Buy HCL Technologies Ltd for the Target Rs. 1,800 by Motilal Oswal Financial Services Ltd

A standout quarter

All-round beat on revenue and deal TCV drives guidance upgrade

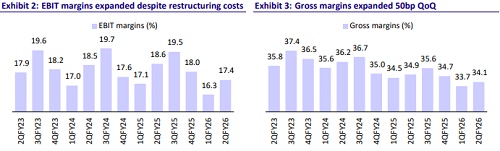

* HCL Technologies (HCLT) reported 2QFY26 revenue of USD3.6b, up 2.4% QoQ CC vs. our estimate of 1.7% QoQ CC growth. EBIT margin came in at 17.4% vs. our estimate of 16.8%. New deal TCV stood at USD2.6b (up 15.8% YoY) in 2QFY26. For FY26, revenue growth guidance was maintained at 3-5% YoY in CC (while for Services, guidance was upgraded to 4-5% from 3-5%). EBIT margin guidance was maintained at 17.0-18.0%.

* For 1HFY25, revenue/EBIT grew 9.4%/3.3% and PAT declined 4.9% YoY in INR terms. We expect revenue/EBIT/PAT to grow 10.2%/4.5%/10.2% YoY in 2HFY26. HCLT is the fastest-growing large-cap IT services company, and its all-weather portfolio remains the best large-cap bet in an uncertain macro environment (refer to our report dated 22th July’25, HCLT: Becoming Future Ready, following our two-day NDR with the management). We reiterate our BUY rating on HCLT with a TP of INR1,800, implying a 20% potential upside.

Our view: Well-placed for 2HFY26; first to break out AI revenue

* Strong results; continues to be the fastest growing large-cap: HCLT delivered a strong quarter, with Services revenue up 4.5% in organic YoY cc terms (2.5% QoQ), making it the fastest-growing large-cap IT services company. Deal TCV at USD2.6b rose 40% QoQ, positioning the company well for H2FY26E (the ask rate to achieve the midpoint of the updated Services business guidance now stands at 1% CQGR, which we believe is easily achievable). We now expect HCLT's Services business to grow at 4.5% cc (3.5% organic YoY cc).

* Advanced AI revenues called out: Advanced AI solutions now comprise 3% of HCLT's total revenue. Its AI Force platform is now live across 47 clients (target: 100 clients by the end of the year). The AI business has expanded to include new pillars, such as the AI Factory (with partners like NVIDIA) and AI Advisory (enterprise AI strategy and deployment), with early wins seen across technology, manufacturing, and BFSI. These services are being delivered under both T&M and fixed-price models. HCLT is the first Indian vendor to break out AI-led revenues, and as enterprise GenAI scales, HCLT looks to be in relatively good stead.

* On legacy business disruptions: HCLT has been forthcoming in calling out deflation in the traditional IT services business model (40-50% deflation in BPO, 25-30% in SDLC, and 10-15% in IT Ops and IMS). However, the company has started selling its own IP, built on the intelligence layers of cutting-edge OEMs such as OpenAI and Nvidia. This is a sweet spot- we believe competing with rich world OEMs on R&D is futile (see our note dated 19th Sept’25: GenAI and IT Services: The waiting game). Instead, Indian IT vendors should continue to feed off cutting-edge innovation and be willing to disrupt their traditional T&M-led model.

* Good beat on margins, but expect short-term pressure: 2Q saw a healthy beat on operating margins at 17.4%. However, looking ahead, wage hikes, furloughs, as well as elevated restructuring charges may weigh on margins in FY26E, which we expect to be nearer to the lower end of guidance.

Beat on revenue and margins; IT services guidance upgraded to 4-5% YoY cc (vs. 3-5% earlier)

* Revenue rose 2.4% QoQ in CC vs. our estimate of 1.7% growth.

* New deal TCV stood at USD2.6b (up 41.8%/15.8% QoQ/YoY) in 2QFY26.

* IT business grew 2.6% QoQ CC, while ER&D/P&P rose 2.2%/0.5% QoQ cc.

* For 2QFY26, EBIT margin stood at 17.4%, above our estimate of 16.8%. This included a 55bp impact from restructuring costs; adjusted for that, the margin stood at 17.9%.

* For FY26, revenue growth guidance was maintained at 3-5% YoY in CC (while for Services, the guidance was upgraded to 4-5% from 3-5%). EBIT margin guidance was maintained at 17.0-18.0%.

* In 2QFY26, PAT rose 10.2% QoQ and remained flat YoY at INR42b vs. our est. of INR43b.

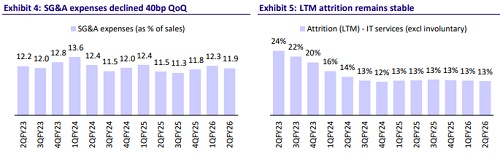

* LTM attrition declined 20bp QoQ to 12.6%. The net employee headcount increased 1.6% in 2QFY26, reaching 226,640 by the end of 2QFY26. HCLT added 5,196 freshers during this quarter.

* LTM FCF-to-net income stood at 125%.

* Management declared an interim dividend of INR12/share for 2QFY26.

Key highlights from the management commentary

* Demand environment remains largely unchanged QoQ; BFSI and Technology are seeing healthy momentum, while auto continues to lag.

* Discretionary spending in some areas has become mandatory, driven by M&A and carve-outs at the clients’ end, mostly linked to transformation programs.

* Legacy modernization, led by AI platforms, continues to be the biggest demand driver, with several USD100m+ program opportunities. The company won a large deal from a Europe-based retailer in this space.

* Revenue grew 2.4% QoQ in CC, led by robust growth in IT services and ER&D. The software business remained soft due to lower perpetual licensing revenue, partly offset by higher subscription revenue.

* Wage hikes effective from 1st Oct (3Q) are expected to impact margins by 70- 80bp, with ~40bp incremental impact in 4Q.

* Advanced AI revenue crossed USD100m, contributing ~3% to total revenue, with a balanced mix across services and software. This includes Agentic AI, Physical AI, AI Engineering, and AI Factory, but excludes Classical AI, Data Analytics, and GenAI-enabled delivery.

* Non-linearity is evident as revenue grew faster than headcount (2.4% vs. 1.6%), reflecting productivity gains driven by AI.

Valuation and view

We expect HCLT to deliver a CAGR of 5.3%/7.2% in USD revenue/INR PAT over FY25-27. The company remains the fastest-growing large-cap IT services firm, and we like its all-weather portfolio. We have largely kept our estimates unchanged. Reiterate BUY with a TP of INR1,800 (based on 24x Jun’27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

Ltd.jpg)