Kotak Strategy : Have Indian households been overpaying for their gold? by Kotak Institutional Equities

Have Indian households been overpaying for their gold?

The perceived benefit from the sharp gold price rise may be smaller for Indian households, given (1) the bulk of household gold purchases are in the form of jewelry, (2) the value of gold is only 60-70% of the jewelry purchase price and (3) the weak performance of diamonds, which form a meaningful part of the jewelry purchase price. Nonetheless, gold’s investment appeal has significant negative implications for India’s external sector balance.

Gold jewelry IRR around 10.3% versus 12.5% CAGR return of gold

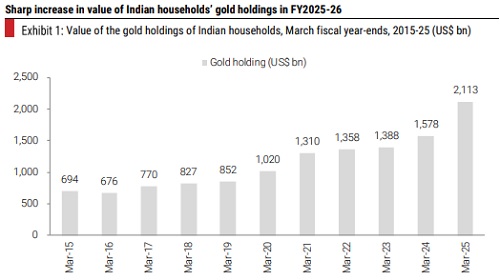

Indian households have seen a sharp increase in the value of their gold stock, the bulk of which is in the form of jewelry (see Exhibit 1). However, the ‘wealth effect’ may be much lower, given the premiums households pay in the form of (1) making charges and (2) precious stones, which have seen steady price corrections that would have offset part of the gains from the sharp rise in gold prices (see Exhibit 2). We estimate 10.3% IRR for household gold jewelry purchases over FY2011-1HFY26 versus the 12.5% CAGR in gold prices (fiscal average) on INR basis over this period (see Exhibit 3).

FOMO is reflected in ETF investments in India

As discussed in our October 7, 2025, report (When haven and risky assets are on a tear), we attribute the sharp rise in gold prices to the strong investment demand (see Exhibit 4 for a breakdown of global gold demand). We note that the FOMO from the sharp increase in gold prices appears to be influencing investment demand in India in recent months as well. Exhibit 5 shows the monthly inflows in gold ETFs versus gold prices over the past six years. We note that retail investors have increased their allocation to financial gold compared with equities over the past two months (see Exhibit 6).

Buying gold jewelry for investment may not be a smart strategy

In our view, gold jewelry as an investment product makes limited sense, given that gold prices would need to rise 25-30% for households to break even on their purchases (assuming stable prices of precious stones, which may be an optimistic assumption). It makes better investment sense to buy financial (ETFs) or physical (coins, bars, bricks) gold. We note that Indian households’ gold holdings are (1) owned largely by low-income households (see Exhibit 7), (2) held as insurance against exigencies and (3) used for specific big-ticket spending (such as education and wedding).

Higher gold allocation has negative implications on India’s external balance

We highlight that an increase in Indian households’ allocation to gold over other asset classes has negative implications for the external sector, as it has the potential to widen India’s current account and trade deficits. Exhibit 8 shows India’s net gold imports relative to its current and trade deficits for the past 15 years. Exhibit 9 shows the key components of India’s BoP accounts for the past few years. Importantly, foreign inflows, which previously buffered India’s BoP, no longer provide support to this ‘exchange’ anymore (see Exhibit 10).

Please refer disclaimer at https://www.kotaksecurities.com/disclaimer

SEBI Registration No. INZ000200137