Neutral Aditya Birla Fashion and Retail Ltd for the Target Rs. 90 by Motilal Oswal Financial Services Ltd

High A&P spends weigh on margins; sustained revival in Pantaloons key to re-rating

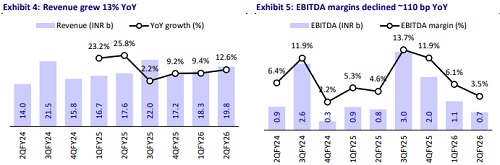

* Aditya Birla Fashion and Retail (ABFRL) reported a weak 2Q as higher A&P spends (up 200bp YoY) and losses in TMRW led to a 14% decline in reported EBITDA (37% miss). Pre-Ind AS EBITDA for 1HFY26 declined ~12% YoY.

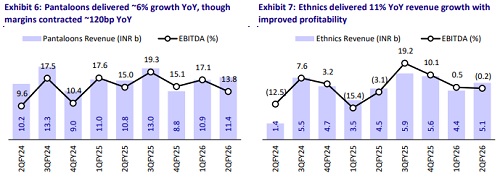

* Pantaloons delivered 7% LFL growth, driven by the boost from early festive, revamped retail identity and growth in OWND (+43% YoY, on a low base). However, EBITDA margin declined 120bp YoY due to higher A&P spends and continued losses in OWND.

* Ethnic portfolio revenue grew 11% YoY (19% LTL growth in TCNS), with margin expanding 280bp YoY, driven by improved profitability in TCNS. Management expects strong growth and profitability in the Ethnic segment in 2HFY26, driven by wedding demand.

* TMRW grew 27% YoY, but losses remained elevated as the company invested in marketing and ramp-up of offline presence.

* Margin expansion in Pantaloons with the refreshed brand identity, loss reduction in TCNS, and scale-up of TASVA/OWND remain key long-term triggers for ABFRL. However, high marketing spends and investments in TASVA/OWND could drag near-term profitability.

* We cut our FY26-28E EBITDA by 6-11% due to the adverse impact of continued higher marketing spends across segments. We build in a CAGR of 13%/21% in revenue/EBITDA over FY25-28E, though we expect ABFRL to remain in losses over FY25-28E.

* We value ABFRL on SoTP basis. We assign EV/EBITDA multiples of 10x/13x to Pantaloons (inc. OWND!) and designer-led ethnic portfolio. We ascribe EV/sales multiples of 1x/0.9x/1.5x to ABFRL’s premium ethnic/TMRW/Luxury Retail portfolio to arrive at our revised TP of INR90. Reiterate Neutral rating.

Weak 2Q; margins hurt by higher marketing spends

* Revenue grew 13% YoY to INR19.8b (in line), driven by strong growth in Ethnic (up 11% YoY), Luxury retail (+13% YoY) and TMRW (up 27% YoY).

* Pantaloons segment grew 6% YoY, aided by strong 7% LFL growth, while Ownd (erstwhile Style up) revenue rose 43% YoY.

* E-commerce sales grew 20% YoY, with share of digital business in ABFRL’s mix crossing 15% in 2Q.

* Gross profit grew 21% YoY to INR11.5b (8% ahead) as gross margin expanded ~395bp YoY to 57.9% (~390bp beat).

* Despite better gross margins, a sharp increase in rentals (up 25% YoY) and other expenses (up 30% YoY) adversely impacted the operating profitability.

* EBITDA at ~INR688m (37% below) declined 14% YoY as EBITDA margin contracted to 3.5% (vs. 4.6% YoY and our est. of 5.6%).

* Pantaloons EBITDA margin declined ~120bp YoY to ~13.7%, due to OWND losses and higher ad spends.

* Ethnics profitability improved ~280bp YoY, driven by improvement in TCNS profitability, though the segment continued to report operating loss.

* TMRW’s operating losses grew to INR620m (vs. INR380m YoY, INR630m QoQ).

* Other segments (including Luxury retail) saw sharp margin contraction, which was a major reason for the miss on our estimates.

* Higher A&P spends across ABFRL portfolio impacted profitability by ~200bp.

* Adjusted losses after tax inched up ~6% YoY to ~INR2.95b (vs. ~INR2.8b loss YoY) as lower EBITDA and higher depreciation (up 14% YoY) were offset by increase in other income (up 75% YoY) and lower finance costs (down 12% YoY).

* For 1HFY26, revenue/EBITDA grew by 11%/6%.

* Pre-IND AS operating losses stood at INR3.4b (vs. INR3.9b loss YoY), with margins improving 235bp YoY to -9%.

* Pre-INDAS OCF outflow for 1HFY26 stood at INR7.2b (vs. INR4.9b in 1HFY25), though not strictly comparable as 1HFY25 included ABLBL’s cash flows. 1HFY26 FCF outflow stood at INR9.8b.

* Gross borrowings (excluding leases) rose 19% YoY to INR17.2b, while net cash stood at INR4.3b (down from INR9.3b as of Mar’25).

* During 1HFY26, revenue/EBITDA increased by 11%/6%, while losses widened by 49%. For 2H, we estimate revenue/EBITDA growth of 9%/1%.

Key highlights from the management interaction

* Demand: The early onset of the Pujo boosted footfalls and conversions, leading to healthy LFL growth across segments. However, heavy monsoons in the East dampened festive momentum.

* Margins softened due to a 200bp YoY rise in A&P as the company stepped up brand-building initiatives, especially in Pantaloons. Pantaloons’ network-level margins improved ~180bp YoY, though reported margins were hurt by higher marketing spends and losses in OWND.

* Pantaloons: ABFRL is refreshing the brand identity in Pantaloons with improved product assortment, enhanced retail experience and reduced inventory in stores. ABFRL plans to open 15 new Pantaloons stores in a revamped format annually (8 closures, 6 openings in 1HFY26) and renovate 8-15 stores annually. ABFRL aims to improve gross margins to over 50% (vs. ~50% currently), raise private label share to 70-75% (from mid-60s), and achieve 25% store-level profitability (15-17% segment level).

* Capital: Cash reduced to INR16b (down by INR6b in 1HFY26) due to inventory build-up ahead of the festive and wedding periods. Capex stood at INR2.6b; with plans to spend INR1.0-1.25b in 2H, for scaling up Ownd and Tasva. Management indicated that typically profitability and cash conversion improve in 2H.

Valuation and view

* ABFRL (demerged) provides a diversified play across several high-growth segments in apparel retail. However, over the last few years, ABFRL’s profitability and valuations have been hurt by investments in several new business, which are currently in build-out phase and are loss-making.

* Margin expansion in Pantaloons with the refreshed brand identity, loss reduction in TCNS, and scale-up of TASVA/OWND remain key long-term triggers for ABFRL. However, higher marketing spends and investments in TASVA/OWND could drag down near-term profitability.

* We cut our FY26-28E EBITDA by 6-11%, due to the adverse impact of continued higher marketing spends across segments. We build in a CAGR of 13%/21% in revenue/EBITDA over FY25-28E, though we expect ABFRL to continue to report losses over FY25-28E.

* We value ABFRL on SoTP basis. We assign EV/EBITDA multiples of 10x/13x to Pantaloons (inc. OWND!) and designer-led ethnic portfolio. We ascribe EV/sales multiples of 1x/0.9x/1.5x to ABFRL’s premium ethnic/TMRW/Luxury Retail portfolio to arrive at our revised TP of INR90. Reiterate Neutral rating.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412