Buy Blue Dart Express Ltd for the Target Rs. 7,900 by Motilal Oswal Financial Services Ltd

Strong margin expansion driven by higher volumes and cost optimization

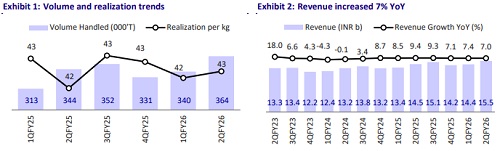

* Blue Dart Express’s (BDE) revenue grew ~7% YoY to INR15.5b in 2QFY26 (in line). The company handled 0.36m tons of cargo volumes (+6% YoY) in 2QFY26. Realization rose ~1% YoY to INR42.6/kg. It carried 106.3m shipments in 2Q.

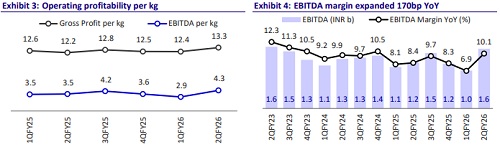

* EBITDA margin came in at 10.1% in 2QFY26 (up 170bp YoY and 320bp QoQ) vs. our estimate of 8.7%.

* EBITDA grew ~29% YoY to INR1.57b (13% above our estimate). The company reported a profit of INR795m vs. INR608m in 2QFY25 (6% above our estimate).

* In 2QFY26, BDE reported a steady improvement in revenue, with APAT increasing 31% YoY due to higher EBITDA margins, which were driven by a higher number of shipments and cost optimization initiatives. The ground express segment continued to experience healthy traction, driven by B2C growth and e-commerce volumes. Management expects EBITDA margins to remain strong going forward, driven by yield improvement, cost rationalization, product mix optimization, and network efficiencies. We largely maintain our estimates for FY26/27. We reiterate our BUY rating with a revised TP of INR7,900 (based on 20x FY28 EV/EBITDA).

Utilization levels improve in newly added aircraft; B2B:B2C revenue mix at 70:30, with B2C growing at robust pace

* In 2QFY26, BDE reported shipment volume of 106.3m (+10% YoY) and tonnage of 0.36mt (+6% YoY). Margins have substantially expanded due to the increasing number of shipments and cost optimization.

* The company’s revenue mix remained stable, with Air Express contributing ~70% and Surface Express ~30% of total revenue, while the B2B and B2C segments accounted for 70% and 30%, respectively.

* During the quarter, B2C revenue grew ~18% YoY on strong e-commerce demand, while B2B revenue rose ~3% YoY, respectively.

Highlights from the management commentary

* EBITDA margins increased 170bp YoY on account of improvement in the number of shipments and cost controls, which led to margin expansion.

* BDE announced a General Price Increase (GPI) effective 1st Jan’26, with average shipment prices set to rise 9-12%.

* During the quarter, B2C revenue grew ~18% YoY on strong e-commerce demand, while B2B revenue rose ~3% YoY.

* Management mentioned that margins are expected to sustain in the near term and, going forward, margin expansion will be driven by yield improvement, cost rationalization, product mix optimization, and network efficiencies.

Valuation and view

* The ground express segment continues to experience healthy traction, driven by B2C growth and e-commerce volumes. Despite competition, the company has been able to maintain market share through its premium offerings.

* Management expects EBITDA margin to expand going forward. We largely maintain our estimates for FY26/27. We reiterate our BUY rating with a revised TP of INR7,900 (based on 20x FY28 EV/EBITDA).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412