Accumulate Kajaria Ceramics Ltd For Target Rs. 895 By Elara Capital

Awaiting demand recovery

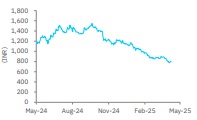

Despite muted tile demand driven by weak exports and soft retail sentiment, we anticipate a recovery in the medium-to-long term. In FY25, Kajaria Ceramics (KJC IN) continued to outperform the market, leveraging its strong brand positioning to gain share. However, nearterm headwinds are likely to persist. So, we lower our TP to INR 895 (from INR 1,040), based on 30x (from 33x) FY27E P/E. We reiterate Accumulate.

Soft domestic demand and weak exports drag Q4 growth: KJC reported a modest 1.1% YoY increase in consolidated net sales to INR 12.2bn in Q4, falling short of our estimates by 3.2%. Tile revenue was largely flat in value terms, with a 1.8% growth in volumes. The muted performance was driven by continued softness in domestic demand and weak traction in exports. For FY25, KJC’s tile volumes rose 6%, outperforming the industry’s 2-3% growth. However, tile exports for the industry declined by 20% amid elevated freight costs, the Red Sea crisis, and broader geopolitical tensions. The management anticipates a rebound in exports to FY24 levels as freight rates have now normalized. Tile realization dipped 2.1% YoY in Q4, aligning with the declining trend seen in the past two years, though it held steady sequentially, supported by a stable sales mix (retail 70%, projects 30%). The bathware segment grew 8% in Q4, leading to a 6% rise in FY25. Meanwhile, KJC has decided to exit its plywood venture, initiated in 2017, as the expected GST-driven shift from unorganized to branded products did not materialize

Challenging demand environment; KJC aims to outperform industry in FY26: The environment in the domestic market is challenging for the industry. In response, KJC is actively pursuing strategic initiatives such as rebranding, SKU consolidation, and strengthening its market presence by re-positioning and expanding its network of exclusive dealers, which currently stands at 450 out of a total 1,800 dealers. Also, KJC is reassessing its cost structure to enhance competitiveness and drive growth ahead of industry, with focus on margin improvement. While maintaining the aim to outperform the sector, the management has chosen not to provide guidance for FY26 due to prevailing demand uncertainties.

Q4 margin hit by negative operating leverage and losses in UK operation: Q4 EBITDA margin contracted 300bps YoY to 11.3% versus our estimates of 12%, given subdued growth in tiles and bathware, losses in the UK business, and a sharp margin decline in bathware (4% in FY25 versus 8% in FY24). Power costs remained largely stable on a sequential basis. However, the management anticipates a margin recovery going forward, supported by improved volume growth and ongoing cost optimization efforts.

Reiterate Accumulate with a lower TP of INR 895: We cut our earnings estimate by 8% and 5% for FY26E and FY27E respectively, to factor in lower volume growth and lower profitability. We reiterate Accumulate with a lower TP of INR 895 from INR 1,040, based on 30x (from 33x) FY27E P/E, due to near-term growth challenges. We introduce FY28 numbers.

Please refer disclaimer at Report

SEBI Registration number is INH000000933