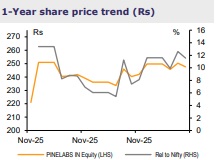

Reduce Pine Labs Ltd for the Target Rs.225 by Emkay Global Financial Services Ltd

Pine Labs reported 17.8% YoY revenue growth, with strong growth in the Issuing and Acquiring business (up 32.5% YoY) offsetting the weakness in Digital Infrastructure and Transaction Processing (DITP) business (up 11.9% YoY). EBITDA increased 46.7% QoQ and 132% YoY on the back of operating leverage. The management highlighted that Issuing, VAS, Affordability, and Online are all growing at +30% YoY. However, DITP business’ revenue growth was dragged by the company moving away from hardware-included deals to software deals. Affordability business’ scale-up is leading to higher working capital investments, which resulted in Rs(2.15)bn FCF for H1FY26. We are increasing our FY26E/27E EBITDA by 4.5%/5.2% on account of strong growth in the Issuing and Acquiring business. On FY28E, the stock trades at 27x EV/EBITDA and 52.9x P/E. We increase our DCF-based TP to Rs225 (Rs210 earlier). However, we maintain REDUCE, given rising competitive intensity.

Weak growth in DITP due to seasonality and move to an asset-light model DITP business’ revenue growth was weak at 11.9% YoY, as revenue per DCP declined sharper than expected to Rs336 vs Rs380 in FY25. The company added 60k devices (390k in FY25). Pine Labs is moving away from hardware-included deals to capex-light software deals, where the company earns software and platform revenues with the hardware costs being covered by its customers. These are margin-accretive but have lower absolute revenue per deployment. Affordability, VAS, and transaction processing GTV saw 37% YoY growth, with Affordability, VAS, and transaction processing-enabled DCPs (up from 21% of the portfolio in Q2FY25 to 25% in Q2FY26).

Strong growth in Issuing and Acquiring business led by international business Issuing and Acquiring business’ revenue grew a healthy 33.3% YoY, with 31%/35% YoY growth in India/international business. The management attributed the subdued growth in FY24 and FY25 to confusion regarding GST payable on sale of gift cards. With resolution of this matter, brands have accelerated commissioning the issuance of gift cards. Given this resolution, and strong pipeline in the international business, we have raised our revenue estimates for the Issuing and Acquiring business by 4.9%/8.4% for FY26/27, leading to 4.5%/5.2% increase in FY26E/FY27E EBITDA.

Outlook and valuations: Tailwinds in Issuing and Acquiring business For Pine Labs, we are now building in 20.4% revenue CAGR over FY25-28E, with 24.3% CAGR for the Issuing and Acquiring business (19.7% earlier). We will watch out for the execution on this front, considering strong growth in Q2FY26 and the tailwinds from international geography. The revenue decline in the POS business is higher than our estimates, but we expect strong growth in Affordability, VAS, and TP to offset it and deliver 18.6% CAGR for the DITP business over FY25-28E. Pine Labs trades at 27x FY28E EV/EBITDA and 52.9x P/E. We maintain REDUCE, with a DCF-based TP of Rs225.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354

.jpg)