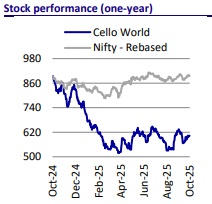

Buy Cello Ltd for the Target Rs. 700 by Motilal Oswal Financial Services Ltd

Improving prospects with new plant ramp-up and demand revival

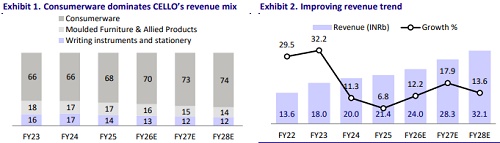

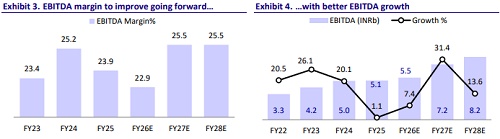

CELLO has been witnessing muted performance for the last few quarters due to a weak demand scenario amid a consumption slowdown. Further, the geopolitical stress has been affecting exports of writing instruments, and a new glassware facility at Falna (Rajasthan) has incurred higher initial costs that hit CELLO’s profitability. However, with consumption gradually picking up both for consumerware and writing instrument businesses and improving efficiency in the new plant, we expect CELLO’s performance to improve going forward.

* Cello’s 20,000 MT Falna glassware facility, commissioned in Feb’25, has reached ~65% utilization in 1Q and is likely to hit 80% by the end of FY26. With efficiency improving and solar-driven cost gains (2.1MW solar plant), the glassware category should turn profitable in 2HFY26, generating INR2–2.5b revenue by FY27, positioning CELLO as India’s leading import-substitution glassware manufacturer.

* Apart from the glassware plant at its 27-hectare land parcel at Falna, it is also expanding into steelware and plasticware with INR1–1.2b capex. Even after current projects, ~50% of the land remains for future expansion. Falna will serve as a multi-product import-substitution hub.

* Cello’s writing instruments division is set for a gradual revival, driven by new launches in mechanical pencils, art stationery, and international brand-licensed kids’ products. Retail restocking and export demand are improving. With a superior gross margin, this segment enhances portfolio diversification and profitability for the company.

* CELLO is currently trading at 27x FY27E EPS with RoE/RoCE of 18%/19% in FY27E. We reiterate our BUY rating with a TP of INR700 (premised on 32x FY27E EPS).

Healthy ramp-up of new glassware capacity

* The new glassware capacity of 20,000MT commissioned in Feb’25 at Falna, built with advanced European technology (German furnaces and Italian press-and-blow systems), ensures superior design precision and productivity. ? CELLO has reached ~65% utilization as of 1QFY26, and the utilization is further expected to improve to 70-80% by the end of FY26, generating a revenue of ~INR1.1-1.2b.

* However, with efficiency still on the lower side (~60-65% efficiency) and higher energy and wage costs in Daman, the glassware category reported losses in 1Q (while opalware is profitable). EBITDA has now reached breakeven for the Falna plant, and with the efficiency reaching over 85% (mostly expected in 2HFY26), we expect the segment to turn profitable. CELLO targets ~INR2-2.5b revenue in FY27 (i.e., full potential of the plant).

* CELLO has been launching multiple SKUs (currently ~70 and expanding to 100+) across the premium category, focusing on import substitution. It is also adding a coldware and decorative glass line, which is expected to enhance value by ~20%. The in-house glassware products have seen strong acceptance, as they are currently priced at par with the imports.

* Further, as energy is one of the major cost elements, the company is setting up a 2.1MW solar plant (operational by Nov’25), which is expected to reduce energy cost by ~20%.

* This plant positions CELLO as the only large branded player with in-house sodalime glassware capacity, offering strong import substitution potential as India’s INR35b glassware market (FY23) shifts toward domestic sourcing. This plant not only adds capacity but also gives CELLO a base from which to compete with global-tier manufacturers in India — particularly those with imported products.

Falna – a multi-product hub in the making

* The company has ~27 hectares of land parcel at Falna, mainly for the glassware segment. The company is also expanding the capacity of its steelware and plasticware categories here with a capex of ~INR1-1.2b.

* After setting this capacity and the glassware capacity, the company is still left with ~50% of the area for future expansions.

* CELLO envisages this location as a multi-product hub focused on the import substitution theme in both glassware and steelware (vacuum flasks) categories.

* The recent anti-dumping duty (ADD) on imported vacuum flasks and steel vessels from China (effective Mar’25) provides a meaningful boost. CELLO, being the second-largest importer earlier, is now partnering with Indian OEMs to localize production, gaining from widening domestic supply gaps.

* Simultaneously, government intervention through measures like BIS enforcement and anti-dumping duties to protect local manufacturers will aid against Chinese glass products, which are being dumped in the Indian market at artificially low prices, causing margin pressure for domestic firms.

Recovery expected in the writing instrument segment

* CELLO’s writing instruments segment, marketed under the Unomax brand, is expected to see a broad-based recovery after several muted quarters.

* The company has been expanding its SKUs by launching new products such as mechanical pencils, art-related stationery, and geometry boxes. Further, it is entering into global cartoon character-focused products for kids (through licensing). These new launches are gaining healthy traction from the customers.

* We expect retail restocking after muted demand quarters led by improved school/office buying patterns. The company has also sharpened its portfolio (premium gel/petrol-based pens + affordable ballpoints) to capture both premiumization and mass demand.

* Exports are also expected to pick up across the Middle East, Africa, and Latin America as buyers diversify suppliers away from China. Cello’s consistent quality, competitive pricing, and a stronger international distribution footprint underpin this trend.

* Recovery in this segment adds both diversification and margin stability to the portfolio (the segment with the highest gross margin of 57-59%), with exports expected to contribute meaningfully over the next two years.

Valuation and view

* The last few quarters for the company have been muted due to weak demand, higher costs, and initial gestation of the Falna plant. However, we expect the overall demand to improve in both consumerware and the writing instrument segment, coupled with improving efficiency in the new glassware unit.

* We estimate CELLO to deliver a CAGR of 15%/17%/18% in revenue/EBITDA/adj. PAT over FY25-28.

* CELLO is currently trading at 27x FY27E EPS with RoE/RoCE of 18%/19% in FY27E. Reiterate BUY with a TP of INR700 (premised on 32x FY27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412