Buy Power Finance Corporation Ltd for the Target Rs. 485 by Motilal Oswal Financial Services Ltd

Earnings below est.; muted loan growth from higher repayments

Asset quality broadly stable; reported NIM dips ~5bp QoQ

* Power Finance Corporation (PFC)’s 2QFY26 PAT grew ~2% YoY to INR44.6b (~17% miss). PAT in 1HFY26 grew 11% YoY, and we expect PAT in 2HFY26 to grow by 10% YoY. NII grew ~20% YoY to ~INR52.9b in 2QFY26 (inline).

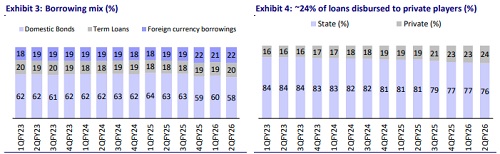

* Other operating income declined ~19% YoY to ~INR11.8b (PY: INR14.7b), which included dividend income of INR11b (PY: INR12.5b). The company reported exchange losses of INR5b (PQ: exchange losses of INR6.5b). The EUR/INR movement is one of the major reasons for the foreign exchange translation loss in 2QFY26.

* Opex declined ~18% YoY to ~INR1.9b (inline), and the cost-income ratio rose ~25bp QoQ to ~3.65%. PPoP grew ~9% YoY to INR57.8b (~9% miss).

* PFC shared that ~95% of its foreign currency borrowings are hedged, with the small unhedged portion majorly linked to Euro-denominated bonds. The EUR appreciated by ~8% against the USD in 1HFY26, which led to mark-to-market losses. However, the company also shared that since these foreign borrowings are long-term, any favorable movement in exchange rates could help reverse these exchange losses. The company noted that the EUR/USD exchange rate has moved more favorably in recent days.

* The reported yield dipped ~3bp QoQ to ~9.98%, while the reported CoB rose ~3bp QoQ to ~7.43%. This led to ~5bp QoQ dip in spreads to 2.55% in 1HFY26. Reported NIM for 2QFY26 contracted 5bp QoQ to ~3.62% (PQ: 3.68%).

* GS3 declined ~5bp QoQ to ~1.87%, while NS3 was broadly stable QoQ at 0.37%. PCR on Stage 3 was stable QoQ at ~80.2%. Provisions for the quarter stood at INR2.4b (PQ: -INR6.8b and PY: -INR1.2b). This translated into annualized credit costs of 4bp (PY: -3bp and PQ: -12bp).

* PFC highlighted that the resolution plan for the Sinnar Thermal Power project (with an exposure of ~INR10b) has been submitted for NCLT approval. The company has ~80% provision cover on this account.

* We estimate a disbursement/advances/PAT CAGR of 11%/12%/10% over FY25-FY28E, an RoA/RoE of 3.1%/18%, and a dividend yield of ~5.5% in FY28E. We reiterate our BUY rating with an SoTP (Sep’27E)-based TP of INR485 (premised on 1x target multiple for the PFC standalone business and INR151/share for PFC’s stake in REC after a hold-co discount of 20%).

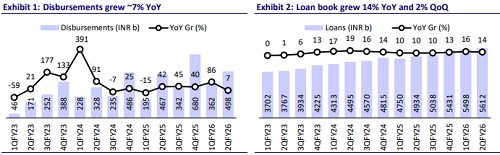

Disbursements rise ~7% YoY; loan book grows ~2% QoQ

* Loan book stood at INR5.61t and grew 14% YoY/2% QoQ. Disbursements during the quarter rose ~7% YoY to ~INR498b. Repayments during the quarter stood at ~28% (PQ: 22% and PY: ~24%).

* The renewables segment in the loan mix was stable at 15% (PQ: 15%). Disbursements to the infrastructure sector formed ~4% of the total disbursements in 2QFY26.

* PFC maintained its loan growth guidance to ~10-11% in FY26. We model a loan book CAGR of ~12% over FY25-FY28E.

Asset quality broadly stable; PCR also stable QoQ

* GS3 declined ~5bp QoQ to ~1.87%, while NS3 was broadly stable QoQ at 0.37%. PCR on Stage 3 was broadly stable QoQ at ~80.2%. Standard assets (Stage 1 + 2) PCR was broadly stable QoQ at ~1%.

* PFC has ~22 projects (PQ: 22 projects) that are classified as NPA. Resolutions in ~11 NPA projects (PQ: 11) are being pursued under NCLT, and the remaining ~11 NPA projects (PQ: 11) are being pursued outside NCLT.

* CRAR stood at ~21.6% as of Sep’25.

Key highlights from the management commentary

* Management noted that there have been no prepayment requests for the Kaleshwaram project (exposure of ~INR260b), and repayments are happening in their normal course. Given that this project is backed by a state guarantee and has budgetary support, PFC does not see any prepayment or credit risk associated with this exposure.

* The company closed its first cross-border project financing transaction in Bhutan, providing INR48b of funding for a 600MW hydropower project. The loan has been denominated in INR, and the transaction was undertaken with a special approval from the RBI

Valuation and view

* PFC delivered a muted performance for the quarter, with loan growth remaining soft and earnings coming in below expectations due to elevated forex losses on the unhedged portion of its foreign currency borrowings. NIM and spreads moderated during the quarter, reflecting some pressure on yields in a declining interest rate environment. Asset quality, however, remained broadly stable, and credit costs continued to remain benign.

* PFC (standalone) trades at 0.8x FY27E P/BV and ~4x FY27 P/E, and we believe that the risk-reward is attractive considering decent visibility on loan growth, further stressed asset resolutions, and healthy RoE of 18-20% over FY26-27E. Reiterate our BUY rating with an SoTP (Sep’27E)-based TP of INR485 (premised on 1x target multiple for the PFC standalone business and INR151/share for PFC’s stake in REC after a hold-co discount of 20%).

* Key risks: 1) weaker loan growth driven by higher prepayments; 2) increase in exposure to power projects without PPAs; 3) compression in spreads and margins due to an aggressive competitive landscape; and 4) any slowdown in the offtake of renewable energy projects.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

Ltd.jpg)