Buy Tata Steel Ltd for the Target Rs. 210 by Motilal Oswal Financial Services Ltd

Slightly better-than-estimated 2Q; Europe remains EBITDA positive

Standalone performance broadly in line

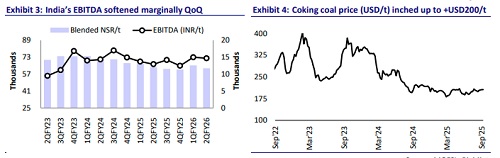

* Tata Steel (TATA)’s revenue was in line at INR347b (+7% YoY and 12% QoQ). The increase was aided by a rise in domestic deliveries, which was partly offset by a drop in realizations.

* Steel production stood at 5.4mt (+7% YoY and QoQ), whereas deliveries were in line with our estimates at 5.55mt, up 9% YoY and 17% QoQ. This was largely attributed to the capacity ramp-up at Kalinganagar and the completion of the relining of the G-blast furnace.

* ASP remained subdued at INR62,486/t in 2QFY26, declining 1% YoY and 4% QoQ, led by price corrections during the quarter due to monsoons.

* TATA’s EBITDA stood at INR81.5b (+23% YoY and +14% QoQ) and was slightly above our estimate of INR75.4b. This translated into an EBITDA/t of INR14,681/t (vs. our estimate of INR13,733/t) in 2QFY26.

* APAT for the quarter stood at INR44.6b (+25% YoY and +19% QoQ) vs. our estimate of INR38b, supported by better operating profit.

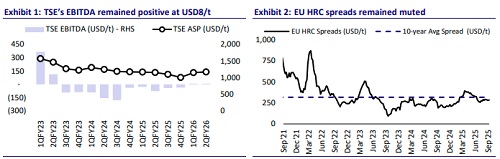

European operations remain EBITDA positive

* Consolidated steel deliveries stood at 2.1mt (-1% YoY and flat QoQ), in line with our estimate during the quarter.

* Revenue stood at INR216b (+5% YoY and +4% QoQ) during the quarter.

* TATA’s EBITDA continued to be positive during the quarter at INR1.5b (in line), vs. an operating loss of INR13.4b in 2QFY25.

* EBITDA/t stood at USD8/t (flat QoQ) in 2QFY26 vs. an EBITDA/t loss of USD75/t in 2QFY25.

Consolidated performance: PAT slightly better than our estimate

* TATA’s revenue stood at INR587b (+9% YoY and +10% QoQ) and was in line with our estimate. Sales volume stood at 7.91mt (+5% YoY and +11% QoQ), which was offset by a muted ASP of INR74,196/t (+4% YoY and flat QoQ) in 2QFY26.

* Adjusted EBITDA stood at INR89b (+61% YoY and +20% QoQ), in line with our estimate of INR85.3b, translating to an EBITDA/t of INR11,247 (vs. our est. INR10,548/t) in 2QFY26.

* APAT for the quarter stood at INR32.7b (6.2x YoY and +53% QoQ) against our estimate of INR28b.

* Net debt stood at INR870b as of 2QFY26, which included cash of INR86b. This translated into a net debt/EBITDA of 2.97x as of Sep’25.

Key highlights from the management commentary

* In India, average HRC prices fell INR2,300/t QoQ, while TATA’s NSR declined by INR1,700/t led by a better product mix. For 3QFY26, management guided the India business realizations to decline by INR1,500/t QoQ.

* Management expects the Netherlands NSR to decline by EUR30/t in 3Q and expects a stronger recovery from 4QFY26 onwards.

* The UK prices are expected to remain largely flat in 3QFY26, but management expressed concern about the current low price levels, which are unsustainable.

* Consumption costs for coking coal are likely to increase USD6/t QoQ in 3Q on account of rising coking coal prices globally, while the coking coal consumption costs in the Netherlands are expected to fall by EUR5-10/t in 3QFY26 over consuming lower cost inventory.

Valuation and view: Long-term outlook remains strong

* Overall, TATA posted a decent performance in 2QFY26, primarily driven by strong operating profits at the India business and EBITDA improvement in Europe. The Indian business continues to post a healthy performance as anticipated, fueled by healthy volume supported by capacity ramp-up at Kalinganagar and relining of the g-blast furnace. These offset the muted NSR caused by seasonal weakness.

* EBITDA improvement in Europe operations is expected to continue steadily in the coming quarters on account of its cost-restructuring measures. The capacity ramp-up in the Netherlands and lower fixed costs should also support the overall EBITDA performance going forward.

* Though there are near-term uncertainties related to price volatility due to trade tensions and the recent correction in steel prices, the long-term outlook remains strong for TATA. We largely maintain our earnings estimates. At CMP, TATA is trading at 6.8x FY27E EV/EBITDA and 1.9x FY27E P/B. We reiterate our BUY rating with an SOTP-based TP of INR210 per share on Sep’27E.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412