Buy 360 ONE WAM Ltd for the Target Rs. 1,400 by Motilal Oswal Financial Services Ltd

Strong inflows and better yields drive ARR income beat

* 360 One WAM (360ONE) reported operating revenue of INR7.6b (in-line), reflecting a 30% YoY growth. For 1HFY26, revenue grew 20% YoY to INR14.2b. Revenue growth was driven by a 39% YoY growth in ARR income to INR5.5b (6% beat), and 9% YoY growth in TBR income to INR2.1b (in-line).

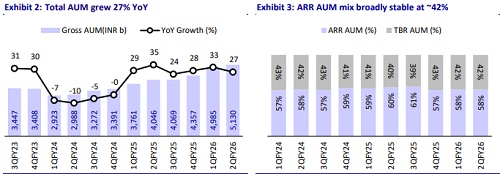

* ARR AUM rose 22% YoY to INR2.9t (in-line), while TBR AUM grew 34% YoY to INR2.2t (in-line), taking the total AUM to INR5.1t (+27% YoY).

* Cost-to-income ratio at 52.4% increased by 160bp YoY (MOFSLe – 53.8%), but revenue momentum resulted in a 25% YoY growth in operating profits to INR3.6b (7% beat). 19% miss in other income resulted in PAT of INR3.2b (in-line), which grew 28% YoY. For 1HFY26, PAT grew 23% YoY to INR6b.

* Over the next 12-18 months, management plans to add 7-8 new RM teams, with a longer-term target of 280-340 RMs to manage the growing client base. Flow momentum is expected to sustain through 2HFY26 and beyond, aided by newly onboarded teams. The cost-to-income ratio is expected to moderate to 47-48% by 3Q/4QFY27 and further to 45-46% in the following year.

* We have marginally upgraded our estimates to factor in the strong performance in 2QFY26, and expect the company to report a FY25-28 revenue/PAT CAGR of 20%/22%. We adopt an SOTP approach, valuing ARR at 45x Sep’27 and TBR/other income at 20x Sep’27, to arrive at a fair value of INR1,400. Reiterate BUY.

Asset management yields improve while wealth management remain steady

* 360ONE reported strong net ARR inflows of INR112b in 2QFY26. On the wealth management side, ARR net flows stood at INR93.2b. AMC net flows grew 33% YoY to INR18.6b, maintaining a strong growth trajectory.

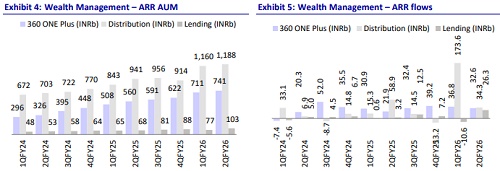

* Wealth Management ARR AUM grew 30% YoY to INR2t, driven by 32%/26%/52% YoY growth in 360 One Plus/Distribution/Lending AUM. Excluding INR24b flows from UBS, the core business witnessed ~INR70b of ARR flows.

* Wealth management ARR retention stood at 72bp (68bp in 2QFY25), driven by a YoY improvement in lending book retention, while distribution and 360 One Plus yields were stable YoY. Going forward, lending book yields are likely to slightly improve, supported by the UBS lending book.

* Asset management AUM grew 7% YoY to INR921b, driven by 13%/1%/6% YoY growth in AIF/discretionary PMS/MF AUM. The segment added ARR flows worth INR18.5b, taking the total ARR flows to INR90b, and management expects a similar trajectory going forward.

* Asset management yields stood at 83bp (67bp in 2QFY25), driven by carry income (INR371m in 1QFY26) and an improvement in both AIF and MF yields. Going forward, MF yields are expected to stabilize in the range of 45-50bp (58bp in 2QFY26).

* Employee costs grew 27% YoY to INR2.9b (5.4% higher than the estimate), supported by hiring in the mid-segment and the addition of new teams in the UHNI segment. Other admin costs grew 54% YoY to INR1,151m (8% lower than estimate), resulting in total costs of INR4b (in-line).

* Other income came in at INR506m in 2QFY26 (vs. INR298m in 2QFY25).

Highlights from the management commentary

* Of the gross inflows, 30-35% came from existing clients, while the remaining 65- 70% were contributed by new investors. However, with respect to net inflows worth INR85-90b during the quarter (excluding UBS), 90% was sourced from new clients.

* Currently, ~40% of TBR is from equity brokerage, which is expected to rise from the current INR3-5b to INR5-5.5b, driven by UHNI clientele and B&K acquisition. The remaining INR5b of TBR will come from REITs, unlisted securities, debt syndication, and other areas.

* The pipeline for institutional mandates remains healthy, although conversion timelines could be elongated given the current global environment. Management reiterated its full-year guidance of net flows at 10-12% of the opening AUM.

Valuation and view

* 360ONE offers a compelling structural growth story anchored in India's expanding wealth and asset management market. The company continues to drive strong gross flows across both wealth and asset management, which is likely to be supported by the onboarding of new teams. The recent acquisition of B&K and the UBS collaboration enhance the company’s international footprint, broaden client access, and strengthen its transactional platform. Operating leverage and cost synergies from integrations are expected to improve profitability as new businesses scale.

* We have marginally upgraded our estimates to factor in the strong performance in 2QFY26, and expect the company to report a FY25-28 Revenue/PAT CAGR of 20%/22%. We adopt an SOTP approach valuing ARR at 45x Sep’27 and TBR/other income at 20x Sep’27 to arrive at a fair value of INR1,400. Reiterate BUY.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)