Buy Axis Bank Ltd For Target Rs. 1,385 By JM Financial Services

Beat on operational parameters; one-offs continue to nag

PAT declined by 26% YoY but adjusted for one-off std. assets provisioning and other opex for PSL declassification, PAT was down by 8% YoY (~21% higher than JMFe). Assets quality improves as gross/net slippages declined by ~100bps/130bps QoQ, but credit cost remain elevated due std. assets provisioning of INR 12.3bn for reclassification of crop portfolio from PSL. As a result, bank has incurred INR 9.5bn PSLC cost of which INR 4.7bn is charged in 2QFY26 and balance will be amortised over the next two quarters. Thus, opex has increased by 5%/7% YoY/QoQ (+5% JMFe). Balance sheet performance was better than our expectation with loan/deposit growth 12%/11% YoY. Bank reported beat on operational performance by arresting margin decline at just 7bps QoQ driven by expanding CD ratio and shift in IEA towards loans. Management guided for bottoming out margins in next quarter. We expect loan CAGR of ~15% during FY25-27E with avg. RoE of ~14% during FY26/27E. We increase our FY26/28F EPS estimates by ~2%-4% factoring higher margins; driving ~4% increase in TP of INR 1,385 (vs. earlier TP INR 1,330), valuing core bank at 1.7x FY27E BVPS and maintain BUY.

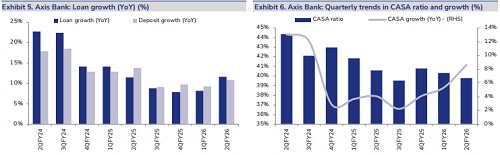

* Loan/deposit growth better than expectation; rise in LCR outflow rate weigh CASA: Bank reported loan/deposit YoY growth of ~12%/11% better than sector growth and JMFe. Improvement in loan growth was mainly driven by pick up in corporate/SME lending (20%/19% YoY). However the overall momentum was partially offset by subdued growth in retail (~6% YoY). Within retail, HL/Auto loan growth declined by ~1%/2% YoY, while unsecured retail credit (PL+CC) growth remain sluggish at 5% YoY. CASA ratio continue to remain flat despite traction in CA (grew 13% YoY) due to increase LCR outflow rate to 27.2% from 25.5% in Mar’25.

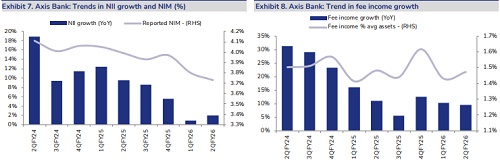

* Operating profit higher than JMFe; Margin compression partially offset by better than expected yields: Reported NIM compressed by 7bps QoQ to 3.73% primarly due to better than expected yields whereas COF declined by ~22bps QoQ. Shift in interest earning assets (IEA) and CD ratio expansion aided bank to arrest yield compression at 25bps QoQ. Management expect magins to bottom out in 3QFY26. However, operating profit declined 10%/3% YoY/QoQ (+3% JMFe) due to increase in operating cost driven by one-off expenses. Further, lower than expected treasury gains drove sub-optimal non-interest income growth.

* Slippages improve but credit cost higher than JMFe: Gross/net slippages has declined QoQ to 2.16%/1.07% (-100bps/-130bps QoQ). Retail GNPA improved marginally to 2.02% vs 2.1% in 1QFY26. Bank has provided one time std. assets provision of INR 12.3bn due to reclassification in PSL Crop portofolio of INR 240bn resulting in higher credit cost of 1.3% (+15bps JMFe).

* Valuation and view: Axis bank delivered operating profit beat despite lower treasury gains and increase in opex. Bank has delivered a surprise on margin front with just 7bps contraction. We expect loan growth momentum to inch-up ~15% from coming quarters as liquidity condition is expected to improve. Moreover, we expect improvement in credit cost and bottoming of margins from next quarter. The core bank currently trades at 1.4x FY27E BVPS, and we believe a sustained re-rating will depend on a more meaningful acceleration in earnings growth. We revised our FY26/27/28E EPS estimate upward by 2%-4% to reflect loan growth and better margins leading to ~4% increase in TP of INR 1,385 (vs earlier TP INR 1,330), valuing core bank at 1.7x FY27E BVPS and maintain BUY.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361

.jpg)