Hold Hindustan Unilever Ltd for Target Rs 2,540 by Axis Securities

Changes in Estimates post Q3FY26

FY27E/FY28E: Revenue: -2%/-2%; EBITDA: -8%/-8%; PAT: -8%/-8%

Recommendation Rationale

Volume recovery gaining ground: HUL posted a 2.8% YoY increase in revenue in Q3FY26, with underlying volumes expanding 4%, reflecting broad-based traction across categories. Management indicated that demand trends have gradually improved, supported by moderating inflation, particularly in food, over recent months. The steady improvement in consumer confidence signals an early recovery in overall consumption sentiment.

Margins Outlook: EBITDA margins contracted 14 bps YoY to 23%, impacted by a 28 bps decline in gross margins. However, management expects sequential improvement, supported by a favourable price–cost equation, better product mix, and ongoing net productivity initiatives. Management reiterated margin guidance of 22–23%, while continuing to invest in the business to drive sustained growth, with a clear focus on volume-led growth and premiumisation.

Growth Outlook: HUL remains focused on driving competitive, volume-led growth through stronger brand positioning, expansion in high-growth segments, and scaling of future-ready channels such as quick commerce. With macro conditions stabilising and portfolio as well as channel transformation underway, management expects FY27 to outperform FY26, with growth remaining the top strategic priority.

Strategic moves: HUL announced two strategic actions within its Health & Wellbeing portfolio — acquisition of the remaining 49% stake in OZiva and exit from its 19.8% minority holding in Nutritionalab Private Limited.

Sector Outlook: Cautiously Positive

Company Outlook & Guidance: Management expects a gradual recovery in the coming quarters, aided by recent GST rate reductions, which could act as a catalyst for demand recovery in the long term, along with other favourable macro policies. However, we remain cautious in the short term and prefer to adopt a wait-and-watch approach and therefore maintain our HOLD rating on the stock.

Current Valuation: 50xDec’27 EPS; (Earlier Valuation: 52xSep’27 EPS ).

Current TP: Rs 2,540/share; (Earlier TP: Rs 2,750/share).

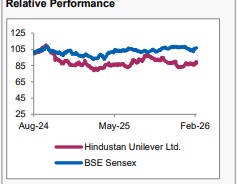

Recommendation: With a 5% upside from the CMP, we maintain our HOLD rating on the stock.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633