Neutral KEI Industries Ltd for the Target Rs.4,200 by Motilal Oswal Financial Services Ltd

Earnings beat; Sanand Phase I commissioning by Sep’25

Management reaffirms ~18-19% revenue growth for FY26

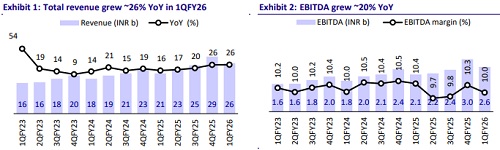

* KEI Industries (KEII)’s 1QFY26 revenue increased ~26% YoY to INR25.9b (~9% beat, fueled by higher-than-estimated revenue in C&W). EBITDA grew ~20% YoY to INR2.6b (~12% beat). However, OPM contracted 45bp YoY to 10.0% (+20bp vs. our estimate). PAT grew ~30% YoY to INR2.0b (~12% beat).

* Management indicated the demand outlook remains strong, led by power T&D, renewable energy, data center, and manufacturing sectors. KEII retains its FY26 growth guidance of ~18-19% and ~20% in next two to three years. This will be led by the completion of the Sanand expansion and KEII’s continued expansion strategy (bought land in Gujarat and Rajasthan for future expansions). KEII aims to achieve an OPM of ~11%, considering the strong order book of domestic institutional cables as well as export orders of cables/EH cables. Further, the completion of Sanand Phase I is likely to improve its margins.

* We raise our FY26/FY27E EPS by ~4%/3%, factoring in higher revenue growth in C&W. We also introduce our FY28 estimates with this note. We value KEII at 38x Jun’27E EPS (5% discount to POLYCAB’s, given the lower margins of KEII vs. POLYCAB) to arrive at our TP of INR4,200. Reiterate Neutral.

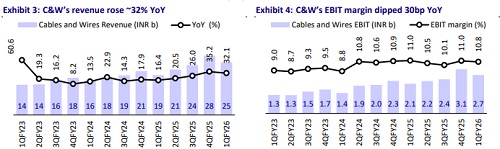

C&W revenue up 32% YoY; EBIT margin dips 30bp YoY to 10.8%

* KEII’s revenue/EBITDA/Adj. PAT stood at INR25.9b/INR2.6b/INR2.0b (+26%/ +20%/+30% YoY and +9%/+12%/+12% vs. our estimates) in 1QFY26. OPM contracted 45bp YoY to 10.0%. Depreciation spiked 28% YoY due to the completion of brownfield expansion in the Silvassa and Pathredi plants in 1HFY25, whereas interest costs inched up ~2% YoY. Other income jumped 122% YoY due to higher interest earned from the unutilized QIP money.

* Segmental highlights: 1) C&W revenue was up ~32% YoY to INR24.8b; EBIT rose ~29% YoY to INR2.7b, while EBIT margin dipped 30bp YoY to 10.8%; 2) EPC business revenue declined ~56% YoY to INR994m; EBIT declined ~73% YoY to INR79m, and EBIT margin contracted 5.2pp YoY to 8.0%; 3) Stainless Steel Wires (SSW) revenue declined ~3% YoY to INR521m; EBIT jumped 312% YoY to INR42m, and EBIT margin surged 6.2pp YoY to 8.1%.

Key highlights from the management commentary

* C&W volume growth was ~28-30% in 1QFY26. Cable institutional sales came in at 45% vs. 39% last year. Sales through the distribution network rose 22% YoY. B2C sales stood at 51% vs. 53% in 1QFY25.

* The pending order book stood at INR39.2b vs. INR38.4b in 4QFY25. The order book breakup is as follows: EPC (INR5.40b), EHV (INR5.38b), domestic cable (INR21.4b), and exports (INR7.03b).

* Export revenue increased 61% YoY to INR3.7b. The C&W export jumped 122% YoY to INR3.2b. The company is trying to raise its export share and has entered the US and European markets. KEII targets to increase its export share to 17-18% in the next two years.

Valuation and view

* KEII’s 1QFY26 earnings were above our estimates, led by strong revenue growth in the C&W segment. We estimate KEII to achieve its full-year revenue growth guidance of ~18-19% YoY for FY26, fueled by a strong demand outlook in the industry and its capacity expansion plans. We estimate KEII’s margin to gradually improve to ~11% by FY28.

* We estimate KEII’s total revenue CAGR at ~17% over FY25-28, driven by ~18% growth in the C&W segment and ~5% growth in the SSW segment. However, EPC’s revenue is projected to decline ~12% annually. We project its EBITDA and PAT to clock a CAGR of ~21% and 20% over FY25-28, respectively. We estimate the company to generate healthy cash flows, which should support its annual capex requirement of INR6-7b. We project KEII’s RoE/RoCE at ~15% (each), lower than its historical average of the last seven years, at 21%/19%.

* We value KEII at 38x Jun’27E EPS (5% discount to POLYCAB’s, given the lower margins of KEII vs. POLYCAB) to arrive at our TP of INR4,200. Reiterate Neutral.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412