Neutral Oberoi Realty Ltd for the Target Rs. 1,779 by Motilal Oswal Financial Services Ltd

Healthy performance of 360 West with improved annuity income

Operational highlights – 2QFY26

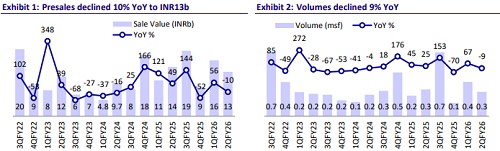

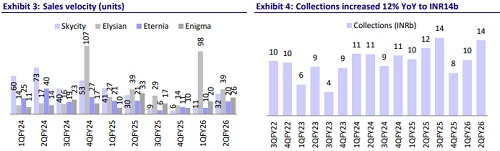

* In 2QFY26, Oberoi Realty (OBER) achieved pre-sales of INR13b, down 10% YoY and 21% QoQ (7% below our est.), wherein ~62% was contributed by Elysian and 360 West. In 1HFY26, bookings stood at INR29.4b, up 18% YoY.

* Volumes were down 9% YoY / 29% QoQ to 0.25msf (16% below estimates). In 1HFY26, volumes stood at 0.6msf, up 24% YoY.

* Total units booked in the quarter stood at 158, which was flat YoY and down 13% QoQ. In 1HFY26, a total of 339 units were booked, up 14% YoY.

* An interim dividend was declared for 2Q at INR2/sh, i.e., 20% of face value.

* OBER was ranked No. 1 globally among listed residential developers in the high-rise multifamily category, earning a 5-Star rating and a perfect score of 100 in its second year of participation in the GRESB Real Estate Assessment.

* P&L performance: In 2QFY26, revenue grew 35%/80% YoY/QoQ to INR17.8b (25% above our est.). In 1HFY26, OBER’s revenue was INR27.7b, up 2% YoY.

* The company reported an EBITDA of INR10.2b for the quarter, up 25%/96% YoY/QoQ (12% above estimates), while the margin contracted 4% YoY to 57%. In 1HFY26, OBER reported an EBITDA of INR15.4b, down 5% YoY.

* PAT in the quarter was up 29%/80% YoY/QoQ to INR7.6b, which was 19% above our estimates. In 1HFY26, PAT stood at INR11.8b, flat YoY.

Offices to be fully leased out by end-FY26; hospitality margins stable

* Overall, the annuity portfolio delivered a 47% YoY revenue growth to INR2.8b with an EBITDA margin of 92%.

* Office: Occupancies at Commerz-I and -II were stable at 96%. Commerz-3 occupancy increased to 87% from 83% QoQ, resulting in a revenue growth of 38% YoY to INR1.3b. This brought the total office revenue to INR1.8b (+29% YoY), leading to an EBITDA margin of 91%.

* Retail: Oberoi Mall delivered a 7% YoY increase in revenue to INR522m at an EBITDA margin of 99%, while Sky City Mall delivered revenue of INR452m with an EBITDA margin of 92%. Oberoi Mall was 99% occupied, while Sky City was 53% occupied.

* Hospitality: In 2QFY26, The Westin hotel witnessed a 2% YoY growth in revenue to INR446m, although there was a 9% YoY increase in ARR of INR13,735. Occupancy was at 80% in the quarter, from 82% YoY and 72% QoQ. EBITDA came in at INR177m with a margin of 40%.

Key highlights from the management call

* Launches: OBER’s 2QFY26 did not witness any launches during the quarter. Overall, in 1HFY26, one new tower — Elysian Tower D (Goregaon) — was launched. In FY26, management expects to launch one tower in Borivali, Peddar Road and Gurugram and may also bring in projects such as Adarsh Nagar, Worli, and Tardeo in the year. One more tower in Goregaon and Alibaug to be launched in FY27.

* Annuity portfolio: Commerz I and Commerz II are fully leased out following an increase in occupancy in Commerz III to 87% in 2QFY26. Sky City Mall is ~53% occupied. Both Commerz III and Sky City Mall are likely to reach occupation stability at ~80-90% by the end of FY26.

* Gurugram project: Demolishing has started. An office has been set up in Gurugram. The design has been completed, with contract negotiations finalized and issuance expected shortly. Approvals are in place, and the project is estimated to be launched in the current year.

* Construction for the Ritz-Carlton, Mumbai, is 70–80% complete, with a planned launch within FY26. The hotel will feature over 200 keys along with extensive F&B and banqueting facilities.

* Thane strategy: Sales at the Thane project follow a typical high-rise cycle— strong launch momentum, slower sustenance sales, and revival closer to completion. They remain confident of long-term demand, expecting steady annual sales of ~INR10b with potential price hikes as construction advances.

Valuation and view

* While OBER's current valuation does not suggest significant near-term gains, we foresee a strong 24% CAGR in its presales over FY25-28. The key to a future rerating lies in the company's ability to reinvest the substantial cash flow derived from its completed and near-completion projects.

* OBER's residential segment is presently valued at INR288b. This valuation accounts for recent business development activities and incorporates a future outlay of INR30b towards prospective land acquisitions. Reiterate Neutral with an NAV of INR647b or INR1,779 per share.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)