Buy JSW Infrastructure Ltd for the Target Rs.380 by Motilal Oswal Financial Services Ltd

In-line quarter; project expansion underway, aided by a strong balance sheet

Outlook remains bright

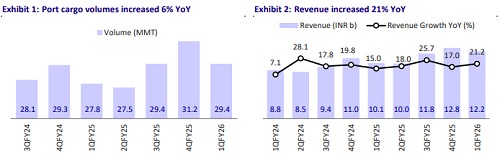

* JSW Infrastructure (JSWINFRA)’s consolidated revenue grew 21% YoY to INR12.2b (in line). During 1QFY26, the company handled cargo volumes of 29.4m tons (+6% YoY). Growth was driven by strong coal handling at Ennore, PNP, and Paradip, along with solid performance at South West and Dharamtar Ports. Interim operations at Tuticorin and JNPA terminals also aided volumes, though lower iron ore volumes at Paradip partially offset the gains.

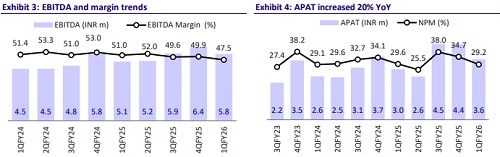

* EBITDA grew 13% YoY to INR5.8b. EBITDA margins stood at 47.5% (our estimate was 50.4%). The margins were lower by ~350bp YoY and ~250bp QoQ. APAT grew ~20% YoY to INR3.6b (in-line).

* JSWINFRA reported steady growth in 1QFY26, supported by improving thirdparty cargo share and solid logistics growth through Navkar. The company is executing multiple expansion projects across ports and logistics, with INR55b capex planned in FY26. Backed by a strong balance sheet and rising cargo diversity, JSWINFRA aims to scale port capacity to 400MTPA and logistics revenue to INR80b by FY30, positioning it well for long-term growth. We broadly retain our FY26 and FY27 estimates. We estimate a volume/revenue/EBITDA/APAT CAGR of 13%/22%/23%/18% over FY25-27. Reiterate BUY with a TP of INR380 (premised on 23x FY27 EV/EBITDA).

Cargo volumes up 6% YoY, driven by third-party cargo; strong balance sheet to support capex in the ports and logistics business

* JSWINFRA posted healthy cargo volumes of 29.4MT in 1QFY26, up 5% YoY, led by robust performance at Ennore, PNP, Paradip, South West Port, and Dharamtar, along with interim operations at the Tuticorin and JNPA terminals.

* The port business contributed INR10.8b in revenue (+8% YoY), while the logistics segment recorded INR1.4b. Third-party cargo volumes grew 8% YoY, improving their contribution to 52% in 1Q FY26 (vs. 50% in 1Q FY25), reflecting ongoing customer diversification efforts.

* JSW Steel’s plant maintenance shutdown at the Dolvi unit impacted cargo volumes for JSWINFRA during the quarter.

* Navkar delivered strong growth, with EXIM container volumes rising 31% YoY and domestic cargo growing 11% YoY.

* The company maintains a healthy balance sheet with net debt at INR12.5b and cash and equivalents of INR43.6b as of Jun’25, supporting its expansive capex program.

Highlights from the management commentary

* JSWINFRA is aggressively scaling its logistics footprint through an asset-light model, targeting pan-India multimodal integration. The logistics segment is likely to generate INR7–8b in revenue and ~INR1b in EBITDA in FY26, aided by synergies from Navkar and operational ramp-up of the recently added infrastructure.

* For FY26, management expects a minimum of 10% growth in port volumes despite the slow growth in 1QFY26.

* JSWINFRA is executing multiple brownfield and greenfield expansion projects, including the Tuticorin (7MTPA) and JNPA Liquid Terminal (4.5MTPA), with completion timelines over FY26–27. Strategic capacity upgrades are ongoing at Mangalore, South West Port, Dharamtar, and Jaigarh, with a combined expansion of over 40MTPA. Landmark greenfield projects such as the Keni Port (30MTPA), Jatadhar Port (30MTPA), and a 302km slurry pipeline in Odisha are progressing well, all scheduled for commissioning by FY28–30.

* Execution continues to be on track across major port and logistics infrastructure projects, with recent wins such as the Netaji Subhas Dock concession (Kolkata) and LoI for NCR Rail Infra in Khurja further strengthening its multimodal logistics play. The total planned capex stands at INR55b for FY26 (INR40b for ports and INR15b for logistics).

Valuation and view

* Management reiterated its FY26 cargo volume growth guidance of 10%, expecting stronger traction in 2HFY26. Long-term vision includes expanding port capacity to 400MTPA by FY30 and building a logistics platform delivering INR80b in revenue and a 25% EBITDA margin. Backed by aggressive yet disciplined capex, customer diversification, and multimodal infrastructure expansion, JSWINFRA remains well-positioned for structural growth across India’s maritime and logistics value chain.

* We expect JSWINFRA to strengthen its market dominance, leading to a 13% volume CAGR over FY25-27. This, along with a sharp rise in logistics revenues, is expected to drive a 22% CAGR in revenue and a 23% CAGR in EBITDA over the same period. We reiterate our BUY rating on the stock with a TP of INR380 (based on 23x FY27 EV/EBITDA).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412