Buy Radico Khaitan Ltd for the Target Rs. 3,600 by Motilal Oswal Financial Services Ltd

Solid performance backed by robust underlying volumes

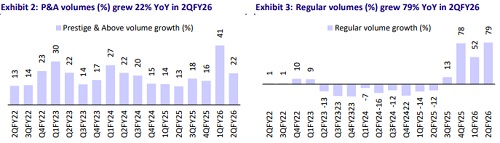

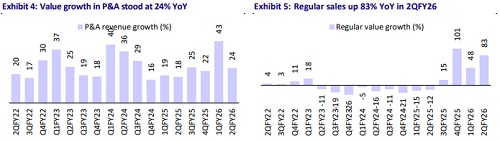

* Radico Khaitan reported another quarter of strong operating performance, as its 2QFY26 revenue grew 34% YoY (est. 25%) and total volume grew 38% (beat). The Prestige & Above (P&A) segment clocked volume growth of 22% and value growth of 24%. Regular segment posted 83% value growth and 79% volume growth, aided by a low base and route-to-market changes in Andhra Pradesh (Oct’24). The market share in AP jumped to 30% in 1HFY26 from 10% in 1HFY25. Non-IMFL delivered revenue growth of 27% YoY, led by higher bulk alcohol sales YoY.

* Management indicated that the overall share of Radico in the Alcobev space has increased by ~200bp, primarily driven by its premiumization drive and broad-based growth across geographies. Luxury segment contributes ~10% of company sales. Radico remains on track to achieve its FY26 revenue target of INR5b from this segment.

* Gross margin was flat YoY at 43.6% (est. 43.2%), led by stable RM prices. EBITDA margin expanded 130bp YoY to 15.9% (est. 15.3%), led by operating leverage. Radico has maintained its margin expansion guidance of 125- 150bp annually for the next three years, aiming to reach high-teen margins. We model EBITDA margins of 16%/16.5% for FY27/FY28.

* Radico has delivered robust returns (~30%) since our initiation in May’25 (IC report), where we highlighted its strong growth trajectory in the P&A segment and its strategic expansion into premium and luxury portfolios, which continue to exhibit strong industry volume growth. With continued focus on premiumization and broad-based geographic expansion, Radico has delivered industry-leading growth. We believe the rich valuations are well justified by its strong performance delivery. We reiterate a BUY rating with a TP of INR3,600 (based on 60x Sep’27E EPS).

Robust volume growth; beat across parameters

* Strong volume growth of 38%: Standalone net sales rose 34% YoY to INR15b (est. INR14b) in 2QFY26. Total volume grew 38%, with P&A volume up 22% YoY (41% in 1QFY26) to 3.9m cases (in line). Regular volume rose 79% YoY to 5m cases. Volume growth was aided by a low base, resolution of state-specific issues, and route-to-market changes in AP. Royalty cases were down by 46% YoY to 0.4m cases. Non-IMFL revenue grew 27%, led by higher bulk alcohol sales YoY.

* EBITDA up 46% YoY: Gross margin was flat YoY at 43.6% given relatively stable raw material costs and a higher proportion of Regular volumes. Management remains optimistic about the stability of ENA and grain prices in FY26. Employee costs rose 14%, S&D was up 46%, and other expenses increased 21% YoY. EBITDA margin was up 130bp YoY at 15.9%.

* Strong growth in profitability: EBITDA/PBT/APAT grew 46%/67%/69% YoY in 2Q. For 1HFY26, revenue/EBITDA/APAT grew 33%/50%/76% YoY.

* The board has approved the amalgamation of its wholly owned subsidiary and step-down subsidiaries. These subsidiaries were formed to acquire the land for the Sitapur greenfield project. As the project is now complete, the amalgamation will streamline the corporate structure and bring the land holdings directly under the company.

Highlights from the management commentary

* Luxury segment contributes ~10% of company sales. Management is confident of achieving INR5b sales from the luxury portfolio in FY26 (vs. INR3.4b in FY25).

* In the next three years, Radico expects Magic Moments to achieve volume of 10m cases vs. 7m in FY25.

* The industry saw a decline of 25% in Maharashtra and Radico declined by ~20%.

* The company has maintained its margin expansion guidance of 125-150bp annually for the next three years, aiming to reach high-teen margins.

* Radico remains on track to be debt free by FY27.

Valuation and view

* We raised our EPS estimates by 3% for FY26/FY27 on strong volume growth and beat in EBITDA margin.

* Radico’s debt is likely to decline steadily, supported by healthy free cash flow generation. The company has reduced net debt by INR1.4b since Mar’25 and is on track to be debt free by FY27.

* Radico remains focused on accelerating the premium and luxury growth while driving greater efficiency across operations with disciplined capital allocation.

* The valuation gap with UNSP has narrowed significantly, reflecting market recognition of Radico’s brand strength and execution. Despite past margin pressures, the company’s ability to sustain premium-led volume growth makes it a compelling long-term story.

* Radico is currently trading at 59x/48x FY27E/FY28E EPS, with RoE/RoIC of ~19%/20% in FY27E. We believe a ~35% EPS CAGR provides adequate support for sustaining rich valuations. We value the company at 60x P/E on Sep’27E EPS to derive a TP of INR3,600.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)