Neutral Shoppers Stop Ltd for the Target Rs. 520 by Motilal Oswal Financial Services Ltd

Footfall recovery drives growth; profitability remains under pressure due to investments in new ventures

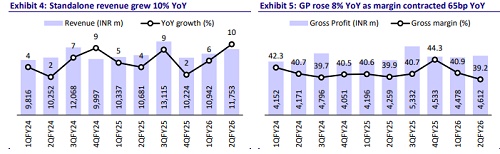

* Shoppers Stop’s (SHOP) revenue growth accelerated to 10% YoY in 2QFY26 (vs. +6% YoY in 1Q), led by a 10-year high LFL of ~9.4% in departmental stores and ~70% YoY growth in INTUNE (driven primarily by store additions).

* Store additions remained muted, with four net store additions during the quarter. The scale-up in INTUNE has been slower than expected, with only seven store additions in 1HFY26 (well below management’s revised guidance of 30-40 stores for FY26).

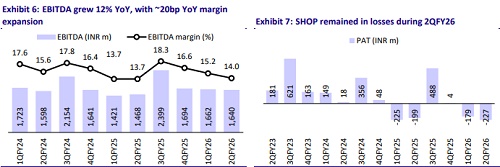

* Reported EBITDA grew 12% YoY (4% below), as operating leverage was offset by GM contraction and higher losses in new ventures (INTUNE, SSBeauty.in).

* SHOP’s focus on premiumization and enhanced in-store experience through initiatives such as Personal Shopper is playing out favorably, with a 6% LFL in customer entry during 2QFY26, which improved further during the ongoing festive season (as highlighted in our recent channel checks).

* However, subdued profitability in SHOP’s core segment (~3.4% pre-INDAS EBITDA margin), high losses, and muted store expansions in INTUNE remain key constraints to sustained growth recovery.

* Our FY26-28E EBITDA remains broadly unchanged, as the slower ramp-up in INTUNE was partly offset by an improved performance in the departmental stores segment. We build in FY25-28E revenue/EBITDA CAGR of 7%/9%.

* We value SHOP at 10x Dec’27E EV/EBITDA (implies ~26x Dec’27E pre-INDAS 116 EBITDA) to arrive at our revised TP of INR520. Reiterate Neutral.

Strong growth in departmental format driven by footfall recovery

* Standalone revenue grew 10% YoY to INR11.7b (vs. 6% YoY in 1Q and our estimate of 8%), driven by improved performance by departmental stores.

* Departmental store has made a strong rebound, with the highest LFL in past 10 years at ~9.4%. Premiumization continues to drive growth, with the premium mix rising 16% (LFL of 14% vs. ~9% departmental LFL).

* Private Brand’s revenue grew 3% YoY to INR1.61b, with improved profitability.

* The Beauty segment’s revenue at INR3.3b grew 22% YoY, with the Global SS Beauty (distribution) segment posting 2x YoY growth at INR1.06b.

* Store additions remained muted, with four net stores added during the quarter (seven opened and three closed). The respective store counts stand at: Departmental: 111 (1 opened, 2 closed), Beauty: 84 (3 opened, 1closed), INTUNE: 78 (3 opened), and Home Stop: 10 (flat), bringing the total store count to 303.

* Gross profit rose 8% YoY to INR4.6b (in-line), as gross margins contracted ~65bp YoY to 39.2% (75bp miss).

* Employee costs/other expenses increased 8%/6% YoY.

* Reported EBITDA grew 12% YoY to INR1.6b (4% below), with margins at 14% (up ~20bp YoY, 80bp miss), as operating leverage offsets GM contraction.

* Pre-Ind-AS operating loss stood at INR20m (vs. a profit of INR30m/INR20m in 1QFY26/2QFY25).

* Profitability improved in the core segment, with pre-INDAS segment EBITDA (including other income) at INR460m (up 42% YoY). Segment EBITDA margin expanded ~80bp YoY to 3.4%.

* However, new ventures (INTUNE, SSBeauty.in) remain in the build-out phase, with losses doubling YoY to INR240m.

* Depreciation and interest costs rose 9%/11% YoY.

* Reported losses came in at INR227m (higher than our estimated loss of INR132m).

* Core working capital declined 1% YoY to INR3.4b, as the slightly higher inventory days (156 vs. 154 YoY) were offset by an increase in payables.

* OCF (after interest + leases) stood strong at INR1.07b (vs. INR368m YoY), led by a 14% increase in operating cash flows and working capital release of INR684m (vs. INR102m release in 1HFY25).

* Capex for 1H stood at INR714m (vs. INR0.9b in 1HFY25). As a result, FCF improved sharply to INR351m (vs. outflow of INR0.6b in 1HFY25).

INTUNE: Scale-up remains challenging; hoping to breakeven by end-FY27

* INTUNE revenue grew 70% YoY to INR0.7b, driven mainly by store additions, as LFL remained muted at 1%, albeit an improvement over decline in 1QFY26.

* The company added three INTUNE stores in 2Q, reaching 78 stores (seven stores opened in 1HFY26), and plans to add 13-15 stores in 2H. However, the scale-up of INTUNE has been significantly slower than management’s revised guidance of 30-40 stores for FY26.

* Management is focused on strengthening supply chain, improving the look and feel of stores, and enhancing operational efficiency for weekly product drops.

* However, management does not expect store-level breakeven in INTUNE during FY26 and aims to reduce losses by half in 2HFY26, with hopes of reaching close to breakeven by end-FY27.

Highlights from the management commentary

* Demand trends: Despite sluggish discretionary demand amid GST-related disruptions and volatile macro situations, SHOP delivered strong LFL growth, driven by its focus on premiumization and enhanced shopping experience. Management indicated that during the ongoing festive season, customer entry further improved from ~6% LFL in 2Q, leading to a double-digit LFL.

* Store additions: SHOP opened four net stores in 2Q, with departmental stores seeing one net closure, as certain store additions were delayed due to external factors. The company plans to add five departmental and INTUNE stores each in 3QFY26.

* INTUNE: Store openings have tracking below management’s revised guidance of 30-40 store openings, as the company focused on enhancing the supply chain and improving the look and feel of stores. As a result, LFL growth has shifted to a positive trajectory (from a high double-digit negative in 1Q).

Valuation and view

* SHOP stands to benefit from the recent measures taken by the government to boost consumption, which has led to improved footfalls in malls during the ongoing festive season.

* However, for sustained growth, SHOP would require: 1) profitability improvement in the departmental format; 2) sustained high-growth in marginaccretive Beauty segment; and 3) profitable ramp-up in INTUNE, which has so far proven challenging.

* Our FY26-28E EBITDA remains broadly unchanged, as a slower ramp-up in INTUNE was partly offset by improved performance in departmental. We build in FY25-28E revenue/EBITDA CAGR of 7%/9%.

* We value SHOP at 10x Dec’27E EV/EBITDA (implies ~26x Dec’27E pre-INDAS 116 EBITDA) to arrive at our revised TP of INR520 (earlier INR510). Reiterate Neutral.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)