Neutral Can Fin Homes Ltd for the Target Rs. 915 by Motilal Oswal Financial Services Ltd

Steady quarter; reported NIM expands ~20bp QoQ

Advances grew ~8% YoY; impact of IT transformation business to be monitored

* Can Fin Homes’ (CANF) PAT for 2QFY26 grew ~19% YoY to ~INR2.5b (~5% beat). PAT grew 16% YoY in 1HFY26 and is expected to rise ~20% YoY in 2HFY26. NII grew 19% YoY to ~INR4b (~8% beat) in 2QFY26, while fees and other income stood at ~INR63m (PY: INR72m).

* Opex rose ~28% YoY to INR762m (~13% higher than MOFSLe). The cost-toincome ratio stood at ~19%. (PQ: ~18%, PY: ~17%). PPoP grew ~16% YoY to INR3.3b (~5% beat). The effective tax rate for the quarter stood at ~24.2% (PQ: 19.4% and PY: ~22.8%). CANF’s 2QFY26 RoA/RoE stood at ~2.45%/~18.4%.

* CANF reiterated its FY26 disbursement target of INR105b, though 3Q disbursements are expected to be modestly impacted by the ongoing IT transformation. However, management remains confident of a strong recovery in business momentum in 4Q. It has guided for loan growth of 12- 13% in FY26 and ~15% from FY27 onwards.

* Management has raised its FY26 guidance for spreads and NIM to ~2.75% and 3.75%, respectively, supported by continued benefits from a lower cost of funds. It noted that asset repricing continues but with a lag. Management also highlighted that competition in the HFC space remains rational, with no signs of aggressive or irrational pricing behavior.

* We have raised our FY26 EPS estimate by ~5% to factor in higher NIMs and lower credit costs, while keeping our FY27 EPS estimates broadly unchanged. We project an advances/PAT CAGR of ~13% each over FY25-28, with an RoA/RoE of ~2.2%/~17% in FY28.

* CANF, in our view, is a robust franchise with strong moats on the liability side. However, we await: 1) execution on its loan growth guidance, and 2) clarity on potential disruptions (if any) from the tech transformation the company is set to undertake this calendar year, before turning constructive on the stock. Reiterate our Neutral rating with a TP of INR915 (premised on 1.7x Sep’27E P/BV).

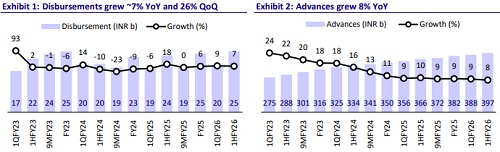

Disbursements up ~7% YoY; repayment rate increases

* CANF’s 2QFY26 disbursements grew ~7% YoY to INR25.4b.

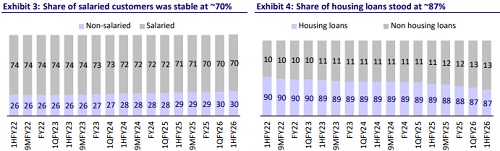

* Advances grew ~8% YoY and ~2.3% QoQ to ~INR397b. Annualized run-offs in advances remained elevated at ~17% (PQ: 15.3% and PY: ~15.2%), suggesting a rise in BT-OUTs, likely due to the company not implementing any additional PLR cuts during the quarter.

* Management indicated a sequential increase of ~INR2b in prepayments during the quarter. Of this, ~INR1.2b was attributed to BT-OUTs to other lenders, with ~40% originating from Telangana. The remaining ~INR800m was driven by customers making higher-than-scheduled EMI payments (from their own funds) with these accounts continuing to remain active with CANF.

Reported NIM expands ~20bp QoQ; bank borrowings rise sequentially

* NIM (reported) rose ~20bp QoQ to ~3.83%, primarily due to a decline in the cost of borrowings. We model an NIM of ~4%/3.8% in FY26/FY27.

* Reported yields were stable QoQ at 10.1%, while CoB declined ~20bp QoQ to 7.3%, leading to reported spreads rising by ~20bp QoQ to 2.8%. ? Bank borrowings during the quarter rose to 57% of the total borrowings (PQ: 53%).

Asset quality improves; GS3 declines ~5bp QoQ

* Asset quality exhibited minor improvements, with GS3 and NS3 declining ~5bp QoQ each to ~0.95% and ~0.5%, respectively. PCR on stage 3 loans rose ~380bp QoQ to ~48.8%.

* Credit costs were benign and stood at INR31m (vs. MOFSLe of INR140m), resulting in annualized credit costs of ~3bp (PQ: ~27bp and PY: ~15bp).

* Management indicated that credit costs are now expected to be lower than the earlier guidance of ~15bp, supported by a further improvement expected in asset quality in 3Q/4QFY26. We model credit costs of ~11b/15bp for FY26/FY27, respectively.

Highlights from the management commentary

* GNPA reduction reflects a broad-based improvement across SMA-1, SMA-2, and NPA buckets, with delinquencies declining INR1.3b in 2Q. Management expects an additional ~INR1b reduction in 3Q and further improvement in 4Q, leading to lower credit costs than its initial guidance.

* The company will target disbursements of ~INR25b in 3QFY26, with a temporary moderation expected due to the IT transformation rollout, and aims to ramp up disbursements to ~INR31b in 4QFY26.

* CANF has realized the full benefit of repo rate cuts across its bank borrowings and does not intend to pass on any rate reduction to customers in 3QFY26. However, in the event of further repo rate cuts, it may consider a 10bp PLR reduction for customers.

Valuation and view

* CANF delivered a mixed performance during the quarter, with earnings beat driven by strong net interest income and lower credit costs. However, loan growth remained subdued despite a ~26% QoQ rise in disbursements, as elevated BT-outs led to higher repayments. Asset quality showed improvement, resulting in benign credit costs, while reported NIM expanded ~20bp QoQ, aided by a sharp decline in the cost of borrowings.

* While disbursements momentum strengthened in 2Q, the ongoing IT transformation may temporarily disrupt disbursement activity in 3QFY26, potentially keeping loan growth muted in the near term.

* CANF has successfully demonstrated its ability to maintain asset quality over the years, and we expect this trend to continue going forward. We estimate a CAGR of 14%/13%/13% in NII/PPOP/PAT over FY25-28, with an RoA of 2.2% and RoE of ~17% in FY28. Reiterate Neutral with a TP of INR915 (premised on 1.7x Sep’27E P/BV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412