Buy DLF Ltd for the Target Rs. 1,002 by Motilal Oswal Financial Services Ltd

MMR launch and Dahlias' incremental sales drive bookings

Robust medium-term pipeline

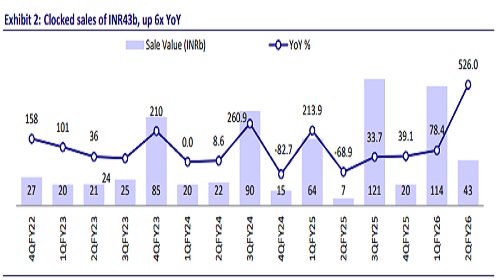

* In 2QFY26, DLF reported bookings of INR43b, up 6x YoY and down 62% QoQ (55% above our est.). In 1HFY26, bookings stood at INR157.6b, up 2x YoY.

* This impressive performance was fueled by healthy sales from its maiden launch ‘The Westpark’ in Mumbai in 2Q, which contributed ~53% of sales. ~37% of sales came from Dahlias.

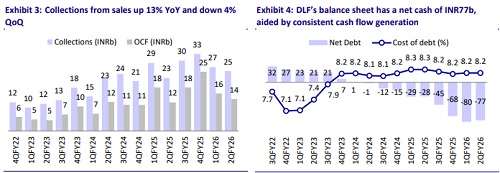

* Collections increased 13% YoY but declined 4% QoQ to INR27b (40% below estimate). Consequently, OCF rose 12% YoY but dipped 15% QoQ to INR14b. Net cash stood at INR77b vs. INR80b in 1QFY26.

* After the Westpark launch, the medium-term launch pipeline stands at INR602b. The company guided for launches worth INR172b+ in FY26, of which DLF has already achieved 80% in 1HFY26.

* P&L performance: 2Q revenue stood at INR16.4b, down 17% YoY/40% QoQ (33% below our est.). In 1HFY26, revenue was up 31% YoY at INR43.6b.

* EBITDA was down 44% YoY/22% QoQ at INR2.8b (61% below estimate). EBITDA margin stood at 17.3%. In 1HFY26, EBITDA came in at INR6.5b, down 11% YoY.

* PAT stood at INR11.8b, -15% YoY/+55% QoQ (8% above our estimate), with a margin of 72% due to a one-off reversal of impairment loss in JV business and a one-time receipt of interest recognized under extraordinary items and other income, respectively. In 1HFY26, PAT stood at INR19.4b, down 4% YoY with a 45% margin.

DCCDL: Healthy growth; debt-to-GAV 20% (down 13% from FY21)

* Occupancy in DCCDL’s office portfolio was stable at 93% (98% in non-SEZ/ 86% in SEZ/97% in Retail).

* Rental income increased 15% YoY to INR13.6b, driven by steady growth across the portfolio.

* Net debt rose to INR174b from INR173b in 1QFY26, with net debt to GAV of 0.20x. Cost of debt declined to 7.3% in the quarter from 7.67% in 1QFY26.

Key management commentary

* Housing demand in Gurgaon remains robust, supported by a growing preference for quality residential options, both for ownership and rental purposes.

* Quarterly sales were driven by the Mumbai launch and incremental sales from the Dahlias project, which contributed ~37-40% of presales; Mumbai accounted for 50%.

* In 2Q, 18 units were sold at Dahlias, taking cumulative sales to 121 units, with current ASP ranging at INR125,000-150,000 psf on carpet.

* Collections were impacted by construction delays, but momentum is expected to recover in 2HFY26 as milestones are achieved; DLF targets INR130-140b of collections in FY27.

* All approvals for the Goa project have been received, with launches planned for 3Q/4QFY26; Arbour 2 and Panchkula are also on track, while Mumbai Phase 2 and Dahlias 2 are expected in FY27.

* The company launched Privana North in 1QFY26 with 39% embedded gross margins and the Mumbai project (~0.9msf) in 2QFY26; FY26 presales guidance is INR200-220b, ~72% already achieved in 1HFY26.

* RERA escrowed cash stands at ~INR84b, with ~INR8.5b remaining after dividend payout; this balance is expected to decline as the high-rise cycle matures.

* DLF remains focused on NCR, Tri-City, MMR, and Goa markets with limited scope for new land acquisitions but remains open to evaluating strategic opportunities.

* Capex is guided at around INR50b each for FY26 and FY27, supporting the next phase of project and annuity development.

Valuation and view: Growth trajectory remains intact

* DLF continues to enhance its growth visibility as it replenishes its launches with its existing vast land reserves. However, our assumption of a 12-13-year monetization timeline for its remaining 150msf of land bank adequately incorporates this growth.

* DLF’s business (Devco/DLF commercial) is valued at INR1,721b, wherein land contributes INR1,304b. DCCDL is valued at INR708b. GAV is at INR2,429b. After taking FY26E net cash of INR52b (incl. DCCDL) into consideration, NAV stands at INR2,481b. We reiterate our BUY rating with a TP of INR1,002.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412