Buy Adani Ports & SEZ Ltd for the Target Rs. 1,550 by Motilal Oswal Financial Services Ltd

Performance broadly in line; focus on becoming an integrated transport utility company

* Adani Ports & SEZ (APSEZ) reported a revenue growth of 23% YoY to INR85b in 4QFY25 (in-line). Cargo volumes grew 8% YoY to 118mmt. The growth was primarily led by containers. In FY25, APSEZ managed ~27% of the country’s total cargo and ~45% of container cargo.

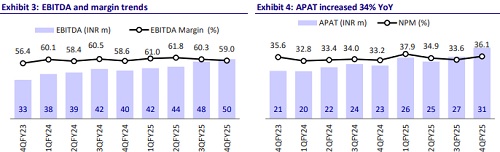

* EBITDA margin came in at 59% in 4QFY25 vs. our estimate of 63.6% (+30bp YoY, -130bp QoQ). EBITDA grew 24% YoY to INR50b (6% below our estimate), while APAT increased 34% YoY to INR31b (in line).

* During 4QFY25, port revenue grew 17% YoY to INR64.2b. Port EBITDA margin stood at 72% in 4Q (+200bp YoY)

* Logistics revenue grew 84% YoY to INR10.3b. EBITDA margins in the logistics business stood at 18% in 4Q FY25 (19% in 4Q FY24) ? During FY25, APSEZ’s revenue was INR305b (+14% YoY), EBITDA was INR184b (+16% YoY), EBITDA margin came in at 60.4%, and APAT stood at INR108b (+22% YoY).

* APSEZ’s 4QFY25/FY25 performance was broadly in line, and the company is projected to grow at 1.5-2.0x India’s cargo volume, propelled by market share gains and capacity expansion. Additionally, its logistics business will enhance last-mile connectivity, adding value to domestic port operations. We largely retain our estimates for FY26/FY27. We expect APSEZ to report 11% growth in cargo volumes over FY25-27. This would drive a CAGR of 15%/16%/21% in revenue/EBITDA/PAT over FY25-27E. We reiterate our BUY rating with a TP of INR1,550 (premised on 15x on FY27E EV/EBITDA).

In-line performance led by strong growth in container cargo; scale-up in the marine services business

* In 4QFY25, APSEZ reported a 17% YoY rise in port revenue to INR64.2b with a robust EBITDA margin of 72%. Containers comprised 42% of cargo volume in FY25 (up from 37% in FY24), boosting APSEZ’s all-India cargo and container market shares to 27% and 45.5%, respectively.

* Domestically, APSEZ expanded with the acquisition of Gopalpur Port and launched Vizhinjam Port, India’s first automated transshipment port. Internationally, operations began at Sri Lanka's CWIT, and key developments continued in Tanzania and Israel, including a 36% YoY EBITDA growth at Haifa Port.

* APSEZ’s marine business expanded its fleet to 115 vessels, with 46 more operated by Adani Harbor. The integration of its marine services subsidiaries—Ocean Sparkle, Astro, and TAHID—is progressing well, and the company aims to triple the business in two years. Global marine projects are further boosting revenue and operational efficiency.

Expansion of integrated logistics infrastructure and network

* In 4QFY25, Adani Logistics (ALL) posted ~84% YoY growth in revenue and an EBITDA margin of 18% (19% in 4QFY24).

* In FY25, APSEZ strengthened its integrated logistics network by launching its first block train and expanding its total rake count to 132. It now operates 12 multimodal logistics parks (MMLPs) and raised its warehousing capacity to 3.1m sq. ft.

* Agri silo capacity rose to 1.2MMT, with a target of 4MMT, while trucking volume surged over 200%, driven by growth in container and bulk transport.

Highlights from the management commentary

* In FY25, APSEZ achieved major milestones across port operations, logistics, and international expansion. It began operations at India’s first fully automated Vizhinjam Port, acquired Gopalpur Port, expanded internationally with terminals in Sri Lanka and Tanzania, and saw strong growth in marine and logistics services.

* Containers continued to dominate the cargo mix, making up 42% of total volume in FY25, an increase from 37% in FY24. This growth in container traffic reflects APSEZ’s continued investment in container handling infrastructure, which is expected to remain a key driver of growth.

* Management expects to handle 505–515 MMT of cargo in FY26, with containers being the primary growth driver, followed by dry cargo and liquid cargo.

* Revenue is projected to reach INR360-380b, while EBITDA is expected to be ~INR210-220b. Further, APSEZ has outlined a capex plan of INR120b for FY26. The bulk of this expenditure will be directed towards domestic ports (INR60b).

Valuation and view

* APSEZ expanded its domestic and global footprint with new ports, terminals, and logistics infrastructure in FY25 and guided further volume and revenue growth in FY26 backed by INR120b capex.

* We broadly maintain our estimates for FY26/27 and expect APSEZ to report 11% growth in cargo volumes over FY25-27. This would drive a revenue/ EBITDA/PAT CAGR of 15%/16%/21% over FY25-27E. We reiterate our BUY rating with a TP of INR1,550 (premised on 15x FY27 EV/EBITDA).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412