Neutral PVR-Inox Ltd for the Target Rs. 1,245 by Motilal Oswal Financial Services Ltd

Continued momentum at box office drives strong 2Q

* PVR-INOX (PVR) maintained its strong momentum from 1Q, with footfalls improving 15% YoY, driven by a steady and diverse slate of films across languages and scales as 12 movies crossed the INR1b mark in 2QFY26.

* Occupancy rose to 28.7%, driven by quality content and footfall-enhancing initiatives, which helped PVR deliver the best quarter in terms of revenue, EBITDA and profitability in the last two years.

* Pre-INDAS EBITDA rose 64% YoY to INR3.1b (10% beat), driven by operating leverage as margin expanded to 16.8% (up 530bp YoY).

* Backed by a strong content slate across languages and tactical levers such as ‘Blockbuster Tuesday’, re-releases, event streaming, etc., PVR management expects 2H to match if not better the 1H performance.

* Despite momentum in recent quarters, we note that PVR’s business remains highly sensitive to occupancy, which is dependent on quality and consistency of content, a factor largely outside the company’s control. While management remains optimistic about the FY26 content pipeline, even a 200-300bp decline in occupancy could materially impact screenlevel economics and EBITDA performance, posing downside risk to our current estimates.

* Our FY26-28E revenue and EBITDA estimates are broadly unchanged. We Reiterate our Neutral rating with a TP of INR1,245, premised on 12x preInd-AS 116 Dec’27E EBITDA.

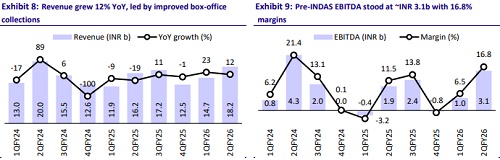

Recovery continues with improvement in box-office collections

* Consolidated revenue grew 12% YoY (+24% QoQ) to INR18.2b (in line), the highest in last two years, driven by the recovery in box office (with 12 films crossing INR1b mark in 2Q).

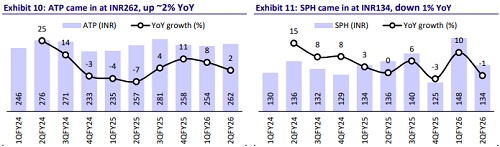

* Ticketing revenue at INR9.8b (+35% QoQ) was up 17% YoY, driven by sharp recovery in occupancy to 28.7% (vs. 25.7% YoY, 22% QoQ), while ATP grew by a modest ~2% YoY to INR262 (+3% QoQ).

* F&B revenue at INR5.9b (+20% QoQ) grew 12% YoY, largely driven by 15% YoY (+31% QoQ) jump in overall admits to 44.5m, while spends per head (SPH) declined 1.5% YoY to INR134 (-10% QoQ) due to discounted offerings and religious/youth-focused movies doing better during 2Q.

* Ad revenue grew 15% YoY (+15% QoQ) to INR1.26b, the highest in any 2Q since the pandemic.

* Pre-IND AS 116 EBITDA jumped 64% YoY (+3.2x QoQ) to INR3.1b.

* Movie exhibition cost at INR4.3b (+30% YoY) came in at ~43% as a percentage of ticketing revenue (vs. 39% QoQ and YoY).

* F&B COGS at INR1.3b (-2%YoY) came in at ~22.3% of F&B sales (205bp lower QoQ, 25.4% YoY).

* Reported PAT grew 5.7x YoY to INR1.27b (vs. est. of INR1.04b).

* PVR generated OCF of INR4.7b (up ~40% YoY), driven by improved profitability and favorable WC movement. PVR incurred capex of INR1.35b in 1HFY26 (-34% YoY), which led to FCF generation of INR3.3b (vs. INR1.3b/INR3.3b in 1HFY25/FY25).

* Net debt fell by ~INR3.3b in 1HFY26 to INR6.2b, the lowest since the merger.

Highlights from the management commentary

* Box-office trends: The momentum seen in 1Q further accelerated in 2Q for a remarkable 1H, led by strong performance across Bollywood, Hollywood and regional films. Twelve films crossed the INR1b mark in 2Q (22 in 1H), with films such as Saiyaara (INR4b) and Mahavatar Narasimha (INR3b) emerging as blockbusters on the back of quality content. Hollywood recovery continued with box-office collections crossing the ~INR5b mark. Kannada box-office grew 100% YoY, while Malayalam saw 50% YoY jump, rounding off an all-round performance.

* Box-office outlook: 3Q, which is typically the biggest quarter for PVR driven by festive releases, started on a strong note with Kantara 2 crossing INR5b and a host of big-ticket movie releases such as Thamma, De De Pyaar De 2, Dhurandhar, and Avatar: Fire and Ash are releasing in 3Q, followed by Border 2, Raja Saab, Toxic, O’Romeo, etc. in 4Q. Management expects 2H to deliver similar if not better performance as 1H.

* Screen openings: PVR opened 42 new screens and rationalized eight during 1H. The company plans to open ~100 new screens in FY26. PVR has signed up 132 screens under the capex-light mode (44: FOCO and 88: asset light), which would be opened over the next 18-24 months.

* Lower SPH: Management indicated that SPH was affected by the genres of movies doing well during 2Q – Saiyaara, attracted younger audiences, while Mahavatar Narasimha brought in religious crowd, who refrained from consuming food, given non-veg options are served at PVR. Further, there was some impact on SPH due to the discounted offerings on Tuesdays (15-17% of footfalls).

Valuation and view

* A recovery in Hollywood collections and promising content slate bode well for PVR, given its skew toward premium screening formats.

* Initiatives such as Blockbuster Tuesdays, curated re-release, live sports screenings and weekday value meal offers are driving up footfalls, aiding weekday monetization. These targeted interventions reflect a strategic effort to smoothen occupancy volatility and enhance revenue per patron, particularly during non-peak periods.

* Nevertheless, PVR’s business remains highly sensitive to occupancy, which is dependent on the quality and consistency of content, a factor largely outside the company’s control. While management remains optimistic about the 2HFY26 content pipeline, even a 200-300bp decline in occupancy could materially impact screen-level economics and EBITDA performance, posing downside risk to our current estimates.

* Our FY26-28E revenue and EBITDA estimates are broadly unchanged. We Reiterate our Neutral rating with a TP of INR1,245, premised on 12x pre-Ind-AS 116 Dec’27E EBITDA

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412