Neutral United Breweries Ltd for the Target Rs. 2,000 by Motilal Oswal Financial Services Ltd

Cost savings drive margin beat; rich valuation

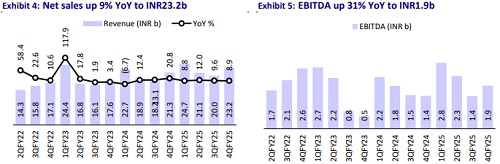

* United Breweries (UBBL) delivered revenue growth of 9% YoY (est. 10%) in 4QFY25. Volume growth was 5% YoY (est. 8%). The Premium portfolio continued to deliver strong performance, posting 24% YoY growth in 4Q (32% in FY25).

* North, West, East and South regions reported volume growth of 3%, 11%, 0% and 5%, respectively. Volume growth was driven by Maharashtra, AP, UP, and Assam, partly offset by a partial suspension in Telangana and duty changes in Karnataka.

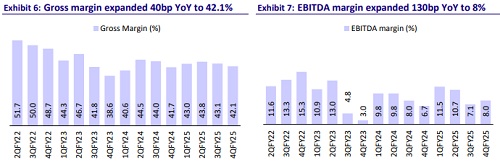

* GM rose 40bp YoY to 42.1% (est. 41.7%). EBITDA margin expanded 90bp YoY to 8% (est. 6.2%), led by a better product mix and cost-efficiencies. Management expects short-term pressure on margins as they continue to face challenges in glass bottle supply, arising from the onboarding of new suppliers and evolving procurement dynamics, which led to some inconsistencies in bottle availability, especially for SKU-specific needs. We model EBITDA margin of 11.3% in FY26 and 12.8% in FY27.

* The company remains focused on volume-led growth, along with share gain in the premium portfolio. It is planning to invest INR7.5b in a greenfield brewery in UP, which will produce both mainstream and premium brands, including Heineken, in cans and bottles. The facility will add 1.0-2.0 MHL capacity, which is expected to be ready by 4QFY27. We estimate a 13% revenue CAGR during FY25-27, led by high-single-digit volume growth. We already model good recovery in EBITDA margin, which has seen sharp contraction over the last five years. Given rich valuations, we maintain our Neutral rating on the stock with a TP of INR2,000 (based on 55x FY27E EPS).

Miss in volume growth; margin beat led by cost savings

* Premium portfolio continues to shine: UBBL’s standalone net sales grew 9% YoY to INR23.2b (est. INR23.4b). Volume growth was 5% YoY (est. 8%), with premium segment volume surging 24% YoY.

* West remains strong: North, West, East and South regions reported 3%, 11%, 0% and 5% volume growth, respectively. Volume growth was mainly driven by Andhra Pradesh, Uttar Pradesh, Maharashtra and Assam, partially offset by Telangana and Karnataka. A positive price mix was driven by price increases in Telangana, Orissa and Rajasthan, coupled with a favorable mix mainly from premiumization.

* Beat in margins: Gross margin was up 40bp YoY at 42.1% (est. 41.7%, 43.1% in 3QFY25). Employee expenses grew 9% YoY and other expenses rose 5% YoY. EBITDA margin expanded 140bp YoY to 8% (est. 6.2%, 7.1% in 3QFY25). EBITDA increased by 31% YoY to INR1.9b (est. INR1.4b). APAT rose 21% YoY to INR974m (est. INR855m).

* In FY25, net sales, EBITDA and APAT grew by 10%, 21% and 14%, respectively.

Highlights from the management commentary

* UBBL reported 5% YoY volume growth in 4QFY25, despite facing regulatory disruptions in key states like Telangana and Karnataka during Jan’25 and seasonal headwinds impacting consumption. The company witnessed a strong recovery after regulatory setbacks in Karnataka and Telangana, with volumes rebounding quickly as the operating environment normalized in subsequent months.

* In Telangana, the company undertook a 15% price hike, which has been absorbed well by the market; however, no further price increases are expected in the near term as the state government is currently reviewing excise policies.

* Management is targeting 35-40% annual growth in the premium portfolio over the coming years, underscoring premiumization as a key structural lever for sustainable growth.

* Management remains confident of sustaining 6-7% annual volume growth in the medium term, supported by premiumization, innovation, and go-to-market initiatives.

* Management is keeping a close watch on input cost trends, with a particular emphasis on glass and packaging costs, which remain volatile due to supply-side constraints and changing global commodity dynamics.

Valuation and view

* We largely maintain our EPS estimates for FY26 and FY27.

* The company is facing numerous challenges, including stiff competition from both local and international brands in India and regulatory issues in the industry.

* UBBL posted 6% volume growth in FY25, while its premium volume grew ~32%, maintaining its robust growth momentum. We estimate a CAGR of 13%/32%/44% of revenue/EBITDA/adj. PAT over FY25-27.

* We estimate EBITDA margin recovery in FY26 and FY27; any delay in margin recovery could lead to further earnings cuts. We maintain our Neutral rating on the stock. Our TP of INR2,000 is based on 55x FY27E EPS.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)