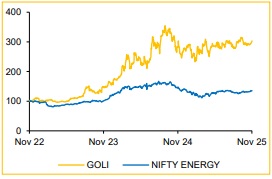

Buy Gulf Oil Lubricants Ltd For Target Rs. 1,600 By Choice Broking Ltd

Margin Stabilisation Paired with Volume growth

Margin stabilisation paired with volume growth through hedging and product launces: GOLI is strategically improving its product mix in order to grow volumes along with protecting its margin . The firm has dedicated advisors, who estimate movement of INR against USD and provide the framework to determine the percentage of forex exposure to be hedged. As a result, company is able to protect its margin in the range of 12 to 14% amidst rupee depreciation. We estimate company’s margin to expand in FY26-27 and ultimately improve beyond 14% in FY28, driven by correction in base oil prices and the company’s ability to defend its margins. Provided GOLI is remarkably expanding in 12 out of the 15 segments it operates in, there is significant upside left for the firm.

Overhang of EV penetration: GOLI increased its stake in Tirex, an EV charger manufacturing firm, from 51% to 65%, by investing INR 380Mn , underlying the firm’s commitment to be the part of EV supply chain. The firm claims that about 33% of the buses are currently being charged using GOLI’s chargers via Tirex. The company has begun supplying AC home chargers to MG Motor – where EVs form a large share of sales – and is also supplying both AC and DC chargers to other clients, with approvals secured from 12+ OEMs. Meanwhile, the PM EDRIVE initiative offers incentives of up to INR 9.6 lakh per electric truck in N2 and N3 categories. This aligns with GOLI’s acquisition in Tirex, positioning it to benefit from the scheme’s boost to EV infrastructure. We increasingly expect this optionality in the business to reach INR300–400 crores over the next few years with EBITDA margin of 12–14%.

View and Valuation: We revise our FY26/FY27 EPS estimate downwards by 1%/3%. However, we maintain the target price of INR 1,600, as we value the company using DCF model, implying a PE multiple of 14.6x/12.8x at FY27E EPS/FY28E EPS. We reaffirm our BUY rating on the stock.

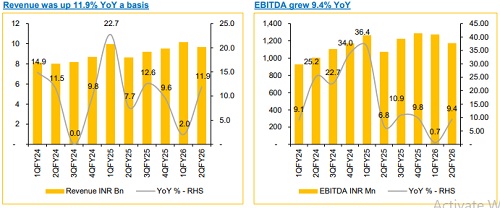

Q2FY26 Results: Revenue and EBITDA beat, while margins degrew

* Revenue was up 12.7% YoY to INR 9.6Bn (vs CIE est. of INR 9.0Bn)

* EBITDA was up 10.6% YoY to INR 1.2Bn (vs CIE est. of INR 1,1Bn). EBITDA margin was down 23bps YoY to 12.36% (vs CIE est. at 12.79%)

* PAT was up 3.2% YoY to INR 871Mn (vs CIE est. at INR 939Mn)

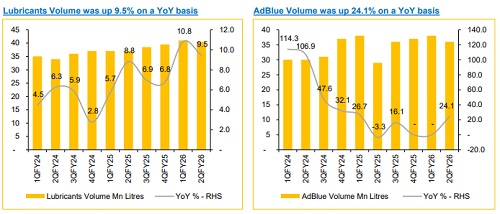

Capacity Ramp-up to Support Volume Growth: GOLI aims to increase its capacity, from 140,000 to 240,000 kilo litres, by FY27. The additional capacity in Chennai is expected to come online earlier than Silvassa’s. We bake in execution risk in our numbers such that volumes reach 77% of announced combined capacity of the two plants by FY27.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131