Buy ACME Solar Holdings Ltd for the Target Rs. 385 by Motilal Oswal Financial Services Ltd

Execution remains a key monitorable for FY27

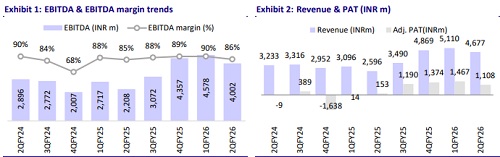

* ACME Solar Holdings (ACME) posted an in-line performance in 2QFY26, with revenue of INR4.7b (3% beat). 2QFY26 benefitted from healthy generation leading to EBITDA coming in line with our estimate of INR4b. Adj. PAT of INR1.1b was 13% above our estimate, aided by higher-than-expected other income.

* The company has continued to execute well and remains on track to scale up its installed capacity to an estimated ~5.4GW by FY28. This is expected to drive an EBITDA CAGR of 74% over FY25-28.

* Key monitorables in 2HFY26 include 1) PPA signing for pending projects and 2) Comissioning of 1GWh of BESS, which should be operationalized by 4QFY26, as this is expected to contribute an annual EBITDA of ~INR1.7b. This could pose an upside risk to our current EBITDA estimates for 4QFY26 and FY27.

* We reiterate our BUY rating with a TP of INR385, implying a 40% upside potential.

EBITDA in line; beat on APAT driven by higher other income

Financial highlights

* ACME’s consol. revenue beat our est. by 3% at INR4.7b (+80% YoY, -8% QoQ), led by higher generation due to improved capacity utilization factor (CUF).

* EBITDA came in at INR4.0b (+81% YoY, -13% QoQ), in line with our estimate, with an EBITDA margin of 86%.

* Adj PAT was 13% higher than est. at INR1.1b (+624% YoY, -24% QoQ) on account of higher-than-expected other income.

* Net debt stood at INR89b. The net debt-to-TTM EBITDA ratio declined to 4.3x from 5x in 2QFY25.

* ACME secured INR70.5b debt for 680 MW FDRE projects.

* It received a ~75bp interest rate cut from the existing lender on INR20.8b debt tied to 600 MW SECI ISTS projects following a credit rating upgrade. Also, the rate was lowered to 8% p.a. on INR12.45b debt for a 300MW operational project.

Operational Highlights

* Generation stood at 1,539MUs in 2QFY26 (+133.8% YoY). The company recorded a CUF of 24.1% (22.2% in 2QFY25).

* Operational capacity reached 2,918MW as the company commissioned 28MW wind capacity during 2QFY26.

* During 1HFY26, ACME won 720 MW/2,460 MWh (Solar + ESS and FDRE) and 550 MWh standalone BESS capacity.

* In 2QFY26, PPAs were signed for 50 MW/220 MWh and 550 MWh, taking cumulative PPA signings in 1HFY26 to 600 MW/1,350 MWh and 550 MWh.

* The total portfolio of the company now stands at 7,390 MW, including 13.5 GWh of BESS installation, with PPAs signed for 5,180 MW.

* A phased delivery of the 5.1 GWh BESS order is expected to start in Dec’25, with phased commissioning from 4QFY26.

Highlights of the 2QFY26 performance

* About 378?MW has been commissioned in FY26 to date, with another 72?MW nearing completion.

* The total portfolio of 7,390?MW included 13.5?GWh of BESS, with a 10?GW target by 2030.

* New wins included 720?MW of projects (450?MW?SJVN,?220?MW?RUMSL,? 50?MW?Tata?Power?FDRE).

* Generation stood at 1,539MUs, and CUF was 24.1%.

* Successfully commissioned a 10 MWh pilot BESS at the ISTS plant to evaluate performance across configurations.

* Placed new orders for 2GWh during the quarter. A phased delivery of the 5.1 GWh BESS order is expected to start in Dec’25, with phased commissioning from 4QFY26 onward.

* About 1GWh of BESS (merchant capacity) should be operationalized from 4QFY26 onwards, which is expected to generate an annual EBITDA of INR1.7b (assuming an INR5/unit difference between merchant power sale during peak hours and the cost of generation of the same).

* The net debt-to-TTM EBITDA ratio was 4.3x, and net debt/net worth was 1.9x.

* ACME incurred ~INR14b capex in 1HFY26 but remains on track to meet its fullyear target of INR120b, subject to a delay of a maximum of one quarter.

Valuation and view

* We reiterate our BUY rating on ACME. We assign a 10x FY28E EV/EBITDA . Adjusting for the net debt, we derive our TP of INR385, implying a 40% potential upside.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)