Hold Britannia Industries Ltd For the Target Rs. 5130 By the Axis Securites

Recommendation Rationale

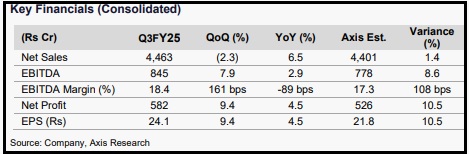

Britannia's Q3FY25 results: Britannia's Q3FY25 results exceeded our estimates on all fronts. Despite a subdued demand environment, the company’s consolidated revenue grew by 6.5% YoY (versus our estimate of 5%), driven by a 6% YoY volume growth. Management indicated a 6-6.5% cumulative price hike, with a 2% increase implemented in Q3, 2.5% planned for Q4, and an additional 1.5% in Q1FY26 to mitigate an 11% inflation impact. Notably, focus states expanded at 2.6x, while rural distribution grew from 30,000 to 31,000 outlets in Q3FY25.

Margin guidance amid commodity inflation: Gross margins declined by 606 bps YoY to 36.9%, impacted by sharp cost inflation in wheat, palm oil, and cocoa. Consequently, EBITDA margins declined by 89 bps to 18.4%, though partially offset by stringent cost efficiency measures, including a 47% YoY reduction in staff costs. Management reaffirmed its focus on maintaining EBITDA margins at current levels, with absolute profit growth expected to continue, supported by price hikes and operational efficiencies

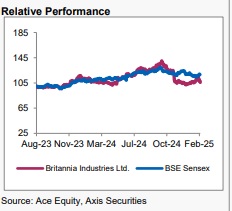

Demand Outlook: The company remains agile in responding to commodity price fluctuations and competitive pricing trends. While sector-wide challenges persist, the overall trajectory appears stable. However, near-term headwinds, including soft demand, urban market weakness, rising input costs, and intensifying competition, may constrain growth and margins, keeping the stock range-bound.

Sector Outlook: Cautious

Company Outlook & Guidance: As the near-term outlook remains challenging, we maintain our HOLD stance in the stock. However, we have increased our FY25/FY26 estimates.

Current Valuation: 45xDec-26 EPS (Earlier Valuation: 50xSep-26 EPS ).

Current TP: Rs 5,130/share (Earlier TP: Rs 5,000/share).

Recommendation: With an upside of 5% from the CMP, we maintain our HOLD stance

Financial Performance Revenue grew by 6.5% YoY, reaching Rs 4,463 Cr, driven by single-digit volume growth (~6% YoY). Gross margins declined by 606 bps to 36.9% due to a steep rise in key commodity prices (wheat, palm oil, cocoa). EBITDA margins stood at 18.4%, down by 89 bps, partly offset by higher operating leverage. Adjusted PAT was Rs 582 Cr, up 4.5% YoY.

Outlook Near-term challenges persist due to several factors: (1) a subdued demand environment, (2) underperformance in urban markets, particularly in metros and large cities, (3) steep commodity inflation, especially in palm oil and other key raw materials, and (4) rising competition. These headwinds are likely to weigh on Britannia’s topline growth and margins. Consequently, we expect the stock to remain range-bound and maintain our rating to HOLD.

Valuation & Recommendation: Based on the above thesis, we estimate Revenue/EBITDA/PAT CAGR of 9.2%/7.6%/9.6% over FY24-27. With an upside of 5% from the CMP, we maintain our stance to HOLD the stock with a revised TP of Rs 5,130/share.

Valuation & Recommendation: Based on the above thesis, we estimate Revenue/EBITDA/PAT CAGR of 9.2%/7.6%/9.6% over FY24-27. With an upside of 5% from the CMP, we maintain our stance to HOLD the stock with a revised TP of Rs 5,130/share.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633