Buy UTI AMC Ltd for the Target Rs. 1,700 by Motilal Oswal Financial Services Ltd

PAT below est. due to a one-off; VRS to impact 2HFY26 PAT

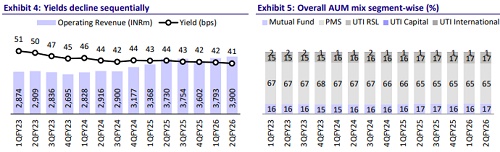

* UTI AMC’s 2QFY26 operating revenue came in at INR 3.9b (in-line), reflecting growth of 5% YoY/3% QoQ. Yield on management fees came in at 41.2bp in 2QFY26 vs. 43.6bp in 2QFY25 (42bp in 1QFY26). For 1HFY26, operating revenue grew 8% YoY to INR7.7b.

* Total opex came in at INR2.4b, registering a growth of 27% YoY (14% above estimates), driven by 38% YoY growth in employee expenses. EBITDA stood at INR1.5b (17% miss) in 2QFY26 (-19% YoY/-14% QoQ), while EBITDA margin was 38.1% in 2QFY26 vs. 49% in 2QFY25.

* A one-time impact on employee expenses and a 55% miss in other income resulted in a 27% miss on PAT, which stood at INR1.3b in 2QFY26 (-50% YoY), and core PAT at INR1.1b. Excluding the one-time impact, core PAT was at INR1.3b. For 1HFY26, PAT declined 28% YoY to INR3.9b.

* Assuming 50% adoption for the VRS scheme, we expect FY26 employee costs to rise 47% YoY and then dip 28% YoY in FY27. Conversely, the assumption on the tax rate has increased from 23% earlier to 26% and 27% in FY26 and FY27, respectively.

* Considering a gradual improvement in the flow momentum and adjusting for VRS as well as higher taxation, we expect UTI AMC to report a CAGR of 26%/20%/27% in AUM/revenue/core PAT over FY25-28. Reiterate BUY with a one-year TP of INR1,700 (based on 30x core Sep’27E EPS).

MF yields continue to dip

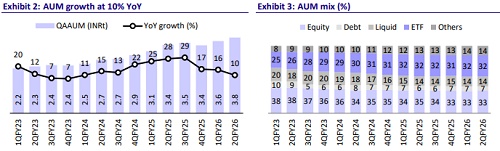

* Total MF QAAUM grew 10% YoY/ 5% QoQ to INR3.8t. Equity/ETFs/Index/ Debt funds saw a YoY growth of 1%/9%/22%/21% for the quarter.

* Equity QAAUM contributed 26% to the mix in 2QFY26 vs. 29% in 2QFY25. The debt/liquid schemes contributed 7%/14% to the mix in 1QFY26 (6%/14% in 2QFY25), while hybrid schemes contributed 7% to the mix (6% in 2QFY25). ETFs contributed 32% to the mix (32.5% in 2QFY25).

* The MF segment yield dipped to 33bp (35bp in 2QFY25), as the contribution in equity declined. Going forward, the same is expected to improve, backed by improving fund performance of equity schemes and a higher equity SIP book, driving the equity AUM contribution upwards.

* Overall net inflows for UTI were INR57b vs. INR35b in 2QFY25 and INR99b in 1QFY26. Equity/ETFs & Index/Liquid schemes garnered inflows of INR5b/ INR49b/INR24b while income schemes witnessed outflows of INR21b.

* Gross inflows mobilized through SIPs stood at INR23.4b in 2QFY26, with the SIP AUM increasing to INR422.7b (+6% YoY). Live folios increased slightly to 13.6m as of the end of Sep’25.

* The overall MF AAUM market share declined to 4.9% from 5.2% in Sep’24. UTI AMC’s market share in Passive/NPS AUM was stable at 13%/25%. The market share in Equity/Hybrid/Cash & Arbitrage/Debt Funds stood at 3%/ 4%/4%/3% in Sep’25.

* The distribution mix in QAAUM remained largely stable in 2Q, with the direct channel dominating the mix with a 69% share, followed by MFDs at 23% and BND at 7%. However, with respect to equity AUM, MFDs contributed 56% to the distribution mix.

* As bp of QAAUM, the cost increased YoY to 25.5bp in 2QFY26 (vs. 22.2bp in 2QFY25), and the cost-to-income ratio increased to 62% (from 51% in 2QFY25). This was mainly driven by 38% YoY growth in employee expenses to INR1.6b (22% higher than estimates) and 10% YoY growth in other expenses to INR817m (in line).

* Other income at INR314m (55% miss) witnessed a decline of 81% YoY. Total investments as of Sep’25 dipped sequentially to INR38.6b (INR43.3b in 1QFY26), with 68%/17%/9%/7% being segregated into MFs/Offshore/Venture Funds/GSec/Bonds.

* The number of digital transactions during the quarter grew 18% YoY to 5.3m, while online gross sales were at ~90%.

Yields improve in the UTI International and UTI Capital segments

* Total Group AUM stood at INR22.4t, up 11% YoY, of which MF AUM stood at INR3.8t, up 10% YoY. Non-MF AUM grew 11% YoY to INR18.6t, with PMS AUM growing 11% YoY to INR14.5t, and UTI Pension AUM growing 16% YoY to INR3.9t. UTI International/ UTI Capital AUM declined 7%/21% YoY to INR28b/INR236b.

* Yields on PMS/Pension businesses largely remained stable YoY, while yields improved YoY for International/Capital businesses to 58bp/75bp.

Key takeaways from the management commentary

* The Board has approved the appointment of Vetri Subramaniam (currently CIO, associated since 2017) as the MD & CEO effective 1st Feb’26. The current CEO will transition to an advisor role until 12th Jun’26 to ensure a seamless handover.

* Steady growth was witnessed in both liquid and non-liquid categories. Valueoriented schemes have delivered strong three-year and five-year performances, while growth-oriented schemes have improved over the past year.

* SIF has been identified as a potential differentiator. However, distribution remains a challenge due to certification requirements for partners. The company is building in-house certified teams and a dedicated SIF branch to prepare for launch, and will time the launch once distribution architecture and market understanding mature.

VRS to hit FY26 earnings

* UTI AMC is implementing a VRS scheme for its employees, and of its 1,400 employees, ~476 are eligible for the same. The average payout for each employee is ~INR6.5m, while the average salary for the eligible employees is INR3m.

* We assume a 50% adoption, and accordingly, the gross hit for 3QFY26 would be INR1,547m. Assuming that the exits happen in the middle of the quarter, the salary cost savings for these employees would be INR89m, while from 4QFY26, the benefit would be INR178m per quarter (highlighted in Exhibit 1).

* Further, the company has guided for an increase in the tax rate, as the amortization of the VRS costs has to be over a period of five years for tax computation. For FY26, we are assuming 26%, and for FY27, we are assuming a 27% tax rate. Resultantly, our earnings for FY26 are being cut by 20%, while FY27/FY28 estimates broadly remain unchanged as a higher tax rate is offset by employee cost savings.

Valuation and view:

* UTI AMC continues to deliver a steady and broad-based performance across its mutual fund, pension, and international businesses. The core AMC operations have seen consistent growth in AUM, supported by a diversified product mix with a strong tilt toward equity, healthy SIP inflows, and robust retail traction.

* Going forward, improving the performance of equity schemes will be key for a rise in contributions from equity schemes, resulting in yield improvement. While earnings of FY26 will be impacted by VRS implementation and a higher tax rate, the same will result in cost savings from FY27 onwards on the employee expense front.

* Considering gradual improvement in flow momentum and adjusting for VRS as well as higher taxation, we expect UTI to report a CAGR of 26%/20%/27% in AUM/revenue/core PAT over FY25-28E. We reiterate our BUY rating with a one-year TP of INR1,700 (based on 30x core Sep’27E EPS)

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412