Monthly Auto Sales - November 2025 by ARETE Securities Ltd

In November, the auto industry recorded 22% YoY growth across segments despite a 7% MoM post-festive normalization, with exports emerging as a key driver across PVs, CVs and tractors amid domestic inventory recalibration. PV volumes were supported by MSIL's Mini portfolio, TAMO's EV dispatches, and HMIL's favourable mix, underpinned by GST reforms, deferred deliveries, wedding-season liquidity, and tight stocks, indicating robust underlying demand. CVs benefited from fleet modernization, led by TAMO's core SUVs and AL's broad M&HCV coverage, while seasonal moderation and elevated dealer inventories constrained sequential gains. Tractor growth drew on M&M's policy-supported domestic dispatches and ESC's export surge, aided by strong Kharif harvests, timely Rabi sowing, MSP hikes, and subsidies. 2Ws reflected rural revival through affordability and financing support, with HERO's motorcycles, TVS's e2Ws and scooters, and BAJAJ's three-wheeler exports driving volumes and mix share. Collectively, these trends point to a broadening structural recovery, with policy measures, exports, and segment-specific demand positioning the sector for sustained momentum into FY26.

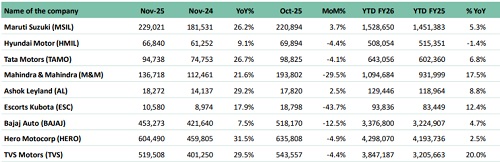

Automobile Sales November - 2025

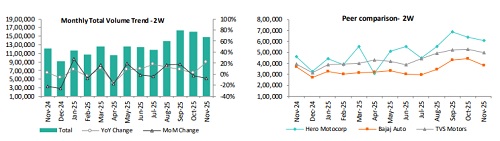

2W Segment

The 2W segment saw a 21% YoY growth in volumes, led primarily by market leader HERO followed by TVS, while a sequential fall persisted post-festive month, causing volumes to decline 8% MoM due to pre-shipments by OEMs over the past two months amid festive-season positivity. Domestic 2W dispatches fell 12% MoM for this reason, alongside a 20% YoY rise supported by enhanced affordability, improved financing options and a revival in rural demand. Positivity continued on the export front for the second consecutive month, with volumes up 11% MoM and 26% YoY. This raised the segment's share from 19% last month to 23%, led by HERO, while BAJAJ recorded minimal growth. In e2W, TVS/BAJAJ/HERO recorded 30,309/25,523/12,199 retail units, yielding market shares of 26%/22%/10%.

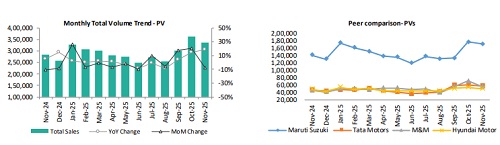

PV Segment

The PV segment recorded an 8% MoM decline in domestic dispatches as post-festive normalization set in but an 18% YoY increase supported primarily by GST reforms and OEMs benefitting from deferred deliveries, pent-up urban/rural orders, and wedding-season liquidity (peaking mid-November). MSIL was least affected, with its Mini portfolio hitting peak fiscal dispatch levels and retail demand materially supported by GST bracket shifts as models in the 18% tax slab rose 38% YoY and those in the 40% slab rose 17% YoY. Inventory remained exceptionally tight with several models clearing out immediately at the plant, indicating firm underlying demand. TAMO gained sequential share on EV strength and moved ahead of M&M during the month. Export activity reached an all-time high with a 35% MoM and 54% YoY increase, led by MSIL, while HMIL continued strengthening its position as a global manufacturing base in India.

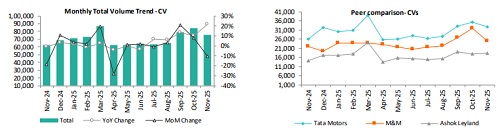

CV Segment

The CV segment declined 10% MoM as most OEMs faced soft dispatches due to elevated dealer inventories and post-festive demand moderation. However, volumes rose 22% YoY supported by GST rate revisions, fleet modernization, and targeted replacement demand. Trucks, contributing 63% of CV volumes, grew 6% YoY led by TAMO with 34% YoY growth and AL with 30% YoY growth, offsetting M&M's 12% YoY decline. LCVs fell 11% MoM but rose 27% YoY driven by AL with 33% YoY growth and TAMO with 35% YoY growth. Buses, representing 7% of CV volumes, increased 16% YoY and 4% MoM led by TAMO with 11% YoY growth and 5% MoM growth and AL with 27% YoY growth. Overall, CV growth is supported by fleet replacement, GST tailwinds, and segment-specific demand, while MoM moderation reflects seasonal demand and elevated dealer inventories.

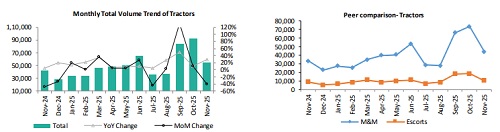

Tractor Segment

Tractor volumes fell 41% MoM after three months of sequential gains but rose 29% YoY, reflecting sustained demand supported by government initiatives, reduced GST rates, subsidies, strong harvests, and timely Rabi sowing. MSP revisions for six Rabi crops and expanded sowing covering 393 lakh hectares are expected to further support farmer incomes and tractor demand. Domestic growth was led by M&M at 33% YoY, the least impacted sequentially, followed by ESC at 16% YoY. Exports continued to gain for the second consecutive month, rising 14% MoM and 19% YoY, driven by ESC with 88% YoY and 22% MoM growth, and M&M with 9% YoY and 12% MoM growth. Strong reservoir levels, positive farmer sentiment, and supportive policies suggest continued momentum into the upcoming season.

Company-wise Performance

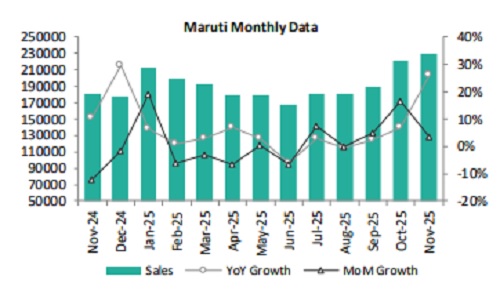

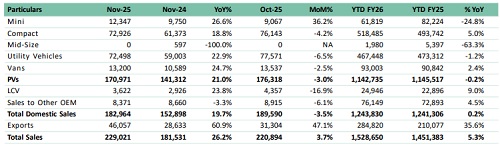

Maruti Suzuki

MSIL reported a 4% MoM and 26% YoY increase in total volumes, driven by a 47% MoM and 61% YoY surge in exports, while domestic dispatches lagged 3% MoM post-festive month. Within domestic markets, all segments except Mini saw sequential declines, with the latter rising 36% MoM, supported by potential CAFÉ 3 exemptions and GST reforms. Overall domestic volumes rose 20% YoY, led by Utility Vehicles and Compact segments, which collectively grew 21% YoY. The performance indicates exports are driving sequential momentum, offsetting post-festive domestic softness, while Mini and UV remain supported by segment-specific demand and policy, reflecting a structural shift toward exports and targeted domestic segments.

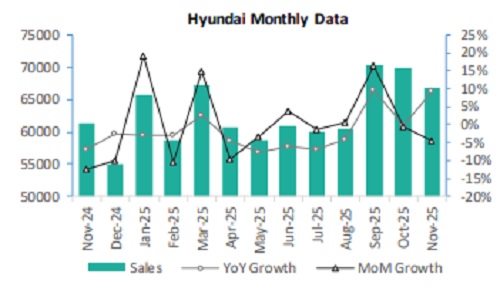

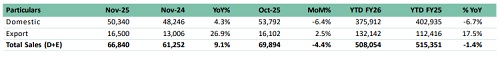

Hyundai Motor

HMIL reported a 4% MoM decline and 9% YoY rise in total volumes, with domestic sales up 4% YoY supported by a favourable product mix. The New Venue recorded 32,000 bookings in its first month, suggesting further upside in domestic volumes in the near term. Exports rose 2% MoM and 27% YoY, reflecting the company's continued progress as a global manufacturing hub and reinforcing overall volume growth.

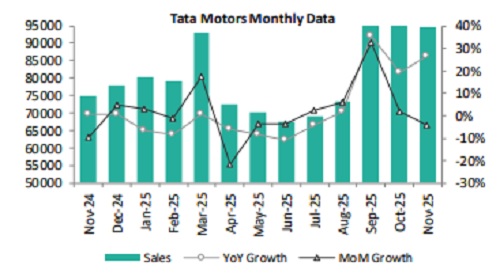

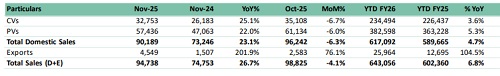

TATA Motors

TAMO reported strong domestic momentum with PV and CV volumes rising 22% YoY and 25% YoY. PV growth was driven by core SUVs including Punch, Nexon, Harrier and Safari along with a 52% YoY increase in EV volumes. Within CVs, SCV Cargo and pickups grew 19% YoY, Trucks rose 34% YoY and Buses recorded 11% YoY growth. Overall domestic volumes increased 23% YoY but declined 6% MoM due to the festive-led high base of the previous month. Overall exports surged 202% YoY and 76% MoM supported by TMPV's post-demerger standalone structure, which enabled sharper focus on PV export channels and more efficient production allocation. CV exports rose 92% YoY and 15% MoM.

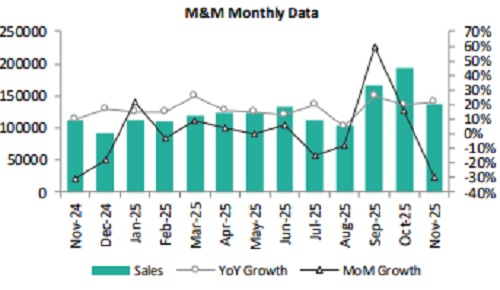

Mahindra & Mahindra

M&M's total volumes declined 29% MoM as most segments softened, except Tractor exports, which rose 12% MoM. Domestic Tractor dispatches dropped 41% MoM after last month's festiveled high base, reducing overall Tractor volumes down 40% MoM, though demand stayed firm with 33% YoY domestic growth driven by GST rate cuts, higher MSPs, and stronger farm cash flows, while exports rose 9% YoY. Automotive volumes dropped 23% MoM across domestic and export markets, but remained up 17% YoY for the third consecutive month. PV volumes grew 22% YoY driven by strong ICE/EV SUV demand, better availability, and mix optimization, alongside 18% YTD UV growth to 4.25 lakh units. Further momentum could be supported by the scheduled January 2026 start of bookings for the XEV 9S and the BE 6 Formula E edition. CV volumes increased 13% YoY, led by the LCV 2T-3.5T segment at 20% YoY (87% of CV volumes), and exports rose 5% YoY.

Please refer disclaimer at http://www.aretesecurities.com/

SEBI Regn. No.: INM0000127