Accumulate Hindustan Unilever Ltd for the Target Rs. 2,772 by Prabhudas Lilladher Ltd

Growth bottomed out, expect gradual recovery

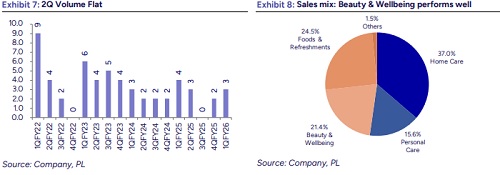

HUL sales remained impacted due to transitory effect of GST 2.0 and prolonged monsoon, however flat 2Q volumes and 2% GST impact do not show any recovery from 1Q standalone volume growth of 3%. However, company remains confident and expects gradual pick up in volumes from Nov25 as the new stock enters the trade gradually.

HUL’s new CEO highlighted focus on competitive growth driven by 1) focus on consumer segmentation by transforming core brands into more modern and youthful brands 2) sustained investments behind Future Core & Market Makers, which are growing in double digits 3) Superior product innovations and relaunches with focus on premiumization and 4) taking fewer and bigger bets. We believe HUVR is making a big push in premium segments especially in Beauty and wellbeing by leading category development and to regain lost ground by B2C acquisitions and new launches/brand extensions.

HUL expects mid-single digit volume growth for 2HFY26 on low base in a favorable macro environment. We expect volume/sales and margins to inch up gradually in coming quarters with expected PAT growth to 2HFY26 in mid to high single digits. We expect 6.9% Sales CAGR and 8.3% EPS CAGR over FY26- 28 (post ice cream demerger). We assign DCF based target price of Rs2772 (Rs2746 earlier), implying target PE of 53.6x FY28E EPS. Retain Accumulate.

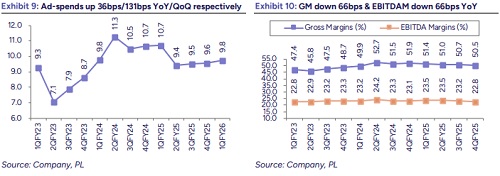

2Q Volumes flat, Gross Margins decline ~66bps YoY: Revenues grew by 0.5% YoY to Rs155.9bn (PLe:Rs157bn). Gross margins contracted by -66bps YoY to 50.4% (PLe:49%). EBITDA declined by -2.3% YoY to Rs35.6bn (PLe:Rs34.7bn). A&P Expenses grew by 4.3% YoY to Rs15.3bn. Adj PAT declined by -4% YoY to Rs25.1bn (PLe:Rs24.1bn).

* Home Care revenues declined by 1.2% YoY; EBIT declined by 3.4% YoY, while margins contracted by 42bps YoY to 18.5%. Mid-single digit volume led growth on a strong base; Fabric wash portfolio grew by mid-single-digit growth driven by strong double digit volume growth.

* Personal Care revenues grew by 0.6% YoY; EBIT grew by 21.4% YoY, while margins expanded by 345bps YoY to 20.1%. Growth was Flat impacted by GST rate transition; Skin Cleansing delivered competitive performance led by double digit growth in premium soaps, Oral Care saw marginal decline, while Closeup delivered low single-digit growth.

* Beauty & Wellbeing revenues grew by 2% YoY: EBIT declined by 8% YoY, while margins contracted by 283bps YoY to 26.6%. Witnessed 5% Sales growth driven by Skin Care and Health & Wellbeing, Skin Care and Colour Cosmetics grew high single-digit driven by Future Core and Market Makers portfolio. Health and wellbeing sustained strong momentum, led by OZiva’s triple-digit growth.

* Food & Refreshment revenues grew by 1.7% YoY: EBIT declined by 8.8% YoY, while margins contracted by 189bps YoY to 16.3%. Low-single digit volume growth. Tea saw high single-digit led by mix of price and volume; Coffee sustained double-digit growth. Nutrition Drinks saw early green shoots however turnover declined due to price actions taken last quarter. Subdued performance in Packaged Foods amid GST transition. Prolonged monsoon affected Ice Cream portfolio with turnover decline YoY

Concall Takeaways:1) Sales remained impacted amidst GST2.0 & prolonged monsoon 2) HUL expects volume to gradually pickup from Q3 onwards as prices stabilize with positive bias. 3) Both urban and rural market growing in line with expectations 4) company’s 40% of portfolio transitioned to 5% GST slab with pricing and grammage change to 1200 SKU’s 5) Mgmt. expects low single digit price growth if commodity prices remain stable 6) Company will sharply focus on consumer segmentation with transforming core brands to align them with modern and youthful capabilities 7) Company will fully focus on volume led growth by enabling superior online brand discovery and investing disproportionately to scale its high-growth demand spaces 8) detergents continues to grow double digit volumes as HUL has been aggressive in taking price correction in competitive environment 9) Nutrition is being viewed as a high growth area, and green shoots are visible 10) HUL will focus on 400mn Genz who will be key growth drivers in coming years 11) 12) Premium soaps saw double digit growth and company likely to push newer launches in liquid soap. 13) Mgmt guided the EBITDA margins to remain in the range of 22-23% and expects 50bps improvement once the demerger of ice cream business is completed.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271