Neutral SONA BLW Precision Forging Ltd for the Target Rs. 490 by Motilal Oswal Financial Services Ltd

Margins hurt by adverse mix

Multiple global headwinds to restrain growth

* SONA BLW (SONACOMS)’s adjusted EBITDA margin came in below our estimates in 4QFY25 due to a model changeover at one of its key OEMs as well as an adverse mix. Adjusted PAT exceeded our estimates because of higher-than-expected other income from surplus funds. The company continues to win new orders, especially in its core division, resulting in its ever-increasing order backlog at INR242b (6.8x revenue in FY25). The share of EVs was higher in the order book/revenue at ~76%/36% as of FY25.

* SONACOMS is now seeing the impact of a slowdown in the EV transition, with 4Q revenue/EBITDA declining 4%/1% YoY. The ongoing global tariff war, weak global macro, and expected supply chain disruption, especially in EVs, remain key headwinds in the near term, which would restrict growth. Given these factors, valuations at ~49x FY26E/44x FY27E consol. EPS appears expensive. Reiterate Neutral with a TP of INR490, premised on ~40x FY27E consol. EPS and assigning INR49/share for the recently acquired railway business.

Margin down QoQ due to a model changeover and unfavorable mix

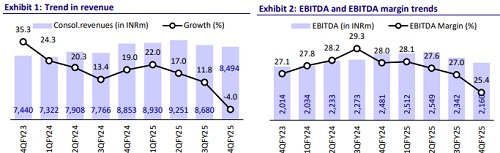

* Revenue declined 2% YoY to INR8.6b vs. 1% growth in the underlying industry. This underperformance in 4Q was largely due to the model changeover at one of its large OEMs. BEV revenue grew 8% YoY in Q4 and BEV revenue share for Q4 has risen to 35%.

* Its reported EBITDA margin stood at 27.1%. However, it is important to note that the company has taken the full-year PLI benefit in 4Q. Adjusting for the prior period benefit of INR190m, EBITDA margin stands at 25.4% – down 260bp YoY and lower than our estimate of 26.2%.

* SONACOMS’ 4QFY25 margins were also impacted by an adverse mix.

* Other income was higher than expected at INR522m, due to surplus funds. ? Led by higher-than-expected other income, adjusted PAT came in at INR1.5b (+2% YoY growth) – ahead of our estimate of INR1.35b.

* For FY25, revenue grew 12% YoY to INR35.5b vs. underlying industry growth of 2% YoY.

* For FY25, BEV revenue grew by 38% YoY and its contribution has increased to 36% from 29% YoY.

* EBITDA margin dipped 90bp YoY to 27.4% due to the adverse mix.

* Overall, PAT grew 16% YoY to INR6b in FY25.

* SONACOMS delivered an FCF of INR3.6b after incurring a capex of INR4.2b in FY25.

* Closing cash and cash equivalents surged to INR26.7b due to INR23.7b worth of QIP proceeds.

Highlights from the management commentary

* The company won new orders worth INR47b in FY25, and the net order win stood at INR242b (6.8x FY25 revenue). EV mix in this order book was 77%.

* New order wins in 4Q included: 1) a large order from a new-age North American EV OEM (existing customer) for rotor embedded differential sub-assembly and epicyclic geartrain worth INR15.2b with SOP for 4QFY26, and 2) a steering bevel box for CVs from an existing global OEM worth INR1.1b with SOP for 3QFY26.

* SONACOMS is also planning to look at opportunities in new areas such as humanoid robots. According to expert estimates, the humanoids market is likely to surge to 10m units by 2035. In this, SONACOMS is looking at working on components that would contribute to about 50-60% of its BOM cost worth USD35-50k which includes components like reducers and gears, sensors, motors, controllers, embedded software, etc.

* The US tariff impact: SONACOMS generates ~40% of its revenue from North America. It has identified about 3% of its revenue contribution from products that may see some risk due to the US tariff impact. The indirect impact from the US is likely to result in a slowdown in end markets and disrupt the global supply chain in the short term. Additionally, the restriction on the supply of rare earth metals from China is expected to cause further disruptions in the electric vehicle (EV) supply chain in the near future.

Valuation and view

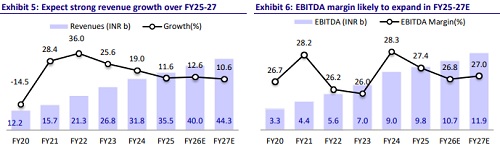

* SONACOMS is poised for faster-than-industry growth driven by 1) content enhancement in the existing portfolio; 2) market share gains in key geographies; and 3) new products such as traction motors, controllers, BSG, and sensors. Further, its focus on expanding the product portfolio, global scale, and customer base should translate into strong earnings growth and healthy capital efficiency.

* However, SONACOMS is currently witnessing the impact of a slowdown in the EV transition, with 4Q revenue/EBITDA growth at -4%/-1%. The ongoing global tariff war, weak global macro, and likely supply chain disruption – especially in EVs – remain key headwinds in the near term, which would restrict growth. Given these factors, valuations at ~49x FY26E/44x FY27E consol. EPS appears expensive. Reiterate Neutral with a TP of INR490, premised on ~40x FY27E consol. EPS and assigning INR49 per share for the recently acquired railway business.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412