Neutral Bharat Forge Ltd For Target Rs.1,060 by Motilal Oswal Financial Services Ltd

India to be the key focus region from here-on

Foray into electronics will be a key monitorable

In this note, we present the key insights from Bharat Forge’s (BHFC) FY25 annual report. Few key highlights: 1) robust order backlog in defense of INR95b, including a domestic ATAG order worth INR40b; 2) material progress in aerospace capabilities, which opens doors to new business opportunities with tier-1 aerospace manufacturers; and 3) strong performance at JSA with EBITDA margin reaching 14.9% with a positive growth outlook. Going ahead, India will become the center of gravity, with capital, engineering, and leadership attention aligned to where demand visibility, policy support, and supply-chain strength converge. BHFC targets to accelerate growth in highreturn Indian verticals – defense, aerospace, advanced castings, and a growing electronics cluster – while concluding the review of its European steel forging assets. Overseas expansion will be pursued only where riskadjusted returns justify the exposure. With capex intensity coming down, its free cash flow is likely to improve in FY26. However, given the current uncertain outlook for its standalone and overseas businesses, the stock at 45.7x/35.7x FY26E/FY27E cons. EPS appears fairly valued. We reiterate our Neutral rating with a TP of INR1,060 (based on 30x Jun’7E cons. EPS).

Auto segment

* BHFC is India’s largest exporter of auto components and the world’s leading manufacturer of powertrain and chassis components.

* Management noted that the recent trade tariffs by the US and the protectionist stance adopted by various nations will cause disruptions and lead to short-term pressure on revenue and profitability of BHFC in FY26. At the same time, new growth avenues may also open up. With OEMs on the lookout to future-proof their supply chains, BHFC has a good chance to gain a foothold in sectors hitherto untapped by it.

Domestic CV business

* The division’s revenue declined 6.9% YoY in FY25 to INR9,627m, due to slower capex in 1HFY25 owing to general elections.

* As witnessed over the last few years, the share of heavier trucks like tractor-trailer and tippers has increased substantially. Further, new generation platform launches by OEMs have created opportunities for suppliers like BHFC to participate in the market growth.

Domestic PV business.

* Revenue rose 20.9% in FY25 to INR3,622m, driven by new business wins, market share gains and higher OEM volumes. In FY26, BHFC expects growth for this business to normalize to the underlying market level.

* Utility vehicles now account for almost 2/3rds of total market sales. Management expects this trend to create opportunities in the medium term.

CV export business

* BHFC is a critical supplier to major CV OEMs and Tier I supplier in its major end markets and has seen an increase in content supplied to OEMs over the years.

* FY25 revenue from the CV export business declined 4.6% YoY to INR20,152m. ? The highlight in this segment has been market share gains in its core regions of North America and Europe.

* After a tough year in FY25 for its European CV exports, BHFC expects the business to remain stable in FY26. However, a well-directed capex push from major European economies can spur some demand for heavy-duty trucks in Europe, thereby aiding recovery.

* In contrast, its North American business saw moderate growth despite flat production volumes. From a policy perspective, a pause to the emission norm change in North America is likely to keep demand balanced in CY25 and CY26 instead of the earlier anticipation of pre-buy benefits in CY25 and the resultant subsequent dip thereafter. However, the unpredictability of the US' trade policy will create challenges in the marketplace. Management expects the policy in its current form to build inflationary pressures in the US and hurt overall demand. In the event of a drop in consumption demand, transport cargo growth may be impacted. This will lead to a decline in demand for CVs in North America.

PV export segment

* A large proportion of BHFC’s PV export components are shipped in a fully machined condition. However, after strong growth in the PV export business in FY24, the segment saw a 12% YoY decline in revenue in FY25 to INR11,167m, due to lower demand for platforms and an overall demand slowdown in some geographies for a brief period.

* BHFC has adopted the ‘last-man standing’ strategy for PV exports. This implies its willingness to supply engine components to all PV OEMs by the time the last ICE gets built. Its strategy is rooted in the belief that the EV transition will be gradual and provide ample scope for ICE and hybrid technologies to compete in markets where development of charging infrastructure and affordability are key issues. In the medium-to-long term, it targets to diversify across OEMs and geographies and increase its market share with its existing and new customers.

* However, in the near future, the US tariffs are likely to disrupt supply chains and push up inflation. Management expects it could curb discretionary consumption, resulting in deferment of vehicle purchases in North America in the short run. This is likely to impact its PV export business and result in lower sales.

Non-auto business

* In the industrial sector, BHFC is one of the few players with the capability to manufacture single-piece heavy components up to 35 tons, a capability embedded with few manufacturers in India.

* BHFC’s strategy on the Industrial side has been to diversify across sectors to create multiple levers of growth. This has also helped to minimize the impact of individual sectoral volatility over the years.

* In FY25, BHFC’s industrial exports stood strong despite a weak performance in some of its end-markets.

* Oil & Gas business posted a strong 27% YoY growth in revenue to INR3,991m over a low base of FY24. This segment had seen challenges of inventory correction and technology change in FY24. BHFC’s endeavor is to expand the product bouquet gradually and increase its share in the fracking industry in North America, which it expects to play out over the next 2-3 years. In FY26, BHFC expects this segment to see flat to marginal growth.

* Aerospace grew 13% YoY to INR2,407m and now contributes to 14% of industrial exports – this division has grown over 4x in size since FY20. This unit has progressed from supplying components to delivering assemblies and finished products (aerospace segment details in subsequent section).

* Construction & Mining faced headwinds as demand plateaued vs. FY24 due to inventory pile-up in the supply chain. BHFC expects this to get corrected gradually and come back to steady growth in the coming quarters.

* In domestic non-auto, demand was strong for heavy-horse power engines. Led by increased needs for standby power from data centers, this segment reported positive performance. Further, after a sluggish FY24, the agriculture segment recorded positive performance, driven by strong growth in rural India. BHFC expects this segment's performance to be in line with tractor OEM growth in FY26.

Aerospace

* The unit focuses on aero-frames, landing gears and critical engine components.

* In FY25, customers recognized BHFC for zero-defect deliveries of critical rotating engine components. Building on this success, it secured new contracts for critical engine components from global customers, including the supply of rings manufactured from superalloys. This achievement demonstrates BHFC's growing capability in advanced metallurgical applications.

* A significant milestone was achieved with the AS9100D certification of its turbomachinery assembly and design facility, validating the quality management systems and processes to international aerospace standards. This certification enhances customer confidence and opens doors to new business opportunities with tier-1 aerospace manufacturers.

* The division successfully rolled out a comprehensive range of fully tested Micro Jet Engines specifically designed for UAV applications. This product launch positions BHFC at the forefront of the rapidly growing unmanned aerial vehicle market, addressing both civilian and defense applications.

* Additionally, BHFC has developed robust maintenance, repair, and overhaul (MRO) capabilities for turbomachinery equipment serving defense, aerospace, and industrial requirements. This strategic expansion into the aftermarket services sector has the potential to create recurring revenue streams and strengthen customer relationships throughout the product lifecycle.

* To augment its production capabilities, BHFC has embarked on capital investment for creating a state-of-the-art production facility for high-precision aerospace rings and machining of landing gears, supported by long-term customer commitments. The ring mill and machining units should come online in CY27. This will double its aerospace capacity and strengthen its role in global engine and structural programs.

Defense segment

BHFC’s defense portfolio spans across land systems (artillery guns, protected vehicles, small arms, consumables and naval systems), underwater autonomous platforms for mine detection, and underwater vehicles for crew training in antisubmarine warfare. In defense, BHFC has developed nine artillery platforms and a diverse product range across mobility systems and MRO, demonstrating its ability to build advanced, multi-domain solutions.

* BHFC’s product strategy follows a solutions provider approach where development priorities are determined basis global requirements and potential IP creation inside India. It aims to house the entire intellectual property vertical inside the Group. This grants BHFC a free hand to market its products in many geographies, subject to Government of India approvals.

* With revenue of around INR18b across artillery systems, armored vehicles, sustainment spares, and naval utility products, the business is slowly delivering on its long-term vision.

* A key thrust area here is the small arms segment where BHFC has invested heavily to build a globally competitive product line. BHFC sees strong potential for this vertical to replicate the success seen in some of its well-established segments within defense.

* BHFC received its biggest ever defense order worth nearly INR40b for the supply of 184 ATAGS platforms in FY25. Its executable order book in defense now stands at around INR95b, offering multi-year visibility.

* Kalyani Strategic Systems (KSSL), a wholly-owned subsidiary of BHFC, has been granted the defense license by the Department for Promotion of Industry & Internal Trade under The Industries (Development and Regulation) Act, 1951, for the manufacturing of various defense products at its Jejuri unit.

* KSSL’s new state-of-the-art manufacturing facility spread over 400,000 square feet at Jejuri near Pune will commence operations in 1HFY26. Its capacity to manufacture artillery guns, vehicles and other defense products would receive a significant boost once this plant comes online.

* In the next 2-3 years, BHFC aims to have a healthy mix of short and long lifecycle products across land and naval, ensuring a faster time from product development to revenue generation. Through its product development initiatives, it aims to insulate its revenue stream from any potential cyclicality and ensure steady returns for the business over the next 3-4 years.

* BHFC has recently acquired a 25% stake in Italian design company EdgeLab SpA. EdgeLab specializes in the design and manufacture of autonomous underwater vehicles.

JS Auto Cast (JSA)

JSA’s acquisition marked BHFC’s entry into the ferrous castings space, unlocking opportunities across wind energy, hydraulics, construction, mining, etc.

* JSA has a diversified customer base, reducing dependency on any single industrial sector or customer. The revenue split between domestic and export markets is also more balanced.

* JSA has gradually expanded its reach to CVs and passenger cars segments, adding to the diversification of the revenue stream.

* It has enhanced its operational capacity to 130,000 MT per annum. Further, the company has enhanced its machining capacity as well.

* FY25 saw organic growth across the board, with revenue of INR6.97b and EBITDA margin of 14.9%.

* Looking ahead, with the opportunities available in the market, JSA is set to significantly scale up its foundry and machining capabilities to meet the growing demand for fully machined castings. It is driving several initiatives across productivity improvements, value addition, operational efficiency, capacity expansion, and new product development.

Update on KPTL

* BHFC’s e-mobility business, housed under Kalyani Powertrain, operates in two business verticals: re-powering business and electronic components business.

* The re-powering business has identified STUs as an ideal candidate for repowering old buses (> 7 years) and rejuvenating their life without impacting the existing employee & depot ecosystem. The business has signed proof-ofconcept MoUs with two states.

* The electronic components business had a transformative year in FY25. A major achievement during the year was the commencement of revenue from operations. It also won its 1st global order for DC-DC converter.

* A conducive policy environment and monetary incentives from the government augur well for the evolution of electronic product manufacturing in India. Recognizing this trend, BHFC has made an initial entry into the value chain of high-tech electronics manufacturing – on both the equipment and EMS fronts.

* KPTL has pivoted toward server solutions for the telecom segment, with the objective of “Make in India”. KPTL inaugurated a state-of?the-art SMT line in FY25.

* The company has signed two strategic MoUs with global industry leaders in processor & server hardware value chain, cementing its entry into this segment.

* It has also enhanced its technical capabilities by onboarding domain experts and establishing a dedicated system integration domain.

* In the medium term, KPTL focuses on structured revenue growth by targeting 3- 4 high-impact sectors: 1) re-powering of trucks for smaller inter-city distances, 2) re-powering of bus at STUs, 3) launching and establishing Make-in-India server business, and 4) strengthening its automotive electronics business by acquiring new customers.

Overseas subsidiaries

* The overseas business had a tough year in FY25. ? European aluminum business showed improvement in pricing to reflect the higher cost of energy and manpower. Better realization per piece in Europe was offset by a slight decline in utilization rates in the aluminum business. In general, a weak consumer sentiment across Western Europe impacted demand, resulting in both the steel forging and the aluminum forging businesses facing negative operating leverage.

* On the contrary, the US business showed progressive reduction in operational losses across quarters, with the final quarter of the year recording a small EBITDA profit. BHFC’s continued effort toward improving operational efficiency in the US is gradually yielding success.

* It aims to sustain the momentum and commission the second phase of its aluminum forging unit in the US by 2HFY26.

* Both its European and US units cater to local needs of their respective OEM customers and have limited export exposure. Given the limited cross-border trade these businesses engage in, management expects the direct impact from the global trade tensions to be marginal in the short run. However, if the global trade policy remains rigid for a prolonged period, inflation may inch up, impacting discretionary spend. This is likely to hit the underlying demand and its business outlook in these regions.

Business outlook

* For over two decades, BHFC has operated in every major continent. That experience brought scale, talent, and global reach, but it also taught the company that global presence requires sharp selectivity. Going forward, BHFC plans to deploy its global footprint with greater caution. India will become the center of gravity, with capital, engineering, and leadership attention aligned to where demand visibility, policy support, and supply-chain strength converge.

* BHFC’s priorities reflect this shift. It targets to accelerate growth in high-return Indian verticals – defense, aerospace, advanced castings, and a growing electronics cluster – while concluding the review of its European steel forging assets.

* Overseas expansion will be pursued only where risk-adjusted returns justify the exposure.

* Digitization will streamline factories and compress development cycles, while the AAM India CV business acquisition strengthens its driveline platform and increases content on domestic vehicles.

* Over the last 3-4 years, BHFC has invested significant capital to strengthen its overseas aluminum operations, scale up its Indian subsidiaries and add capacity in the domestic forging business. Majority of these investments are concluded. FY26 capex would be focused solely on India. With capex intensity coming down, its free cash flow are likely to improve from FY26.

Brief on M&A and investment activities

* BHFC has entered into an agreement to acquire 100% interest in the axles business and the design center located in Pune of AAM India Manufacturing Corporation. This transaction is another step in its endeavor to transform BHFC from a component supplier to a manufacturer of assemblies/products. The transaction is expected to close in 1HFY26. The acquired company has revenue of INR13.85b. This transaction was completed at an EV of INR5.4b. Management indicated that it expects this acquisition to be EPS and returns accretive from the first year itself.

* In FY25, BHFC invested INR3,455m in Bharat Forge Global Holding GmbH (vs. INR3,157m in FY24) for further investments in its subsidiaries, Bharat Forge CDP GmbH, Bharat Forge Aluminiumtechnik and Bharat Forge Kilsta, and converted a loan of EUR1m into equity.

* In FY25, BHFC invested INR8,834m (INR1,248m in FY24) in Bharat Forge America for investments in its US subsidiaries and also converted a loan of USD12m into equity.

* In FY25, BHFC invested INR3,779m in KPTL for further investment in Tork Motors, Refu Drive GmbH and Electro Forge. Also, it has made provision for diminution in value of investments amounting to INR1,457m in KPTL. In FY24, it invested INR2.6b in KPTL for further investments in Kalyani Mobility, a loan to Electroforge and balance for other business activities. Further, BHFC has transferred its investment in Refu Drive to KPTL for an amount of INR1,055m due to which Ref Drive ceased to be JV of BHFC.

* Further, BHFC has agreed to transfer a 39.43% stake held in TMJ Electric Vehicles to Bharat Forge International, a wholly-owned subsidiary. The said transfer has been completed on 10th Oct’24.

Board Details

* As on 31st Mar’25, the company has 11 directors. Of them, six (i.e. 54.54 %) are Independent Directors, including two women Independent Directors, four (i.e. 36.36%) are Executive Directors (including the Chairman and Managing Director, who is a Promoter Director), and one (i.e. 9.09 %) is a Non-Executive NonIndependent Director.

Financials

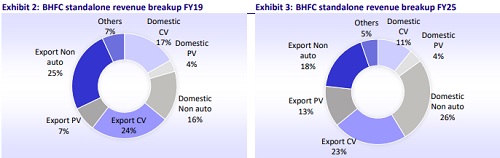

* In FY25, standalone business revenue declined 1% YoY to INR88.4b. While domestic revenue grew 2% YoY, exports declined 4% YoY. The key growth driver in FY25 was non-auto, wherein segments like defense, aerospace and oil and gas posted healthy growth.

* BHFC standalone margins improved 70bp YoY to 28.3%.

* Overall, BHFC standalone business posted 7% YoY decline in PAT in FY25.

* India capex (including India subs) stood at INR7.5b.

* At a consolidated level, BHFC posted 10% YoY growth in PAT to INR10.1b. Overseas subsidiaries and KPTL continued to be a drag on overseas performance.

* As of early 2025, overseas aluminum operations reached 60-65% utilization in Europe and 60% in the US.

* Consolidated long-term debt has come down to INR19.8b from INR24.6b YoY. As a result, net D/E decreased to 0.35x from 0.61x.

* Returns: RoCE (net of cash) 18.1%; RoE 12.1%

Valuation and view

Continued focus on de-risking the business and increasing value additions

Over the last decade, BHFC has broadened its revenue stream by entering new segments (non-Auto) and markets across the globe, resulting in a decline in the share of the Auto business to ~56% in FY25 from ~80% in FY07. It has increased value additions by focusing on machined components, whose contribution grew ~50%, boosting realizations and margin. After having invested for over 10 years, it is now seeing meaningful traction in the defense business. It is also ramping up the Al mix in its overseas subsidiaries. Further, it has set up a dedicated team to work on advanced EV components, which it targets to materially ramp up in a couple of years. These diversification initiatives have helped BHFC reduce cyclicality in revenue over the last few years.

Auto business: Muted outlook across key segments

The domestic CV demand has seen weak demand trends in the last 12 months, with the MHCV goods segment posting a 4% YoY decline in FY25. The outlook remains modest, with an expectation of low-single-digit growth for FY26E. Similarly, the domestic PV industry expects modest growth of 2-4% in FY26. Management has indicated that it expects the CV export business to post a decline in FY26. While BHFC has a good order backlog, PV exports may see subdued demand given the ongoing geopolitical challenges in the region. Overall, the outlook across its key auto segment remains modest for FY26.

Defense to be the key growth driver over FY25-27E

Over the last decade, BHFC has developed new frontiers for growing beyond its core business, with investments in capabilities and capacities in place. Some of these new businesses offer huge potential in the long term and the scope to drive the next phase of evolution for the company. BHFC has ramped up its defense business to INR15.6b in FY24 and further to INR17.7b in FY25, a growth of 14% YoY. On the back of strong demand, its defense order book has sharply scaled up to INR95b to be executable over the next 3 to 4 years, which includes the domestic ATAG order worth about INR40b, which is likely to commence from FY27 onward. Thus, defense business is likely to be the key growth driver for BHFC in the coming years.

Ramp-up in Industrial and Aerospace to fuel growth

BHFC sees a tremendous opportunity in the industrial space (renewable, offhighway, and others), and it has invested in expanding its capacities (Sanghvi Forgings) and capabilities (JSA) through acquisitions in the last couple of years. BHFC has a relatively smaller contribution from renewable energy and the industrial segment in India. JSA has scaled up well to INR6.9b in revenue for FY25, with margin of about 14.9%. This business is expected to sustain its growth momentum in the coming years as well. Further, aerospace has posted strong growth and now contributes to 24% of non-auto exports in 4Q and to 14% in FY25. BHFC expects the momentum in Aerospace to continue over the next 2-3 years as its new ring mill and machining facilities come online in 2027.

Valuation and view

Management has indicated that FY26 is likely to be challenging amid tariff-led uncertainties and changes in emission regulation in North America. Given these factors, the stock at 45.7x/35.7x FY26E/FY27E consolidated EPS appears fairly valued. We reiterate our Neutral rating with a TP of INR1,060 (based on 30x June27E consolidated EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412