Buy MAS Financial Services Ltd for the Target Rs. 380 by Motilal Oswal Financial Services Ltd

Credit risks stabilize; improved momentum ahead

NIM stable QoQ; credit costs dip sequentially

* MASFIN’s 2QFY26 PAT grew ~17% YoY to INR897m (in line). Net total income rose 29% YoY to INR2.5b (in line), while opex was INR897m, rising ~42% YoY (in line). PPoP stood at INR1.6b (in line) and grew 23% YoY.

* Management indicated growth to pick up in 3QFY26, with quarterly growth expected to be ~5–7%, driven by an increase in the number of eligible borrowers, lower rejection rates, higher enquiry levels, and expansion in manpower to cover a broader geography.

* The rise in operating expenses was attributed to lower disbursements, higher rejection rates, interest spreads paid to fintech partners, and an increase in employee costs.

* Credit costs declined sequentially to ~INR371m (vs. est. of INR437m), translating into annualized credit costs of 1.2% (PQ: 1.4% and PY: 1.0%). Additionally, the asset quality is expected to improve going forward, driven by more prudent lending, reduced borrower leverage, and a higher share of direct lending, which is expected to improve to ~70–75% over the next 2–3 years.

* Management reiterated its AUM growth guidance of ~20-25%, with the organic retail business expected to outpace its NBFC partnership business. This will be driven by continued branch expansion and a strategic focus on the SME and Wheels business, which is expected to be its key growth driver. We estimate a ~21% PAT CAGR over FY25-28E, with RoA/RoE of ~2.9%/15.5% in FY28E. We reiterate our BUY rating with a TP of INR380 (based on 2x Sep’27E BV).

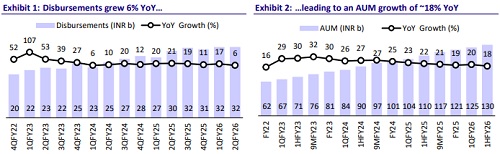

AUM grows ~18% YoY; focus on growing the organic retail segment

* Standalone AUM stood at ~INR130b and rose ~18% YoY/4% QoQ. Within this, AUM of Micro-enterprise/SME/2W/CV loans grew 10%/17%/30%/18% YoY. Salaried personal loans grew ~70% YoY to ~INR11.7b.

* About 35% of the underlying assets in the standalone AUM were through partner NBFCs. The MSME segment contributed ~60% to the incremental YoY growth in the AUM.

* Management targets to scale up to an AUM of ~INR1t over the next decade, targeting long-term growth of ~20–25%. The company aims to pursue stable and sustainable growth, maintaining a decade-long vision and consistent quarterly performance. We model AUM CAGR of ~19% over FY25-28E.

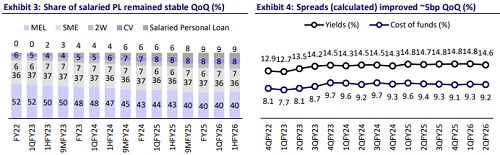

NIM remains stable QoQ; rate cuts to benefit in the next two quarters

* Yields (calc.) declined ~10bp QoQ to 14.75%, while CoF (calc.) declined ~15bp QoQ to 9.2%. This resulted in ~5bp QoQ expansion in spreads to ~5.6%. NIM (calc.) was stable QoQ at ~7.7%

* The company expects the impact of repo rate cuts to benefit its borrowers as well as the company in the next couple of quarters.

Asset quality broadly stable; credit costs dip sequentially

* Credit costs declined sequentially to ~INR371m (vs. est. of INR437m), translating into annualized credit costs of 1.2% (PQ: 1.4% and PY: 1.0%).

* GNPA (basis AUM) rose ~5bp QoQ to 2.5%, while NNPA rose ~5bp QoQ to 1.7%. PCR on Stage 3 assets rose ~10bp QoQ to ~41.3%.

* Management expects the higher proportion of organic distribution to further improve portfolio quality and 0 DPD to be in the ~92–95% range.

Other highlights

* The average ticket size of micro-enterprise loans rose to ~INR88k (PQ: ~INR66k), while SME loans declined to 2.6m (PQ: ~3.5m).

* RoTA was largely stable QoQ at ~2.85% in 2QFY26.

* MASFIN Insurance Broking Private Limited (a subsidiary of MASFIN) has been granted a Certificate of Registration from IRDAI to operate as a Direct Insurance Broker (Life & General).

* CRAR stood at ~24.6%, with Tier1 at ~22.7%.

HFC subsidiary

* MAS Housing reported AUM of ~INR8.2b, which grew ~24% YoY.

* GNPA/NNPA in the housing segment remained stable QoQ at 0.95%/0.65%.

* The company plans to list the housing finance subsidiary within 3–4 years once it reaches an AUM of INR40-50b.

Key highlights from the management commentary

* Management stated that the stress in the MSME segment was primarily due to lenders’ past indiscreet funding and borrower over-leveraging. However, it is now stabilizing due to prudent lending and better funding discipline.

* The company has exercised high caution in incremental funding, especially in tariff-sensitive sectors such as textiles, to mitigate risk.

Valuation and view

* MASFIN reported in-line earnings for 2QFY26, which resulted in AUM growth of ~18% YoY. Asset quality remained largely stable, while credit costs dipped sequentially. The company has a niche expertise in the SME segment, and its asset quality is perhaps the best among (M)SME lending peers.

* Going forward, the organic retail mix is expected to continue to improve, supporting further yield enhancement, margin expansion, and prudent risk management. Although operating expenses will remain elevated due to sustained investments in distribution and technology, it will still be able to deliver healthy return ratios.

* We model a CAGR of 19%/21% standalone AUM/PAT over FY25-FY28E, with RoA/RoE of 2.9%/15.5% in FY28E. The company has maintained high earnings quality, backed by its risk-calibrated AUM growth in a stressed MSME environment. Reiterate BUY with a TP of INR380 (premised on 2x Sep’27E BV). Key risk: Slowdown in the economic environment leading to sluggish loan growth and deterioration in asset quality.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)