Buy Colgate Ltd for the Target Rs. 2,850 by Motilal Oswal Financial Services Ltd

Ltd.jpg)

Muted 2Q print; watchful for growth recovery ahead

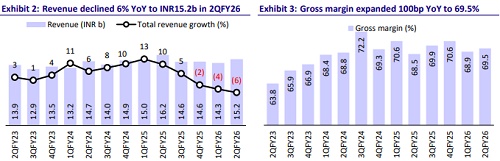

? Colgate’s (CLGT) 2QFY26 performance remained weak as its revenue fell 6% YoY to INR15.2b (in line) on a high base of 10% growth and due to the impact of GST-led transition (trade disruptions). We believe that volume is likely to have declined ~5% (in line). CLGT continued to focus on premiumization and investing in its brands, resulting in the premium portfolio delivering better revenue growth.

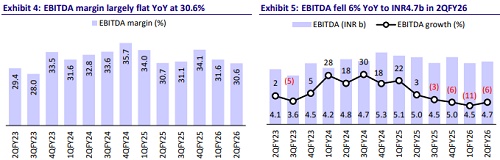

? Gross margin expanded 100bp YoY and 60bp QoQ to 69.5% (est. 67.9%). EBITDA margin was flat YoY at 30.6% (est. 29.8%). EBITDA declined by 6% YoY to INR4.7b.

? CLGT’s performance has been relatively weak over the past 4-5 quarters, marked by muted revenue growth and margin contraction. However, following the reduction in the GST rate on the entire oral care portfolio from 18% to 5%, which benefitted nearly 95% of the company’s portfolio, we believe CLGT is well positioned for a recovery in the coming quarters, supported by improving demand trends.

? We recently upgraded CLGT from Neutral to BUY following the rollout of GST 2.0 (link) and ~30% stock correction over the past 12 months. The stock is trading at a comfortable valuation of 40x P/E for FY27. Maintain BUY with a TP of INR2,850 (45x Sep’27).

Weak performance; but largely in line

* Volumes decline in mid-single digit: Revenue declined 6% YoY to INR15.2b (est. INR15.3b) on a high base of 10% growth and the impact of GST-led transitions.

* Sustains healthy margins - Gross margins expanded by 100bp YoY to 69.5% (est. 67.9%). Gross profit was down 5% YoY. Employee expenses were flat YoY, while ad spends and other expenses were down by 7% and 2%, respectively. EBITDA contracted by 6% YoY to INR4.7b (est. INR4.5b). EBITDA margin was flat YoY at 30.6% (est. 29.8).

* Decline in profitability: PBT declined 7% YoY to INR4.4b (est. INR4.3b). APAT was down 8% YoY at INR3.3b (est. INR3.2b).

* In 1HFY26, net sales, EBITDA and APAT fell 5%, 9% and 10%, respectively.

* The company announced its first interim dividend of INR24 per share.

Key highlights from management commentary

* GST rates on the oral care portfolio were reduced from 18% to 5%, a move welcomed as supportive of consumer confidence and oral health awareness.

* Lower prices were promptly passed on to consumers in collaboration with trade partners.

* The quarter saw temporary disruption for distributors and retailers due to the GST rate change, impacting the company’s near-term performance.

* 1HFY26 has a high double-digit growth base, with a gradual recovery expected in the second half.

* Margins remained resilient, supported by continued focus on its “Funding The Growth” program.

* The company maintained strong premium portfolio momentum, led by Colgate Visible White Purple.

* Palmolive’s new Moments body wash range was launched, featuring 100% natural extracts and patented fragrance technology.

* The “CAVITY-PROOF” campaign under Colgate Strong Teeth reinforced the brand’s advanced Arginine + Calcium Boost technology for 24-hour anti-cavity protection.

Valuation and view

* We largely maintain our EPS estimates for FY26/FY27.

* The company’s performance has been relatively weak over the past 3-4 quarters, marked by muted revenue growth and margin contraction. However, following the implementation of GST 2.0, which reduced the GST rate on toothpaste from 18% to 5%, benefiting nearly 95% of the company’s portfolio, we believe CLGT is well-positioned for a recovery in the coming quarters, supported by improving demand trends.

* CLGT remains focused on driving sustainable revenue growth through multiple levers — 1) launching science-backed, premium innovations to enhance realizations, 2) expanding category reach through increased marketing and consumer education, 3) deepening rural penetration to drive frequency and new user addition, and 4) broadening its presence in personal care to reduce dependence on the slower-growing oral care category.

* The stock has corrected ~30% over the past 12 months and is trading at a comfortable valuation of 45x and 40x P/E for FY26 and FY27, respectively. We maintain BUY rating on the stock with a TP of INR2,850 (45x Sep’27).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412