Buy AU Small Finance Bank Ltd For Target Rs.730 by Motilal Oswal Financial Services Ltd

Cost control drives earnings beat; asset quality deteriorates slightly

RoA outlook steady

* AU Small Finance Bank (AUBANK) reported 3QFY25 PAT of INR5.3b (8% beat), led by controlled opex, though provisioning expenses were high.

* NII grew 2.4% QoQ to INR20.2b (in line), while NIMs declined by 23bp QoQ on higher proportion of investments book, adverse loan mix and higher CoF.

* PPoP grew 6.5% QoQ to INR12.1b (8% beat) as opex was 8% lower vs. our estimate. The C/I ratio declined to 54.4% (56.7% in 2Q), though it is expected to increase in 4Q amid healthy business growth.

* Business growth was healthy as advances grew 5% QoQ to INR995.6b and deposits growth was slightly lower at 2.3% QoQ to INR1.12t. The CD ratio jumped to 88.7% from 86.7% in 2QFY25.

* Slippages were elevated at INR9.6b vs. INR7.4 in 2Q and INR5.4b in 1Q. GNPA/NNPA ratios inched up 33bp/16bp QoQ to 2.21%/ 0.91%. PCR declined to 61.2%. Credit cost as % of total assets rose to 0.36% (1.4% annualized).

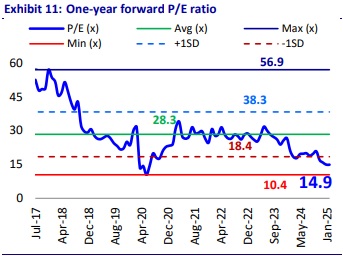

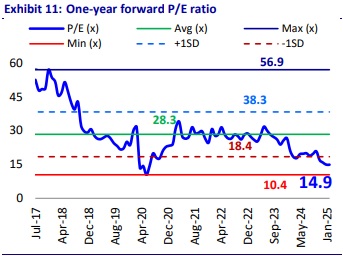

* We tweak our estimates slightly and expect the bank to deliver RoA/RoE of 1.74%/17.3% by FY27E. Reiterate BUY with a TP of INR730 (based on 2.6x Sep’26E BV).

Healthy growth in advances; secured loan business performing well

* AUBANK reported 3QFY25 PAT of INR5.3b (8% beat), led by strong cost control, while provisions were higher. In 9MFY25, earnings grew 38% YoY to INR16b. We estimate 4QFY25 earnings to grow 34% YoY to INR4.96b.

* NII grew 2.4% QoQ to INR20.2b (in line). Margins declined 23bp QoQ to 5.9%. Management has guided for steady margin, as it expects controlled CoF. Provisions were high at INR5b (8% higher than MOFSLe, +34.5% QoQ).

* Other income declined 3% QoQ to INR6.2b (5% miss), due to a decline in fee income and treasury income. Opex fell 3% QoQ to INR14.4b (8% below est.). The C/I ratio thus declined to 54.4% from 56.7% in 2QFY25.

* Advances grew 5% QoQ, with commercial assets up 6.4% QoQ and retail up 4.8% QoQ. Deposits increased by 2.3% QoQ to INR1.12t. The CD ratio thus jumped to 88.7%. However, the CASA mix moderated to 31%. The cost of funds was under control at 7.04%.

* Slippages were high at INR9.6b. GNPA/NNPA ratios thus increased 33bp/16bp QoQ to 2.21%/0.91%. PCR declined to 61.2%.

* Credit cost as % of total assets increased to 0.36% (1.4% annualized), driven mainly by the ongoing stress in the unsecured (MFI and Credit Cards). The bank expects credit costs to remain elevated in 4QFY25; however, stress has started easing in Dec’24.

Highlights from the management commentary

* The bank increased its rate by 10bp in peak TDs. Despite this, the CoF guidance is maintained at 7.10-7.15%.

* C/I for the entire year would be ~58% as 4Q will have more opex on seasonally strong business growth. The bank aims to maintain C/I of 55% for the next two years.

* Although credit cost will be high, RoA would be maintained at ~1.6% in FY25. GLP growth is expected at 20% (25% guidance earlier), affected by a decline in unsecured business, while the secured portfolio will grow faster at 23-24%.

* December was better than November in terms of disbursements and collection efficiency in standard advances.

Valuation and view

AUBANK reported a decent quarter. Although the credit cost was high, the bank has well utilized its opex lever to deliver decent earnings. Margins for the merged entity declined by 23bp QoQ. Management expects margin to remain healthy amid controlled CoF, stable asset yields and healthy traction across business segments. On the business front, loans grew at a faster rate vs. deposits. As a result, the C/D ratio increased to 88.7%. Asset quality deteriorated, resulting in higher-thanestimated provisions. Management expects the credit cost to remain elevated and guides for a full-year credit cost of around 1.5-1.6%. The conversion to a universal bank will further enable healthy growth and strengthen the bank’s market positioning. We tweak our estimates slightly and expect the bank to deliver RoA/ RoE of 1.74%/17.3% by FY27E. Reiterate BUY with a TP of INR730 (based on 2.6x Sep’26E BV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412