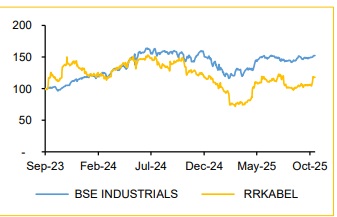

Buy R R KABEL Ltd for the Target Rs. 1,820 By Choice Broking Ltd

Strong Volume Growth Boosts Margin

Sustained Margin Expansion post Q1:

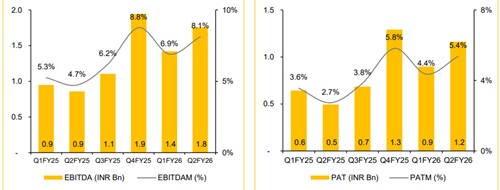

RRKABEL posted superior margin in Q2FY26 of 8.1% vs 4.7% YoY, an increase of 339 bps. This margin expansion was driven by operational efficiency gains, improved product mix and benign costs scenarios. Exports jumped by 34% YoY to INR 21.6 Bn. Moreover, as capacities scale up, we expect further margin expansion to 8.8% by FY28E. FMEG segment is also expected to add to consolidated margin by Q4FY26E.

View and Valuation

We believe RRKABEL is well-positioned to capitalise on structural tailwinds from infrastructure spending, renewable energy and data centre push. Further, the ongoing capacity addition which is expected to come online by FY27E will support revenue and margin growth.

We modify our FY26E / FY27E PAT estimate upwards by 3.3% / 3.5%. However, we maintain our target price at INR 1,820 using the DCF approach. Our target price implies a PE multiple of 55x / 42x on FY26E / FY27E EPS. Accordingly, we reaffirm our ‘BUY’ rating.

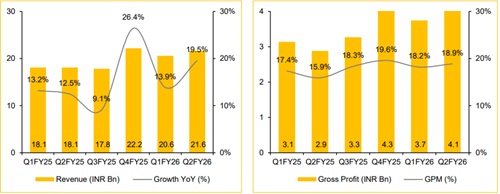

Strong Volume Growth With Margin Expansion

* Consolidated Net Revenues grew by 19.5% YoY, coming in at INR 21.64 Bn.

* Gross margin improved by 296 bps YoY and by 69 bps QoQ coming in at 18.9% for Q2FY26.

* EBIDTA came in at INR 1.76 Bn with a margin of 8.1%, an increase of 339 bps YoY.

* PAT increased by ~135% YoY, coming in at INR 1.2 Bn, versus INR 0.5 Bn in Q2FY25.

C&W Segment

* Revenue grew by 22% YoY to INR 19.7 Bn. EBIT more than doubles to INR 1.8 Bn in Q2FY26 from INR 0.8 Bn YoY.

FMEG Segment

* Revenue degrowth of 3% YoY to INR 1.9 Bn. ? EBITM decreased 16 bps YoY and 289 bps QoQ, coming in at -6.1%.

CapEx to Drive Revenue Growth, Major Outlay Towards Cables

RRKABEL is implementing an upgrade of its production capacity by 70%, the maximum revenue generation potential is INR ~40 Bn at a Fixed Asset turnover of 3.5–4x.The total CapEx is expected to be INR 1.2 Bn over 2 years, with 80% of spent towards High Voltage (HV) Power Cables up to 220 kV. HV Cables offer higher margins of 10–12% v/s 4–6% as compared to Low Voltage Cables. As the mix tilts towards Cables, margin is expected to be buoyant and further RoE gains will accrue.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131