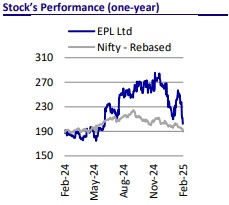

Buy EPL Ltd For Target Rs.270 by Motilal Oswal Financial Services Ltd

Indorama joins as strategic investor; Blackstone trims stake

EPL Limited (EPLL) is set to enter a new phase, with Indorama Ventures Limited (IVL) acquiring a 24.9% stake from Blackstone for INR1.9b (USD221m). While this transaction reduces Blackstone’s ownership to 26.55%, it remains EPLL’s largest shareholder, reaffirming its long-term commitment.

* IVL will secure a board seat and bring strategic advantages, including global expertise in PET production and recycling, along with access to an extensive market network.

* This partnership is expected to drive geographical expansion, operational efficiencies, and sustainability initiatives, strengthening EPLL’s market position.

* IVL’s expertise in advanced materials and sustainable packaging aligns well with EPLL’s growth strategy, particularly in high-margin segments like beauty and personal care.

* With strong financial fundamentals and synergies from this collaboration, EPLL is well-positioned for accelerated growth. We remain optimistic about its prospects and reiterate our positive outlook, valuing the stock at 16x FY27E EPS with a TP of INR270.

Blackstone trims stake; IVL joins EPLL board

* IVL is set to acquire a 24.9% stake in EPLL from Blackstone for INR1.9b (USD221m) at a price of INR240 per share. This transaction will reduce Blackstone’s ownership from 51.45% to 26.55%, but it will continue to be the largest shareholder and promoter, reaffirming its long-term confidence in EPLL. The transaction is expected to be completed in the next three months.

* Since the acquired stake remains below the 25% threshold, no open offer is triggered under regulatory norms.

* As part of the agreement, IVL will secure one board seat, increasing the total number of directors to nine. Of these, four seats will remain with Blackstone, ensuring strategic alignment while allowing IVL to contribute to EPLL’s growth.

* EPLL’s day-to-day operations remain unchanged, with the current leadership team continuing to drive its business forward. The partnership with IVL is expected to strengthen EPLL’s market position, leveraging IVL’s global expertise to accelerate growth and innovation in the packaging and sustainable materials industry.

IVL: One of the world’s leading PET producers & recyclers

* Originally incorporated as Beacon Global Limited in 1994, the company rebranded to Indorama Ventures Public Company Limited in 2009 and is headquartered in Bangkok, Thailand.

* Backed by Indorama Resources Ltd., it has built a strong global presence with 117 manufacturing facilities across 31 countries, making it a dominant player in the industry.

* IVL is a global leader in petrochemicals and sustainable packaging, with operations spanning Thailand and markets worldwide.

* It operates across three key business segments: Combined PET, Integrated Oxides & Derivatives, and Fibers, catering to industries like home care, automotive, medical, and industrial applications.

* As the world’s largest PET producer and recycler, it leads in surfactants and fabric ingredients in the U.S. and is ASEAN’s top PET staple fiber manufacturer, reinforcing its strong market position.

* With USD15b in annual revenue, USD1.5b EBITDA (2024), and USD2.1b liquidity, the company maintains a solid financial position to drive long-term growth.

Unlocking new markets and growth opportunities for EPLL

* Geographical synergies: IVL’s strong presence in Southeast Asia and Africa perfectly complements EPLL’s footprint across India, China, Europe, and the Americas, creating opportunities to accelerate geographic expansion. This will help EPLL establish a stronger foothold in markets like Thailand and Africa (not currently served but represent a large market for EPLL), with IVL’s on-ground expertise being particularly beneficial.

* Operational synergies between the two companies will enhance raw material sourcing, procurement efficiencies, and cost competitiveness. IVL’s expertise in advanced materials and packaging will provide EPLL with access to high-quality materials and supply chain advantages, further strengthening its market position.

* Sustainability synergies: With IVL leading in recycling and eco-friendly materials, EPLL gains a strong partner to drive sustainability initiatives. This collaboration will support EPLL in transitioning to next-generation packaging solutions, reinforcing its commitment to responsible growth and industry leadership.

* Segment penetration: Customer cross-pollination presents a significant growth opportunity, as IVL’s global clientele in pharmaceuticals, cosmetics, and personal care aligns well with EPLL’s expansion strategy. With EPLL’s focus on the high-margin beauty and personal care segments, IVL’s strong industry presence can help garner new customers, improve product offerings, and accelerate growth in this lucrative space.

Valuation and view

* We expect EPLL to report healthy sales growth coupled with margin expansion, led by cost rationalization measures, margin expansion in Brazil, and operating leverage, thereby boosting its earnings.

* We expect a revenue/EBITDA/adjusted PAT CAGR of 9%/14%/25% over FY25- 27. We value the stock at 16x FY27E EPS to arrive at our TP of INR270. Reiterate BUY

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412