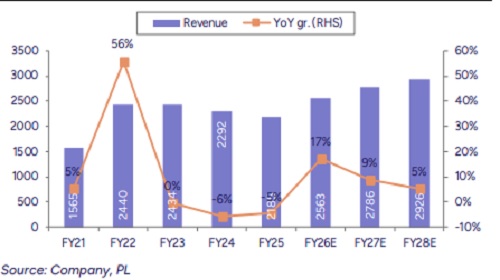

* Tata’s downstream focus to drive margins: With the expected commissioning of KPO-II’s 2.2mtpa CRM in Q2FY26, Tata’s downstream capacity is set to reach ~12mtpa. Tiscon’s double-digit volume growth, coupled with stable pricing (2.4mtpa in FY25), is expected to enhance Tata’s Branded sales and Auto segment mix, supporting NSR expansion. Tata also plans to expand its tubes capacity from ~1.6mtpa to 4mtpa over the next few years, which should further strengthen its downstream portfolio. We factor in volumes of 23/24.8/25.9mtpa in FY26/27/28E, with EBITDA/t at Rs13.5k/15k/15k, reflecting potential margin improvement from the enhanced product mix and capacity expansion.

* Tata’s iron ore self-sufficiency set to decline: With most of Tata’s iron ore mines expected to be auctioned post-2030, iron ore costs are likely to rise, resulting in a significant decline in self-sufficiency as only a few mines remain. However, the ongoing cost transformation program is expected to mitigate these pressures over the long term. On the global front, iron ore prices are likely to remain subdued as Simandou supply ramps up from Nov’25, providing some relief to Indian steel producers.

* Net debt reduction amid moderate capex: Tata plans to reduce net debt by ~Rs100 bn over the next 18 months, supported by a relatively low capex profile in FY26. Over the next two years, capex is expected to total Rs140-150 bn, with the potential for an increase by FY28, reflecting planned growth and expansion initiatives.

Exhibit 1: Revenue trend over FY21-28E with stable pricing assumptions

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271