Buy Metro Brands Ltd for the Target Rs. 1,400 by Motilal Oswal Financial Services Ltd

Doubling down on the S&A portfolio through MetroActiv

* Metro Brands (MBL) has delivered double-digit growth on average over the past four quarters, continuing its outperformance over the listed footwear peers.

* The company also ramped up store additions in 2Q, along with scaling up the recent partnerships with Clarks (presence in 200 MBOs) and Foot Locker (opened four EBOs) to sustain the double-digit growth trajectory.

* MBL is now doubling down on scaling up its presence in the fast-growing sports & athleisure (S&A) segment through the launch of a new in-house format, MetroActiv, focused on providing sports performance products from leading global brands under one roof.

* We view this as a positive portfolio evolution, expanding MBL’s TAM and positioning the brand to participate more meaningfully in the fastgrowing S&A segment in tier 1 and tier 2 towns in India.

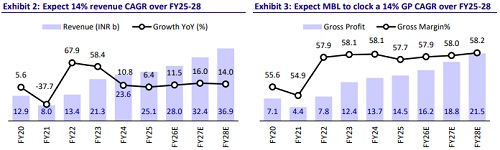

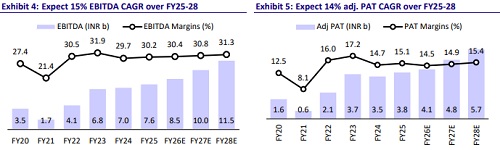

* Given the strong runway for growth in the Metro, Mochi, and Walkway formats, along with significant growth opportunities in FILA/Foot Locker/Clarks, we build in a revenue/EBITDA/PAT CAGR of 14%/15%/14% over FY25-28E.

* We reiterate our BUY rating on MBL with a TP of INR1,400, premised on ~70x Dec’27 P/E.

Launched MetroActiv to tap into the performance S&A segment

* MBL launches a new banner, MetroActiv, a multi-brand retail format focused on the sports performance segment, marking a deeper push into the fast-growing S&A segment.

* MetroActiv brings together leading global performance brands such as Nike, Adidas, Puma, Skechers, Asics, etc., across footwear, apparel, and accessories under the same roof.

* MetroActiv will be rolled out in Indore, Dehradun, and Jodhpur in the first phase, with stores spanning ~3-6k sqft, larger than Metro/Mochi formats (~1.5k sqft) but below Foot Locker scale (~6-8k sqft).

* The company aims to deliver superior retail expansion through a trained team of performance advisors, ‘Pacers’, to provide fitness expertise and product guidance.

* Further, the company would collaborate with local running clubs, fitness groups, and sports enthusiasts to drive discovery and engagement.

* MBL will also launch the e-commerce platform metroactiv.com to complement the physical stores and will integrate wellness tools such as calorie counter, nutrition tracker, and BMI calculator, with a view to providing a holistic active lifestyle ecosystem.

* We view this as a positive portfolio evolution, expanding MBL’s TAM and positioning the brand to participate more meaningfully in the fastgrowing S&A segment.

* CEO Nissan Joseph highlighted MetroActiv as the natural evolution of Metro’s strategy, positioning it at the intersection of fitness, fashion, and functionality. The initiative aims to democratize performance retail and build a broader lifestyle movement centered on active living in India.

Doubling down on S&A with multiple banners spanning price points

* S&A remains the strongest structural growth driver in Indian footwear, compounding at ~19% over FY16–25 vs. ~12% for the industry, supported by fitness adoption, lifestyle usage, premiumization, and higher ASPs driving superior margins.

* MBL is addressing its historical whitespace in the S&A portfolio through the acquisition of strategic licenses for FILA and Foot Locker (high-end sneakers).

* Execution is now gaining momentum after BIS-led delays, with MBL adopting a calibrated rollout strategy, testing formats and store sizes to refine the right playbook. MBL opened four Foot Locker stores in 2Q and plans to scale FILA EBOs from 2HFY26.

* With the launch of MetroActiv, MBL will have an in-house banner catering to the sports performance segment, while Foot Locker will attract sneaker heads through its exclusive ranges.

* Initially, MetroActiv would primarily target Tier 1 and Tier 2 cities (vs. focusing on metros in the case of Foot Locker). The selling price is likely to be in the INR3- 8k range (vs. 6k+ starting price points in the case of Foot Locker).

* While the target customer is different, we believe MetroActiv could serve as a strategic test bed to evaluate the potential of the Foot Locker format beyond top metros, enabling Metro to strengthen its footprint in S&A through a controlled, in-house play.

Valuation and view

* Concerns around Fila's liquidation and BIS-related challenges are now well behind the company, and MBL's strategic focus is on ramping up Foot Locker and FILA, as well as scaling up the recent addition, Clarks.

* We remain positive on MBL’s long-term outlook, given a) its superior store economics, with industry-leading store productivity and strong cost controls, and b) a long runway for growth, largely funded through internal accruals.

* Given the strong runway for growth in the Metro, Mochi, and Walkway formats, along with significant growth opportunities in FILA/Foot Locker/Clarks, we build in revenue/EBITDA/PAT CAGR of 14%/15%/14% over FY25-28E.

* We reiterate our BUY rating on MBL with a TP of INR1,400, premised on ~70x Dec’27 P/E. Consistent double-digit growth and ramp-up of newer formats, such as FILA, Foot Locker, MetroActiv, and Clarks, remain the key re-rating triggers for the stock.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)