Reduce L&T Technology Services Ltd For Target Rs. 4,661 - Centrum Broking Ltd

L&T Technology reported a muted performance for Q4FY25. Both revenue and EBIT margin were slightly below expectations. The company reported revenue at Rs29.8bn (up 12.4% QoQ in INR terms; up 10.7% QoQ in USD terms; up 10.5% QoQ in CC terms). The sequential growth was led by Intelliswift acquisition, which was completed on Nov 11, 2024. Segment-wise in USD terms, Tech was up by 27.9% QoQ; Sustainability was up by 1.9% QoQ; Mobility was down by 0.2% QoQ. EBIT margin declined by 270bps QoQ to 13.2%, led by integration related costs post the Intelliswift acquisition. During the quarter, deal booking remained strong. The company reported the highest ever deal booking for the quarter. Active clients number increased by 43 QoQ to 421 clients. Headcount was up by 793 QoQ at 24,258 employees with attrition down by 10bps QoQ at 14.3%. It has reaffirmed its medium-term US$2bn revenue outlook and aims for mid-16% EBIT margin between late FY27 and early FY28. Double-digit USD CC revenue growth is confirmed for FY26. Despite near-term market uncertainty impacting areas like Mobility, the company relies on its diversified portfolio, AI strengths and 'go deeper to scale' strategy. We expect Revenue/EBITDA/PAT to clock 13.2%/17.8%/20.4% CAGR over FY25-FY27E. We have revised our FY26/FY27E EPS by (3.9%)/(4.3%). We maintain REDUCE rating with a revised target price of Rs4,661 (vs Rs5,050 earlier) at a PE of 27x (vs 28x earlier) on March’27 EPS. We have decreased the target multiple from 28x to 27x to account for near term uncertainties in the demand environment.

Revenue slightly below expectation

Revenue grew by 12.4% QoQ in INR terms; up 10.7% QoQ in USD terms and up 10.5% QoQ in CC terms. Segment-wise in USD terms, Tech was up by 27.9% QoQ; Sustainability was up by 1.9% QoQ; Mobility was down by 0.2% QoQ. This quarter faced headwinds from delayed deal ramp-ups impacting revenue. Mobility outlook is muted in near term before a potential H1FY26 turnaround, but resilient Tech and Sustainability segments will support the confirmed double-digit growth outlook for FY26 towards the US$2bn goal.

Operating margin declined sequentially

EBIT margin improved by 83bps QoQ to 15.9%, led by the Intelliswift consolidation (~150bps), revenue headwinds and strategic customer investments. While FY25 wage hikes are complete, FY26 hike decisions are pending. Margin improvement focus includes operational efficiencies and increasing the offshore mix towards 60%.

Maintain REDUCE

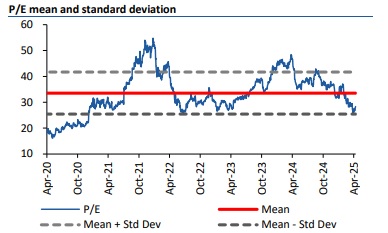

The near term demand environment remains challenging, notably for Mobility, but LTTS is encouraged by record H2FY25 deal wins and a strong ongoing pipeline. It is cautiously optimistic in near term and has confirmed double-digit USD CC growth for FY26, anticipating a better year and maintaining medium-term goals. We expect Revenue/EBITDA/PAT to clock 13.2%/17.8%/20.4% CAGR over FY25-FY27E. We have revised our FY26/FY27E EPS by (3.9%)/(4.3%). We maintain REDUCE rating with a revised target price of Rs4,661 (vs Rs5,050 earlier) at a PE of 27x (vs 28x earlier) on Mar’27 EPS. We have decreased the target multiple from 28x to 27x to account for near term uncertainties in the demand environment.

Valuation

We value the company at a PE of 27x on March’27E EPS to arrive at a target price of Rs4,661.

For More Centrum Broking Disclaimer https://www.centrumbroking.com/disclaimer/

SEBI Registration No.:- INZ000205331