Weekly Derivatives Insights 08th December 2025 by Axis Securities

Nifty Futures closed at 26,333.2 on Friday, down 0.2% (54.2 points), with open interest rising 9.9% as 14.57 lakh contracts were added, taking the total to 161.36 lakh, indicating a short build-up and reflecting cautious trading sentiment.

Bank Nifty futures settled at 60,055.60, slipping 12.6 points with open interest down 3.7% as 0.65 lakh contracts were unwound, reducing the total to 16.80 lakh, signaling long unwinding and reflecting weak trader conviction.

India VIX fell 11.3% to 10.31% from 11.62%, its lowest close in seven weeks, highlighting subdued volatility expectations with reduced hedging activity.

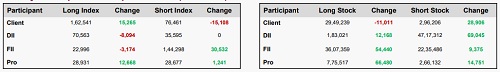

The FII Long-Short ratio declined to 0.16 from 0.23, reflecting unwinding of futures index longs alongside notable build-up in shorts, with short positions clearly outpacing longs, signaling cautious undertones even as broader sentiment maintains a degree of optimism.

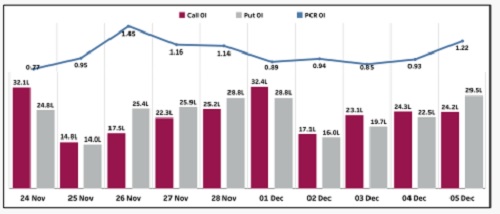

Nifty PCR OI:

Nifty Put-Call Ratio (PCR) rose by 0.08 over the week, driven by a decline in Call option open interest and an increase in Put option open interest, with puts seeing stronger additions than calls, indicating a defensive undertone in positioning.

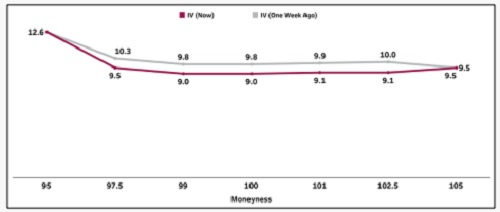

The uniform implied volatility across both OTM call and put options implies that the market is foreseeing steady price action and a low probability of large, sudden price changes.

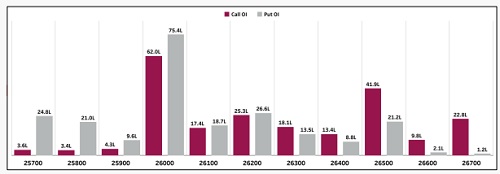

The strike concentration for the current monthly expiry shows significant open interest build-up on the Call side at 27,000 and 26,000, while on the Put side notable positioning is seen at 26,000 and 25,000, indicating a key tussle around the 26,000 strike as the pivotal zone. Based on the data, we project the Nifty to trade between 26,000 and 26,700 in the week ahead.

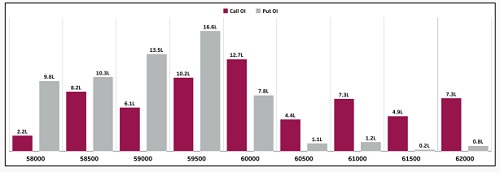

The strike concentration for the current month’s expiry shows significant open interest build-up on the Call side at 60,000 and 59,500, while on the Put side notable positioning is concentrated at 59,500 and 59,000, indicating a tight range with 59,500 emerging as the key pivot level. Based on the data, we project the Bank Nifty to trade between 59,000 and 60,500 in the coming week.

FII's total open interest in Index Futures is atRs 32,943 ,which on a weekly basis has increased by Rs 5,175 Crs.

Foreigners had 1,67,294 Index futures contracts open, adding 27,358 contracts from the previous week, with Nifty futures witnessed added 30,652 contracts and Bank Nifty futures unwinding 2,840 contracts.

Trade Ideas:

Buy KPITTECH December Futures in 1271 – 1258 range | SL 1235 | Targets 1343 & 1379 (Long Build Up).

Buy BRITANNIA December Futures in 5985 – 5925 range | SL 5875 | Targets 6205 & 6315 (Short Covering).

The Week That Was:

* Nifty futures at 26,333.2 on Friday, down 0.2% (54.2 points), with open interest rising 9.9% as 14.57 lakh contracts were added, taking the total to 161.36 lakh, indicating a short build-up and reflecting cautious trading sentiment.

* Bank Nifty futures settled at 60,055.60 , slipping 12.6 points with open interest down 3.7% as 0.65 lakh contracts were unwound, reducing the total to 16.80 lakh, signaling long unwinding and reflecting weak trader conviction.

* India VIX fell 11.3% to 10.31% from 11.62%, its lowest close in seven weeks, highlighting subdued volatility expectations with reduced hedging activity.

* The FII Long-Short ratio declined to 0.16 from 0.23, reflecting unwinding of futures index longs alongside notable build-up in shorts, with short positions clearly outpacing longs, signaling cautious undertones even as broader sentiment maintains a degree of optimism.

Nifty Open Interest Put-Call Ratio

* Nifty Put-Call Ratio (PCR) rose by 0.08 over the week, driven by a decline in Call option open interest and an increase in Put option open interest, with puts seeing stronger additions than calls, indicating a defensive undertone in positioning.

Volatility Analysis

* The uniform implied volatility across both OTM call and put options implies that the market is foreseeing steady price action and a low probability of large, sudden price changes.

* Furthermore, the term structure's flattening trend signals a decrease in the perceived risk of future extreme events, leading to less demand for hedging and leveraged directional bets.

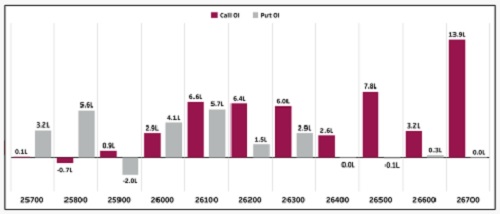

Nifty Open Interest Concentration (Monthly)

* The strike concentration for the current monthly expiry shows significant open interest build-up on the Call side at 27,000 and 26,000, while on the Put side notable positioning is seen at 26,000 and 25,000, indicating a key tussle around the 26,000 strike as the pivotal zone.

* Speaking of open interest changes, the 26,700-strike Call and 26,100 strike Put saw the maximum addition, alongside the 26,800 strike Call and 25,800 strike Put.

* Based on the data, we project the Nifty to trade between 26,000 and 26,700 in the week ahead.

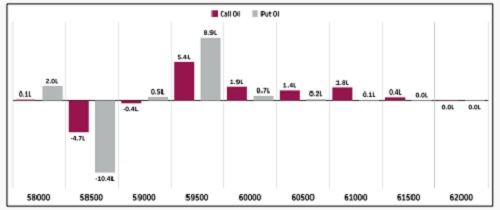

Bank Nifty Open Interest Concentration (Monthly)

* The strike concentration for the current month’s expiry shows significant open interest build-up on the Call side at 60,000 and 59,500, while on the Put side notable positioning is concentrated at 59,500 and 59,000, indicating a tight range with 59,500 emerging as the key pivot level.

* Speaking of open interest changes, the 59,500-strike Call and 59,500 strike Put saw the maximum addition, alongside the 60,000 strike Call and 58,000 strike Put.

* Based on the data, we project the Bank Nifty to trade between 59,000 and 60,500 in the coming week.

Nifty Change in Open Interest (Monthly)

* For Nifty in the current monthly expiration cycle, notable addition in calls was seen at the following strikes - 26,100 (6.6 Lc), 26,500 (7.8 Lc), and 26,700 (14 Lc), respectively. There was notable unwinding observed at 26,900 & 27,000 strike.

* Coming to puts, the 26,100 (5.7 Lc), 26,000 (4.1 Lc), and 25,800 strikes (5.6 Lc) saw considerable addition in open interest. There was notable Unwinding witnessed at 25,900 & 25,600 strike.

Bank Nifty Change in Open Interest (Monthly)

* For the Bank Nifty based on the current monthly expiration cycle - notable addition in calls was seen at the following strikes - 59,500 (5.4 Lc), 60,000 (1.9 Lc), and 60,500 (1.3 Lc), respectively. There was significant unwinding observed at 58,500 strike.

* Coming to puts, the 60,000 (0.7 Lc), 59,500 (8.9 Lc), and 58,000 strikes (2.0 Lc) saw considerable addition in open interest. There was significant unwinding observed at 58,500 strike.

Weekly Participant-wise Open Interest (contracts)

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633