Buy Signature Global Ltd for the Target Rs. 1,383 by Motilal Oswal Financial Services Ltd

Robust 2H launch pipeline; collection pace a key monitorable

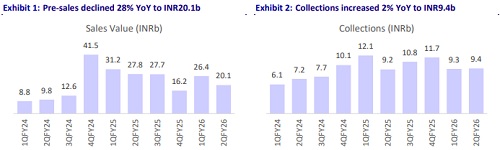

* Signature Global (SIGNATUR) recorded presales of INR20.1b, down 28% YoY and 24% QoQ (in line). This was attributed to the absence of any material launches during the quarter. In 1HFY26, presales stood at INR46.5b, down 21% YoY.

* Area sold during the quarter stood at 1.3msf, down 44% YoY and 17% QoQ (9% above our estimates). In 1HFY26, volumes were 3msf, down 33% YoY.

* Average sales realization stood at INR15,000/sqft, up 28% YoY and down 8% QoQ (8% below our est.). In 1HFY26, realizations stood at INR15,710/sqft, up 17% YoY.

* Total units sold during the quarter were ~573, down 46% YoY and 26% QoQ. In 1HFY26, units sold were 1,351, down 33% YoY.

* Collections stood at INR9.4b, up 2% YoY and 1% QoQ (8% below estimates). In 1HFY26, they stood at INR18.7b, down 12% YoY.

* In 2QFY26, the company acquired 33.47 acres of land with a development potential of 1.76msf. In 1HFY26, the company acquired a total land of 2.3msf.

* Net debt increased to INR9.7b in 2QFY26 from INR8.9b in 1QFY26.

* Its project pipeline remains strong, comprising 17.1msf of recently launched projects, 24.3msf of upcoming developments, and 8.9msf under ongoing construction, all scheduled for execution over the next 2-3 years.

* P&L performance: In 2QFY26, the company reported revenue of INR3.4b, down 55%/61% YoY/QoQ (61% below estimate). In 1HFY26, revenue stood at INR12b, up 5% YoY.

* EBITDA loss stood at INR743m vs a loss of INR116m YoY. In 1HFY26, EBITDA loss stood at INR410m vs a loss of INR128m YoY.

* Adj. PAT loss in 2QFY26 stood at INR469m vs a profit of INR41m YoY. In 1HFY26, PAT loss stood at INR124m vs a profit of INR109m YoY.

Key highlights from the management commentary

* The company remains focused on middle-income and premium housing, supported by steady demand across Dwarka Expressway, SPR, and Sohna, which continue to attract high-net-worth and premium buyers.

* Achieved presales of INR47b in 1HFY26, selling 3 msf at INR15,700/sqft with 1,338 units averaging INR35m each; confident of reaching INR125b in presales and INR48b in revenue in FY26.

* Reported INR19b collections in 1HFY26, achieving ~30% of annual guidance, with 85–90% from ongoing projects; collections expected to accelerate in 2HFY26.

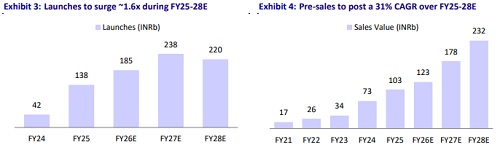

* Launched 2.45 msf of projects in 1HFY26 with a GDV of INR43b, including Cloverdale (Sector 71) and Titanium Phase 2.

* Plans to launch over 7.5 msf in 2HFY26 across Sectors 37D and 71 with a total GDV of INR130–140b, part of a 10msf annual launch pipeline valued at INR170b.

* Generated an INR4b operating surplus in 1HFY26, using INR1.9b for land, INR1.5b for debt servicing, and INR1.4b for approvals; net debt rose by INR0.9b.

* Total debt increased to INR9.7b in 2QFY26 to maintain FY26 net debt below 0.5x projected surplus.

* Raised INR8.75b via private placement of NCDs to fund mid-income and ESG housing projects, debt repayment, and business development.

* Plans to spend around INR11b annually on land acquisition in Gurgaon, targeting emerging greenfield locations.

* Delivered 16msf to date, with 9msf nearing completion and 4–5msf due within 5–6 quarters; pipeline of 41.5msf, of which 17.1msf (GDV ~INR230b) launched and 24.3msf (GDV INR420b) to be launched in 2–3 years.

Valuation and view

* SIGNATUR reported a strong 57% CAGR in pre-sales over FY21-25, driven by an increase in projects under execution and premiumization. As SIGNATUR gears up with a strong launch pipeline of premium projects, we expect it to deliver a 31% CAGR in bookings over FY25-28E as the growth momentum remains intact.

* We have valued the current residential portfolio by discounting the cash flows from all projects and accounting for the recent BD as well as potential land investments of INR15b for future growth.

* However, we see a lag in collections continuing since last year, and hence we have removed the premium from valuation. Rerating or derating from here onwards will be dependent on how the collections pan out in the near term.

* We reiterate our BUY rating with a revised TP of INR1,383 (earlier INR1,760), indicating a 35% upside potential.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412