Buy KEI Industries Ltd for the Target Rs. 4,960 by Motilal Oswal Financial Services Ltd

Earnings in line; demand outlook positive

Management reaffirms its growth guidance of 20%+ over FY27-28E

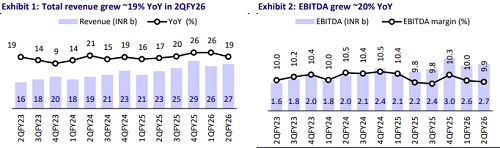

* KEI Industries (KEII)’s 2QFY26 earnings were in line with our estimates. Revenue grew ~19% YoY to INR27.3b, driven by ~22% YoY growth in the C&W segment. EBITDA rose ~20% YoY to INR2.7b. OPM was flat YoY at ~10% (50bp below our estimate). PAT grew ~31% YoY to INR2.0b (in line), fueled by higher other income.

* Management indicated that Phase I of the Sanand project (accounting for over 50% of total capacity) was delayed by four months due to the extended rains and labor shortage. However, it expects this will be commissioned in Nov’25 and will start contributing to the revenue from 4QFY26. Further, phase II (mainly consisting of EHV and MV cables) is delayed by nine months due to some complexities faced in construction. KEII, however, does not expect any further delay and anticipates the commissioning in 4QFY27.

* While KEII maintains its growth guidance of ~18% in FY26 and 20%+ over FY27-28, the key focus remains on higher capacity utilization either through exports or domestic markets. Management expects margins to remain at current levels.

* We retain our earnings estimates for FY26-28 and project a revenue/EBITDA/ PAT CAGR of 18%/21%/21% over FY25-28. We value KEII at 40x Dec’27E EPS to arrive at our TP of INR4,960. Reiterate BUY.

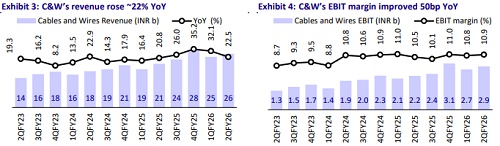

C&W revenue up 22% YoY; EBIT margin improves 50bp YoY to 10.9%

* KEII’s revenue/EBITDA/Adj. PAT stood at INR27.3b/INR2.7b/INR2.0b (+19%/ +20%/+31% YoY and -1%/-5%/-3% vs. our est.) in 2QFY26. OPM was flat YoY at ~10%. Depreciation/interest costs rose ~24%/6% YoY. Other income surged ~232% YoY due to higher interest earned from the unutilized QIP proceeds.

* Segmental highlights: a) C&W revenue was up ~22% YoY at INR26.3b, EBIT rose ~28% YoY to INR2.9b, and EBIT margin increased 50bp YoY to 10.9%. b) EPC business revenue declined ~23% YoY to INR1.0b, EBIT declined 58% YoY to INR51m, and EBIT margin declined 4.2pp YoY to 5.1%. c) Stainless steel wires (SSW) revenue declined ~11% YoY to INR539m, EBIT increased 55% YoY to INR44m, and EBIT margin increased 3.5pp YoY at 8.2%.

* In 1HFY26, KEII’s revenue/EBITDA/PAT grew 22%/20%/31% YoY. EBITDA margin was 9.9% (down 20bp YoY). C&W revenue/EBIT was up 27%/29% YoY, and EBIT margin was up 10bp YoY at 10.8% in 1HFY26. Operating cash inflow stood at INR3.8b vs. operating cash outflow at INR3.1b in 1HFY25. Capex stood at INR7.6b (including INR1.2b for land purchase) vs. INR3.1b. Net cash outflow was INR3.8b vs. INR6.2b in 1HFY25. The net cash balance (ex-acceptances) stood at INR7.3b vs. INR10.5b/INR14.9b in Jun’25/Mar’25.

Key highlights from the management commentary

* Overall exports hit an all-time high; quarterly sales rose ~96% YoY to INR4.7b. The share of exports to total C&W institutional sales stood at ~37% vs. ~22%/29% in 2QFY25/1QFY26.

* KEII’s pending order book stood at INR38.2b. The composition of the order book was: domestic institutional cables at INR20.7b, EHV cables and export cables at INR6.4b (each), and the EPC division at INR4.8b.

* Capacity utilization (in km terms) was 78% for cables, 65% for HW, 85% for SSW, and 46% for communication cable. Its volume growth in 1HFY26 stood at ~15%.

Valuation and view

* KEII reported a strong performance during 1HFY26 with overall revenue/EBITDA growth of 22%/20% driven by robust growth of ~27% and a stable margin in the C&W segment. However, the delay in commissioning of the Sanand greenfield expansion came as a disappointment. Despite this, the management maintained its growth guidance and expects no further delay from the revised timelines. We estimate KEII’s total revenue CAGR at ~18% over FY25-28, driven by ~19% growth in the C&W segment and ~6% growth in the SSW segment. However, EPC’s revenue is projected to decline ~10% annually. We project its EBITDA and PAT to generate a CAGR of ~21% (each) over FY25-28.

* We recently upgraded our rating on KEII to BUY from Neutral, given the positive demand outlook, steady margins, and reasonable valuation at 38x/32x on FY27E/FY28E EPS. We value KEII at 40x Dec’27E EPS to arrive at our TP of INR4,960. Reiterate BUY.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)