Buy Trent Ltd for the Target Rs. 6,000 by Motilal Oswal Financial Services Ltd

Robust cost controls cushion margins; growth pickup vital

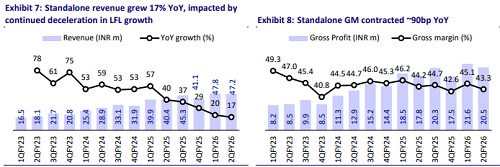

* Trent’s revenue growth continued to decelerate in 2QFY26 (+17% YoY), as ~43% YoY area addition growth was offset by sharp ~17% YoY decline in revenue per square foot, indicating store-level sales cannibalization.

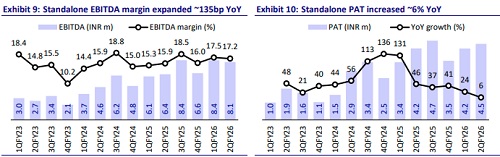

* However, despite revenue growth deceleration and ~90bp YoY gross margin contraction (mix impact), Trent delivered ~16% growth in 2QFY26 pre-INDAS EBITDA (with modest ~10bp YoY margin dip), aided by robust cost controls (employee cost flat YoY, despite 33% YoY store additions).

* Star business continued to underperform as revenue declined ~2% YoY (vs. 7% YoY growth in 1Q) as multiple stores underwent upgrades during 2Q. Store count remained stable at 77, while revenue per sqft declined 14% YoY to INR26.9k (vs. 1.5% YoY uptick on much larger base for DMart).

* We raise our FY26-28 reported EBITDA estimates by ~4-5%, driven by costsaving measures. However, we cut our FY27-28E earnings by 4-5% due to higher depreciation.

* We build in a CAGR of 17%/20%/14% in standalone revenue/EBITDA/PAT over FY25-28E, driven mainly by store expansions and robust cost controls.

* We continue to like Trent for its robust footprint additions, strong doubledigit growth, long runway for growth in Star (presence in just 10 cities), and potential scale-up of emerging categories (Beauty, Innerwear, Footwear, and LGDs). However, revenue growth acceleration remains a key trigger.

* Reiterate BUY on Trent with a revised TP of INR6,000, premised on 44x Dec’27E EV/EBITDA for the standalone (Westside and Zudio) business, ~3x EV/sales for Star JV, and ~1.5x EV/EBITDA for Zara JV (sharp cut from ~6x EV/EBITDA due to tendering of shares by Trent at low valuations).

* After recent correction, the stock currently trades at ~70x Dec’27E EPS, excluding the contribution from Star and Zara JV.

Strong margin performance drives beat; 1H pre-INDAS EBITDA up 26% YoY

* Standalone revenue at INR47b grew 17% YoY (disclosed earlier), driven by ~33% YoY net store additions as revenue per store declined ~9% YoY.

* Trent reported low-single-digit LFL growth for its fashion portfolio. ? Gross profit grew 15% YoY to INR20.5b (vs. our est. INR20.9b) as gross margin contracted ~90bp YoY to 43.3% (~70bp miss).

* Despite 33% YoY net store additions, employee costs remained flat YoY (13% below), driven by savings from RFID implementation.

* SG&A and other costs increased ~11% YoY (2% lower than our est.).

* As a result, reported EBITDA grew 27% YoY to INR8.1b (6% beat) as lower gross margin was offset by superior control on costs.

* Reported EBITDA margins expanded 135bp YoY to 17.2% (~110bp ahead), driven by robust cost controls.

* As per company, standalone pre-INDAS EBITDA grew 16% YoY in 2Q to INR5.75b (23% YoY in 1H), with pre-INDAS EBITDA margin of 12.2% (vs. ~13% in 1QFY26). Standalone pre-Ind AS EBIT margin declined 80bp YoY to 10.2%.

* Trent’s occupancy cost (rentals above EBITDA) remained flat YoY; however, depreciation and interest costs jumped.

* For 1HFY26, pre-INDAS EBITDA grew 26% YoY (vs. 32% YoY growth in reported EBITDA) to INR11.9b, driven by ~70bp margin expansion to 12.5% (vs. ~180bp expansion in reported EBITDA).

* Adjusted PAT grew 7% YoY to INR4.5b (~5% beat) as higher EBITDA and lower tax rate were partly offset by higher depreciation (+65% YoY), finance cost (+28% YoY) and lower other income (-14% YoY).

* For 1HFY26, revenue/reported EBITDA/adj. PAT grew 18%/32%/14%.

* Based on our estimates, 2H revenue/EBITDA/adj. PAT growth would be 20%/29%/23%.

Pickup in store addition in 2QFY26, especially for Westside

* After subdued store expansion activity in 1QFY26, store expansion picked up pace, with store count across fashion formats rising to 1,101 (up 33% YoY).

* In 2Q, Westside added the highest number of quarterly net stores in several quarters, with 13 net store additions (19 openings, 6 closures), taking the total store count to 261 (+15% YoY) and area rising ~28% YoY. Westside entered two new cities to expand its presence to 88 cities.

* Zudio added 40 net store openings (44 openings, 4 closures) in 2QFY26 (41 in 1HFY26 vs. 32 in 1HFY25) to reach 806 stores (+40% YoY), with retail area rising 56% YoY. Zudio entered nine new cities to expand its presence to 244 cities.

* Trent launched a new format, Burnt Toast, during the quarter, which helped to increase the other fashion format’s store count by 5 QoQ to 34 (+21% YoY).

* We note that store additions typically pick up pace in 2H and all eyes would be on further scale-up of Trent’s fashion footprint as it remains the biggest driver of growth amid weakening SSSG.

Working capital steady; FCF improves despite jump in cash capex

* WC days were steady at 37 (flat YoY) as moderation in inventory days to 43 (from 45 YoY) was offset by lower payable days.

* OCF (after interest and leases) surged 1.5x YoY to INR10b, driven by 26% YoY increase in pre-INDAS EBITDA and favorable WC movement (release of INR1.7b vs. build-up of INR2.7b YoY).

* However, Trent’s net capex jumped to INR8.4b (vs. INR3.8b YoY and INR8.2b in FY25), which resulted in FCF of INR2.3b (vs. ~INR500m YoY).

* Trent’s net cash stood at ~INR1.9b in FY25 (vs ~INR3.4b at end-FY25).

Star business: Muted performance with dip in revenue

* Revenue declined 2% YoY (vs. 7% YoY in 1Q) as multiple stores underwent upgrades in 2Q and 1HFY26.

* Store count remained flat in 2QFY26 at 77 stores (1 opening offset by 1 closure).

* Calc. annualized revenue per sqft declined ~14% YoY to INR26.9k (vs. +1.5% YoY for DMart at INR36.6k) and annualized revenue per store declined ~7% YoY to INR457m (vs. +1% YoY for DMart at INR1.51b).

* The share of own-brand offerings now contributes ~73% to Star’s revenue (stable YoY).

Highlights from the management commentary

* Consumer sentiment in 2Q was relatively muted and was further affected by unseasonal rains.

* With GST rationalization, customers initially prioritized purchases of big-ticket products with greater GST cut benefits. Management expects demand traction to pick up over the medium term for discretionary lifestyle categories as well.

* Emerging categories, including beauty and personal care, innerwear, and footwear, contributed to 21% of standalone revenue.

* vOnline revenue grew 56% YoY, contributing 6%+ of Westside sales.

* Investments in technology and automation have aided in delivery of stable operating economics. Especially, the RFID implementation has led to material optimization in manpower requirements across Trent’s portfolio.

* Variable structure of costs, including store rentals and fees to business associates, has helped Trent gain operating leverage. ?

A change in the maturity profile of new stores has led to increased depreciation relative to revenue.

Consolidated performance

* Consolidated revenues grew 16% YoY to INR48b.

* Reported EBITDA grew 27% YoY to INR8.2b. Margin rose 150bp YoY to 17%.

* Pre-IND AS EBITDA for 1HFY26 stood at INR11.9b (up 27% YoY), with margins expanding ~90bp YoY to 12.3%.

* Adjusted PAT stood at INR3.7b (up 11% YoY), driven by higher EBITDA and lower tax rate, partly offset by higher D&A and finance costs.

Zara India: Trent to tender ~15% stake for INR1.5b

* Trent has decided to tender 94,900 shares in Inditex Trent Retail (Zara India) for ~INR15,422/share in buyback.

* This transaction will fetch modest ~INR1.5b to Trent and lower its stake to 20%.

* The implied valuation for Zara India is modest at ~INR7.8b (vs. our earlier ascribed value of ~INR13b for Trent’s 35% stake).

Valuation and view

* TRENT's growth rate has decelerated sharply in the last few quarters due to weak LFL amid a subdued demand environment. However, the company continues to display strong cost controls to report healthy EBITDA growth.

* We continue to like Trent for its robust footprint additions, strong double-digit growth, long runway for growth in Star (presence in just 10 cities), and potential scale-up of emerging categories (Beauty, Innerwear, Footwear, and LGDs). However, revenue growth acceleration remains a key trigger.

* We raise our FY26-28E reported EBITDA by 4-5%, led by cost-saving measures. However, we cut our FY27-28E earnings by 4-5% due to higher depreciation.

* We build in a CAGR of 17%/20%/14% in standalone revenue/EBITDA/PAT over FY25-28E, driven mainly by store expansions and robust cost controls.

* Reiterate BUY on Trent with a revised TP of INR6,000, premised on 44x Dec’27E EV/EBITDA for the standalone (Westside and Zudio) business, ~3x EV/sales for Star JV, and ~1.5x EV/EBITDA for Zara JV.

* After recent correction, the stock currently trades at ~70x Dec’27E P/E, excluding the contribution from Star and Zara JV.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412