Buy KEC International Ltd for the Target Rs. 920 by Motilal Oswal Financial Services Ltd

Decent performance and reasonable valuations now

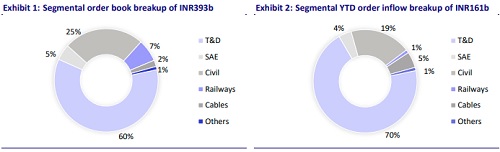

KEC posted good execution growth of 19% YoY and margin improvement of 80bp YoY in 2QFY26. The slight miss in PAT was attributed to higher interest expenses, which moved up due to higher debt and higher working capital. Going ahead, we expect KEC to benefit from 1) a strong prospect pipeline in T&D, 2) a strong order book of INR393b leading to a healthy 17% CAGR in execution, 3) margin improvement over a low base of last year, and 4) the easing of its working capital cycle on improved customer advances and the release of retention money. We cut our estimates by 11%/9%/5% for FY26/27/28 to bake in higher debt and slightly higher NWC. The stock has corrected from its recent highs and is now available at attractive valuations of 19.1x/15.1x on FY27/28 estimates. We upgrade KEC to BUY from Neutral earlier with a revised TP of INR920 (from INR950 earlier).

Good performance; a slight miss on PAT

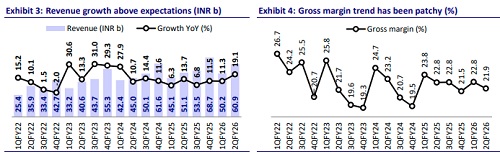

KEC’s revenue and EBITDA were in line; however, PAT reported a slight miss. Revenue grew 19% YoY, led mainly by T&D and Cables divisions, which grew 44% and 19% YoY. EBITDA grew by 34% YoY to INR4.3b with EBITDA margin at 7.1%, up 80bp YoY/10bp QoQ. PAT surged 88% YoY to INR1.6b. Order inflow increased 81% YoY to INR105b in 2QFY26, taking the closing order book (OB) to INR393b (+15% YoY). T&D/non-T&D mix stood at 65%/35%. OB + L1 position stood at INR440b. For 1HFY26, revenue/EBITDA/PAT grew 15%/32%/65% to INR111b/INR8b/INR3b, while EBITDA margin expanded 90bp YoY to 7.0%. OCF/FCF outflow stood at INR9.2b/INR10.3b, declining 88%/83% YoY on higher working capital and capex. Net debt, including acceptances, stood at INR64.8b, vs. INR52.7b as of 30th Sep’24.

T&D witnessing strong traction across geographies

Order inflows in the T&D business witnessed strong traction across geographies, driven by a healthy mix of domestic and international projects. The segment secured orders worth ~INR120b in 1HFY26 across India, the Middle East, CIS, and the Americas. Key wins included a large EPC order of INR31b in the UAE and a substation order of INR10b in Saudi Arabia. The company also secured its first order in a new CIS country. In India, order inflows were supported by growing activity in HVDC and intra-state TBCB projects, along with higher participation from private developers. SAE Towers continued to perform well, aided by strong demand in Latin America. Out of the company’s total tender pipeline of INR1.8t, the T&D business alone accounts for INR600b–650b. We expect T&D segment order inflows/revenue to grow at 20%/24% CAGR over FY25-28.

Non-T&D segment growth will take some time to improve

Among non-T&D segments, the cable business grew 19% YoY to INR5b, supported by a better product mix and cost optimization. In contrast, civil segment revenue stood at INR12b, down 15% YoY, impacted by prolonged monsoon, labor shortages, and delayed payments in water projects. We expect execution to accelerate in 2HFY26. Railway segment revenue declined 16% YoY to INR4b, as execution was selectively focused on projects. Overall, we are building in a recovery in civil segment revenue going forward, while we expect the railway segment to remain largely flat. We expect T&D/non-T&D mix to remain around 68%/32% by FY27.

Margin trajectory improving

EBITDA margin improved 80bp YoY to 7.1% in 2QFY26, driven by strong execution and higher profitability in the T&D business, which has double-digit margins. The improvement was also supported by better cost absorption and operational efficiencies across key projects. We bake in margin improvement of 30bp from FY26 levels for FY27/28 as we expect the impact of low-margin legacy projects and cost overruns to get over by FY26-end. Benefits of project mix and cost optimization will also start reflecting from next year.

Working capital to ease out from current levels

Working capital and net debt increased during the quarter, primarily due to timingrelated factors such as spillover of collections in water and metro projects and higher inventory levels built to support execution momentum. Net debt, including acceptances, stood at INR64.8b as of Sep’25, compared to INR52.7b as of Sep’24. We expect NWC days to ease out from the current levels on improved customer advances and the release of retention money.

Financial outlook

We cut our estimates by 11%/9%/5% for FY26/27/28 to bake in higher debt and slightly higher NWC. Accordingly, we expect a revenue/EBITDA/PAT CAGR of 17%/23%/33% over FY25-28. This will be driven by 1) order inflow growth of 21% over the same period, led by a strong prospect pipeline; 2) a gradual recovery in EBITDA margin to 7.7% in FY26 and 8% by FY27/FY28; and 3) stable NWC. With the expected improvement in execution and margins, we expect its RoE and RoCE to improve to 18.2% and 15.6%, respectively, by FY28.

Valuation and recommendation

KEC is currently trading at 24.7x/19.1x/15.1x on FY26E/27E/28E earnings. Our estimates bake in a revenue CAGR of ~17% and an EBITDA margin of 7.7% for FY26E and 8% for FY27E/28E. We upgrade KEC to BUY from Neutral earlier with a revised TP of INR920 (from INR950 earlier) based on 20x Dec’27E EPS.

Key risks and concerns

A slowdown in order inflows, higher commodity prices, an increase in receivables and working capital, and heightened competition are some of the key risks that could potentially affect our estimates.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412