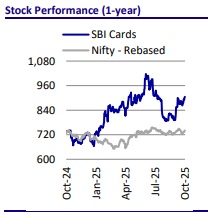

Neutral SBI Cards Ltd for the Target Rs. 950 by Motilal Oswal Financial Services Ltd

Spends growth recovering; Asset quality to improve gradually

NIMs to expand at a calibrated pace

* SBI Cards (SBICARD) is the second-largest player in the card segment in terms of cards-in-force (CIF), with a 19.1% market share in CIF and 16.6% share in total industry spends.

* The company’s market share in spends has moderated over the past few years, mainly because of the decline in corporate spends. We expect corporate and retail spends to incrementally grow at a healthy pace aided by pickup in economic activities and consumption boost from recent GST cuts. We estimate spends to growth at ~18% CAGR over FY25-28E.

* The robust festive spends in 2Q (mainly towards end of Sep) will affect the pace of NIM expansion even as the borrowing cost continues to moderate. This is largely due to stronger balance sheet growth aided by the festive spends.

* However, with ease in funding cost and potential of further rate cuts by the RBI we expect margins to improve further in 2H to 11.9% by FY27E thus driving healthy 16% NII cagr over FY25-28E.

* SBICARD’s credit cost is expected to remain elevated at ~8.5% in FY26E, with 2Q credit cost expected at >9% (9.6% in 1QFY26) while we expect some improvement over 2H. Sustained improvement in credit cost alongside a pick-up in revolve rate is critical for stock performance.

* Maintain Neutral with a TP of INR950 (24x FY27E

Spends to clock 18% CAGR over FY25-28E, aided by recovery in corporate segmen

SBICARD delivered strong spend momentum in FY25-1QFY26, with overall spends up 21% YoY in 1QFY26, supported by steady retail growth of 15% YoY and a revival in corporate spends. While corporate spends had moderated through FY24, trends have improved meaningfully, aided by high diversification of use cases and recovery in travel and entertainment categories.

* The share of corporate spends in total has improved to ~12% in 1QFY26 (vs. ~7% in FY24), and management expects a further uptick as discretionary categories and festive demand pick up. This should also help to balance the spend mix going forward.

* Its market share in spends rose to 16.6% in 1QFY26 (vs. 15.9% a year ago), reflecting SBICARD’s strong positioning across retail categories, steady traction in PoS and online, and increased engagement through co-brand launches.

* We build in an ~18% CAGR in spends over FY25-28E, driven by healthy retail momentum and improving traction in corporate spends as demand normalizes.

? SBICARD continues to hold a dominant position in RuPay credit cards, with growing usage on UPI. UPI spends rose ~20% QoQ in 1QFY26, with higher adoption in Tier-2/3 cities (79% of UPI spend share), underpinning the longterm retail growth opportunity.

Funding cost to ease, expect NIMs to undergo a calibrated expansion

SBICARD has begun to see an easing in its funding costs, with CoF declining to 7.1% in 1QFY26 (vs. 7.3% in 4QFY25) as the impact of repo rate cuts started to filter in. With 2Q usually witnessing heavy spending amid festive seasons, we expect limited improvement of ~10bp in NIMs in 2Q. With further CoF moderation and stable yields and increasing possibility of further repo-rate cut, NIMs are expected to see a positive trajectory in FY26 and recover to 11.9% by FY27E. We estimate healthy 16% CAGR in NII over FY25-28E, aided by lower funding costs and steady growth in receivables.

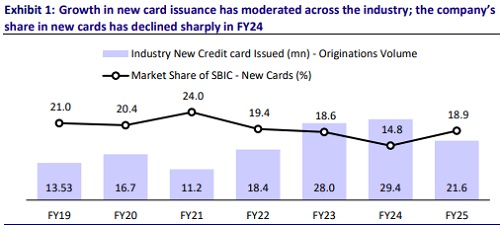

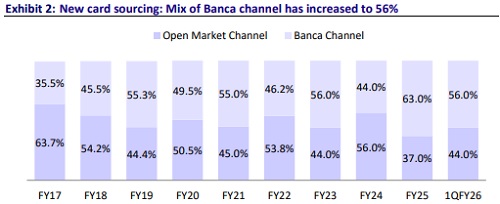

Card issuance slows; sourcing mix balanced with banca strength

SBICARD added 8.7 lakh new accounts in 1QFY26, down from the peak levels seen last year, as the company remains selective in new acquisitions amid a more cautious industry stance with sourcing mix tilted in favour of banca channel (~56%). Unlike the earlier trend where open market share had risen sharply, the banca channel continues to hold a steady majority share, which will help maintain portfolio quality. With tighter underwriting and decline in early delinquency flows we expect credit cost to ease gradually from elevated levels that prevails currently, partly due to ECL model refresh. We expect card sourcing to gain traction as asset quality trends start to stabilize and spends growth gain further traction during the festive season.

Credit cost to stay elevated in near term; gradual improvement ahead

SBICARD’s gross credit cost rose to 9.6% in 1QFY26 from 9.0% in 4QFY25, led by the annual ECL model refresh and higher provisioning, even as early delinquency flows remain at record lows. We expect near term credit cost to remain elevated before easing gradually over the medium term. Stage-2 balances have already declined sequentially, reflecting the benefit of tighter underwriting and portfolio actions. While industry-wide leverage in unsecured lending remains a risk, SBICARD’s prudent sourcing and improving recovery trends should support moderation in credit costs from FY27 onward. For FY26, we estimate ~9% average credit cost, with same recovering to 7.4-7.7% over FY27-28E.

Tier-1 remains strong; internal accruals adequate to fund growth

SBICARD’s capital position remains comfortable, with CAR at 23.2% and Tier-1 at 17.9% as of 1QFY26, aided by healthy profitability and moderation in receivable growth. The recent increase in unsecured risk weights has had a limited impact, as the company has slowed card additions selectively and maintained prudent growth in receivables (~7% YoY in 1QFY26). Management has indicated that internal accruals remain sufficient to fund growth without the need for fresh capital infusion. With receivable growth expected at ~10-12% in FY26 and further pickup likely during the festive season, Tier-1 levels are likely to remain stable, providing an adequate buffer to support medium-term business expansion.

Valuation and view: Maintain Neutral with TP of INR950

SBICARD is the second-largest player in the card industry with 19.1% share in CIF and 16.6% share in total industry spends. However, its market share in spends has declined over the past few years, mainly due to the moderation in corporate spends. Growth in retail spend has though remained healthy.

SBICARD has been the beneficiary of rate cuts, as its CoF has declined by 30bp during the latest repo cuts, while further benefits are yet to be realized. With high prospects of additional rate cuts, SBICARD can see a further reduction in CoF.

* We anticipate the near-term credit cost to stay elevated, although an easing in credit cost and tailwinds in margins should lead to an improvement in return ratios. Thus, we build in an improvement in RoA toward 3.8% in FY26E, 4.6% in FY27E and 4.8% in FY28E.

* With some pickup in economic activity from the current levels, we expect the tailwinds to flow into better spends and loan growth. Thus, we expect spends to clock 18% CAGR over FY25-28E and loans to see ~15% CAGR over the similar period. We maintain our Neutral rating on the stock with a TP of INR950 (24x FY27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)